Japan Battery Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Primary and Secondary), By Product Type (Lead Acid, Lithium Ion, Nickel Metal Hydride, Nickel Cadmium, Lithium Titanate Oxide (LTO), Others), By Application (Automotive Batteries, Industrial Batteries, Portable Batteries), By End-Users (Aerospace, Automobile, Electronics, Energy Storage, Military & Defense, Others), and Japan Battery Market Insights Forecasts to 2032

Industry: Semiconductors & ElectronicsJapan Battery Market Insights Forecasts to 2032

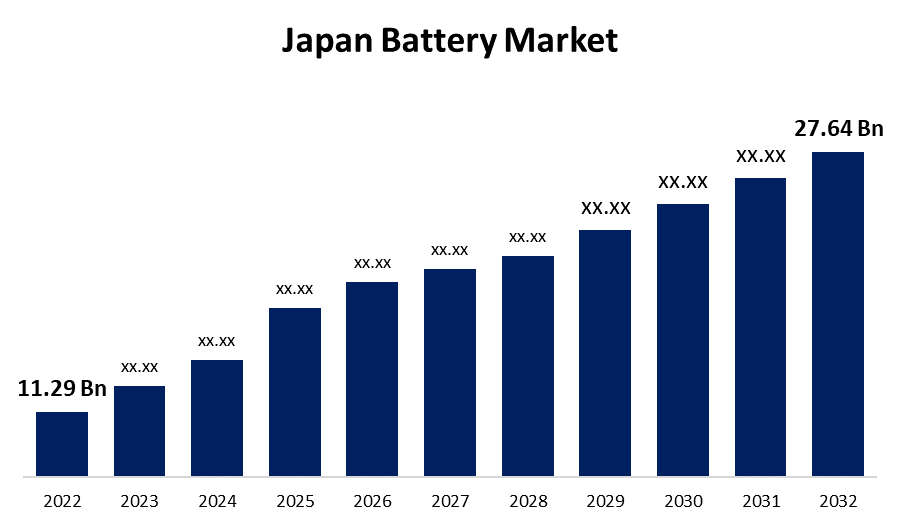

- The Japan Battery Market Size was valued at USD 11.29 Billion in 2022.

- The Market Size is Growing at a CAGR of 9.37% from 2022 to 2032.

- The Japan Battery Market Size is Expected to reach USD 27.64 Billion by 2032.

- Japan is Expected To Grow the fastest during the forecast period.

Get more details on this report -

The Japan Battery Market Size is expected to reach USD 27.64 billion by 2032, at a CAGR of 9.37% during the forecast period 2022 to 2032. The market is likely to be driven by increased adoption of electric vehicles and demand for consumer electronics. Furthermore, the widespread usage of UPS systems for constant power supply in the healthcare, chemical, and oil & gas sectors is likely to drive the Japan battery market growth throughout the forecast period.

Market Overview

The Japanese battery market is predicted to grow for both automotive and stationary applications. Currently, the demand for automotive batteries is rapidly rising in tandem with the growth of the electric vehicle (EV) market. With increasing global rivalry in the design and manufacture of next-generation rechargeable batteries, including all-solid-state batteries, Japan is also encouraging research and development by undertaking industry-academia-government cooperation to maintain its global dominance in research and development, which is projected to increase Japan's battery market. As a result, Japan adopted an aggressive strategy for investing in the research and development of all-solid-state battery technologies. Although all-solid-state batteries continue experiencing shortcomings, but demand for liquid lithium-ion batteries (liquid LiBs) is expected to maintain its dominance in the Japanese battery market.

Japan Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.29 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.37% |

| 2032 Value Projection: | USD 27.64 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 160 |

| Segments covered: | By Battery Type, By Product Type, By Application, By End-Users, and COVID-19 Impact Analysis |

| Companies covered:: | Panasonic Corporation, Toshiba Corporation, Maxell, Ltd., Furukawa Battery Co., Ltd., Vehicle Energy, NGK Insulators Ltd., FDK Corporation, ELIIY-Power, KYOCERA, Hitachi, Ltd., NEC Corporation, Murata, GS Yuasa International Ltd |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Rising technical progress toward leading internationally in the development and commercialization of next-generation batteries, notably all-solid-state batteries, and rapidly acquiring the next-generation battery market are some of the drivers projected to drive the Japanese battery market. Furthermore, increasing awareness concerning greenhouse gas emissions, increased demand from domestic consumers, supporting recycling and reusing, extending the production of green electricity, and lowering the burden of electricity costs are expected to drive product demand in the Japanese battery market.

