Japan Anti-Rheumatic Drug Market Size, Share, and COVID-19 Impact Analysis, By Type of Disease (Osteoarthritis, Rheumatoid Arthritis, Gout, Lupus, Others), By Drug Class (Disease-Modifying Anti-Rheumatic Drugs {DMARDs}, Nonsteroidal Anti-Inflammatory Drugs {NSAIDs}), Corticosteroids, JAK Inhibitor, Others), and By Sales Channel (Prescription-based Drugs, Over-the-counter {OTC}), and Japan Anti-Rheumatic Drug Market Insights, Industry Trend, Forecasts to 2032

Industry: HealthcareJapan Anti-Rheumatic Drug Market Insights Forecasts to 2032

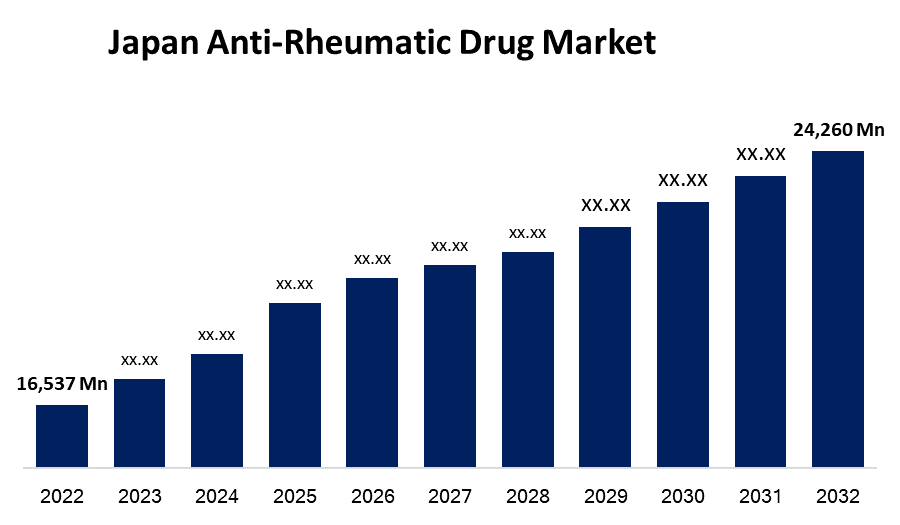

- The Japan Anti-Rheumatic Drug Market Size was valued at USD 16,537 Million in 2022.

- The Market Size is Growing at a CAGR of 3.91% from 2022 to 2032

- The Japan Anti-Rheumatic Drug Market Size is Expected to reach USD 24,260 Million by 2032.

Get more details on this report -

The Japan Anti-Rheumatic Drug Market Size was valued at USD 16,537 Million in 2022 and is Expected To Grow to USD 24,260 Million by 2032, at a CAGR of 3.91% during the forecast period 2022-2032.

Market Overview

The country's constantly growing older population is a primary driver of industry growth. According to World Bank Group data, the proportion of the total population aged 65 and up has grown. According to OECD data, the country's aging population will continue to put pressure on public health spending, while spending on long-term care has remained high. The expanding senior population in Japan will continue to increase the cases of rheumatoid arthritis higher than any other age group, and even if this occurs earlier, symptoms generally appear at this age. The growing older population in Japan will continue to push rheumatoid arthritis cases higher than in any other age group, enhancing the country's antirheumatic medication market growth. The Japan Antirheumatic Drugs market has been categorized based on illness type, drug class, and sales channel. The market has been divided by illness types such as osteoarthritis, rheumatoid arthritis, gout, lupus, and others. The Japanese antirheumatic medicines market has been divided into pharmaceuticals and biopharmaceuticals based on molecular type. The market has also been segmented by sales channels such as prescription and over-the-counter (OTC).

Report Coverage

This research report categorizes the market of Japan anti-rheumatic drug market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan anti-rheumatic drug market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan anti-rheumatic drug market.

