Japan Aerospace and Defense Market Size, Share, and COVID-19 Impact Analysis, By Sector (Aerospace, Defense), By Platform (Airborne, Terrestrial, and Naval), and Japan Aerospace and Defense Market Insights Forecasts to 2032

Industry: Aerospace & DefenseJapan Aerospace and Defense Market Insights Forecasts to 2032

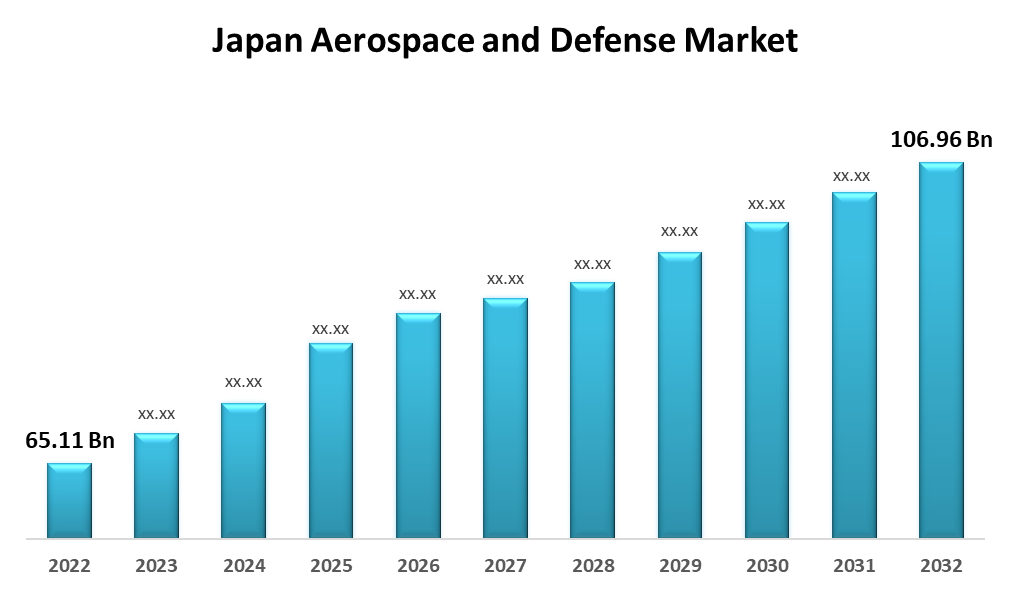

- The Japan Aerospace and Defense Market Size was valued at USD 65.11 Billion in 2022.

- The Market size is Growing at a CAGR of 5.1% from 2022 to 2032.

- The Japan Aerospace and Defense Market Size is expected to reach USD 106.96 Billion by 2032.

Get more details on this report -

The Japan Aerospace and Defense Market Size is expected to reach USD 106.96 Billion by 2032, at a CAGR of 5.1% during the forecast period 2022 to 2032.

Market Overview

The Japan aerospace and defense market refers to the Japanese industry that develops, manufactures, and distributes aerospace and defense-related products and services. Military aircraft, satellites, defense electronics, communication systems, radar systems, and other products are included. The market also includes R&D activities aimed at improving Japan's capabilities in the aerospace and defense domains. Japan's aerospace and defense market has established itself as a major player in the global aerospace and defense industry. Japan has positioned itself as a key market for aerospace and defense products and services, owing to a rich history of technological advancements and a strong commitment to innovation. The aerospace and defense sector in Japan has grown significantly in recent years, owing to increased defense spending, technological advancements, and collaborations with international players.

Report Coverage

This research report categorizes the market for Japan’s aerospace and defense market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan aerospace and defense market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan aerospace and Defense market.

Japan Aerospace and Defense Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.1% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Sector, By Platform |

| Companies covered:: | Mitsubishi Heavy Industries, Ltd. ShinMaywa Industries, Ltd. The Japan Steel Works, Ltd. Toshiba Corporation Kawasaki Heavy Industries, Ltd. Lockheed Martin Corporation Northrop Grumman Corporation ShinMaywa Industries Ltd. Thales Group Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Several key drivers are propelling the Japan aerospace and defense market. First and foremost, increased defense spending has resulted from the country's geopolitical situation and regional security concerns. Furthermore, Japan's emphasis on developing advanced aerospace technologies, as well as its expanding space industry, contribute significantly to market growth. The growth can be attributed to the increasing preference for lightweight and high-strength materials. Because of their high strength-to-weight ratios, lightweight materials such as carbon fiber composites, titanium alloys, and advanced polymers are increasingly sought after by the aerospace and defense industries. These materials not only reduce aircraft weight but also improve structural integrity, fuel efficiency, and operational costs. Furthermore, the aerospace industry is embracing lightweight materials to reduce carbon emissions and comply with stringent environmental regulations. This is consistent with the trend toward environmentally responsible solutions, which ensures a positive environmental image.

Restraining Factors

Despite the market's potential for growth, it faces some significant challenges. Budgetary constraints and the high costs associated with R&D efforts can stymie market expansion. Furthermore, industry participants may face challenges due to Japan's complex regulatory framework and strict export controls.

Market Segment

- In 2022, the aerospace segment accounted for the largest revenue share over the forecast period.

Based on the sector, Japan’s aerospace and defense market is segmented into aerospace and defense. Among these, the aerospace segment has the largest revenue share over the forecast period. Japan is still a profitable market for imported aircraft, aircraft parts, and engines. Japan is currently a key player in the development of several aircraft families, including the B777, B777X, and B787.

- In 2022, the airborne segment is expected to hold a significant share of the Japan aerospace and defense market during the forecast period.

Based on platform, the Japan aerospace and defense market is segmented into airborne, terrestrial, and naval. Among these, the airborne segment is expected to hold a significant share of the Japan aerospace and defense market during the forecast period. Japan's airborne sector has grown significantly in recent years as a result of increased defense spending, technological advancements, and collaborations with international players.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within Japan’s aerospace and defense market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Heavy Industries, Ltd.

- ShinMaywa Industries, Ltd.

- The Japan Steel Works, Ltd.

- Toshiba Corporation

- Kawasaki Heavy Industries, Ltd.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- ShinMaywa Industries Ltd.

- Thales Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, Japan's Defense Ministry signed a USD 3 billion contract with Mitsubishi Heavy Industries, the country's top defense contractor, to develop and mass-produce long-range missiles for deployment by 2026. Advanced versions of Mitsubishi's Type 12 missiles for surface, sea, and air launches, as well as a hypersonic ballistic missile for remote island defense, are included in the contracts.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented Japan’s aerospace and Defense market based on the below-mentioned segments:

Japan Aerospace and Defense Market, By Vertical

- Aerospace

- Defense

Japan Aerospace and Defense Market, By Platform

- Airborne

- Terrestrial

- Naval

Need help to buy this report?