Japan Anti-Rheumatic Drug Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 16,537 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.91% |

| 2032 Value Projection: | USD 24,260 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 204 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type of Disease, By Drug Class, By Sales Channel, and Country Statistics (Demand, Price, Growth, Trends, Competitors, Challenges) |

| Companies covered:: | Janssen Pharmaceuticals K.K., Taisho Pharmaceutical Group, Toyama Chemical Co. Ltd, Asahi Kasei, EA Pharma Co. Ltd, Takeda Pharmaceutical, Eisai Co Ltd, Fujifilm Kyowa Kirin Biologics, Mylan. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan is one of the world's most developed economies, and healthcare services are already widely available. Although individuals tend to live a healthy lifestyle to protect themselves from chronic diseases, the incidence of rheumatoid arthritis in this nation is relatively high. The increasing prevalence of this condition is pushing the usage of anti-rheumatic medications among those affected, fueling market expansion. However, as individuals become more aware of the efficacy and safety of generic pharmaceuticals in our nation, some of them are gravitating toward them. The market for anti-rheumatic medications is declining since these treatments are only a fraction of the price of branded drugs. Nonetheless, we anticipate strong market growth for these medications during the projection period.

Restraining Factors

The adverse reactions of the treatment, as well as the greater cost of biologics and biosimilars, limit the market expansion of Japan anti-rheumatic drug market.

COVID 19 Impacts

COVID-19 had a substantial influence on the Japanese market for antirheumatic medications. The growing number of adolescents and adults suffering from various rheumatic ailments is driving the region's medication need. However, the pandemic forced the closure of numerous manufacturing sites, reducing output due to an increase in active cases and the deployment of harsh measures such as lockdowns and social isolation. Border restrictions impacted regional imports and exports, disrupting the supply chain. During the pandemic, these factors slowed market growth.

Market Segment

- In 2022, disease modifying anti-rheumatics drugs segment is influencing the largest market share over the forecast period.

Based on the drug class, the Japan anti-rheumatic drug market is segmented into disease-modifying anti-rheumatic drugs {DMARDs}, nonsteroidal anti-inflammatory drugs {NSAIDs}. Among these segments, the disease-modifying anti-rheumatics drugs segment dominates the largest market share during the forecast period, due to their action in the medical situation. For example, DMARDs treat the underlying medical disease rather than the symptoms. Furthermore, the nonsteroidal anti-inflammatory medicines sector is predicted to expand the quickest throughout the forecast period, owing to an increase in the occurrences of rheumatoid arthritis linked with joint pain.

- In 2022, prescription-based drugs are dominating the largest market growth during the forecast period.

Based on sales channels, the Japan anti-rheumatic drug market is classified into several factors such as prescription-based drugs, and over-the-counter {OTC}. Among these, the prescription-based drugs segment held the largest market share during the forecast period, as the medical condition requires treatment by a specialist medical practitioner, there has been an increase in the number of specialty hospitals globally. Furthermore, the over-the-counter medications category is predicted to rise at the quickest rate throughout the projection period, owing to an increase in knowledge of treatment alternatives for rheumatoid arthritis. Furthermore, the simple availability of NSAIDs over the counter is a key element that contributes to the rise of the anti-rheumatics industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan anti-rheumatic drug market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Janssen Pharmaceuticals K.K.

- Taisho Pharmaceutical Group

- Toyama Chemical Co. Ltd

- Asahi Kasei

- EA Pharma Co. Ltd

- Takeda Pharmaceutical

- Eisai Co Ltd

- Fujifilm Kyowa Kirin Biologics

- Mylan

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2021, Fujifilm Kyowa Kirin Biologics and Mylan announced the launch of Hulio in Japan. Hulio is available in 40mg/0.8mL syringe and pen form for the treatment of rheumatoid arthritis, juvenile idiopathic arthritis, and ankylosing spondylitis, among other disorders, and a 20mg/0.4mL syringe (recommended for juvenile idiopathic arthritis). In Japan, this is the first biosimilar adalimumab product to be marketed.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Japan Anti-Rheumatic Drug Market based on the below-mentioned segments:

Japan Anti-Rheumatic Drug Market, By Type of Disease

- Osteoarthritis

- Rheumatoid Arthritis

- Gout

- Lupus

- Others

Japan Anti-Rheumatic Drug Market, By Drug Class

- Disease-modifying Anti-Rheumatic Drugs {DMARDs}

- Nonsteroidal Anti-inflammatory Drugs {NSAIDs}

- Corticosteroids

- JAK Inhibitor

- Others

Japan Anti-Rheumatic Drug Market, By Sales Channel

- Prescription-based Drugs

- Over-the-counter {OTC}

Need help to buy this report?