With their technological advantage, Japanese businesses dominated the early market, however as the market developed, Japanese manufacturers lost the marketplace to Chinese and Korean competitors. Furthermore, Japan continues to decline in efficiency in battery cells, and as a result, there is a possibility of growing reliance on neighboring nations. As a result, Japan must uphold and improve all aspects of the supply chain, encompassing the raw material availability and production facilities for materials and cells. However, increased government programs, rising awareness among local manufacturing companies, expanding adoption of electric vehicles (EV) across the nation, and combined an increasing emphasis on the effects of climate change, are likely to boost the demand for the Japan battery market.

Report Coverage

This research report categorizes the market for Japan Battery Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Battery Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Battery Market.

Market Segment

- In 2022, the secondary battery segment is witnessing a higher growth rate over the forecast period.

Based on the battery type, the Japan Battery Market is segmented into primary and secondary. Among these, the secondary battery segment is witnessing a higher growth rate over the forecast period. Lithium-ion, lead-acid, and alkaline storage batteries are among the secondary batteries frequently used in Japan. Secondary batteries, on average, have a low capacity and beginning voltage, a fast-self-discharge rate, and varied recharge life ratings. Furthermore, considering that individual batteries can be more expensive, these batteries are cost-effective in the long run. The lithium-ion battery is the most widely used secondary battery in Japan. It charges rapidly and has a longer battery life than the others in its category. Furthermore, expanding electric vehicle ownership throughout the nation, along with an increasing emphasis on sustainability, is anticipated to provide a favorable business environment for secondary battery producers.

- In 2022, the industrial batteries segment accounted for the largest revenue share of more than 37.8% over the forecast period.

On the basis of application, the Japan Battery Market is segmented into automotive batteries, industrial batteries, and portable batteries. Among these, the industrial batteries segment is dominating the market with the largest revenue share of 37.8% over the forecast period. This growth can be attributable to the rising demand for cost-effective electricity backup and energy storage facilities in a variety of industries, including power production, chemical manufacture, maritime, recreational equipment, and agricultural equipment and machinery. The expansion of the Japanese battery market is anticipated to be boosted by the widespread application of small-sized lithium-ion batteries in lightweight electronics and other consumer goods.

- In 2022, the lead acid segment is witnessing significant CAGR growth over the forecast period.

On the basis of product type, the Japan Battery Market is segmented into lead acid, lithium ion, nickel metal hydride, nickel cadmium, lithium titanate oxide (LTO), and others. Among these, the lead acid segment is witnessing significant CAGR growth over the forecasted period. After the United States, Japan is the world's second-largest producer of lead-acid batteries. Lead-acid batteries are one of the most widely used and commonly accessible rechargeable batteries for an extensive variety of end-use applications, including transportation, industrial, residential, commercial, and utility-scale storage. Furthermore, rising demand for rechargeable batteries that are used in the automotive sector, such as starting, lights, and ignition (SLI) batteries, is also likely to boost lead acid battery market growth in Japan during the forecast period.

- In 2022, The electronics segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of end-users, the Japan Battery Market is segmented into aerospace, automobile, electronics, energy storage, military & defense, and others. Among these, the electronics segment is dominating the market with the largest revenue share of 34.2% over the forecast period. The consumer electronics industrys ongoing improvement has resulted in an increase in the utilization of batteries in many applications. These offer various advantages, including increased rated power, decreased emissions, and increased reliability. Portable batteries can be found in a variety of portable devices and electrical and electronic products. Portable batteries are used in a wide range of electronic products, including mobile phones, laptops, computers, tablets, torches or flashlights, LED lighting, vacuum cleaners, digital cameras, wristwatches, calculators, hearing aids, wearable gadgets, and other similar goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Battery Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Panasonic Corporation

- Toshiba Corporation

- Maxell, Ltd.

- Furukawa Battery Co., Ltd.

- Vehicle Energy

- NGK Insulators Ltd.

- FDK Corporation

- ELIIY-Power

- KYOCERA

- Hitachi, Ltd.

- NEC Corporation

- Murata

- GS Yuasa International Ltd

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On January 2023, Honda Motor Co., Ltd. (Honda) and GS Yuasa International Ltd. (GS Yuasa) announced a fundamental agreement for a high-capacity, high-output lithium-ion battery collaboration. To meet the rapidly increasing demand for batteries, the two companies agreed to collaborate on the joint research and development of lithium-ion batteries and battery production methods that will be highly competitive in the global market, as well as the establishment of a supply chain for key raw materials and a highly efficient battery production system.

- On November 2022, GS Yuasa Corporation started a collaborative study with Osaka Metropolitan University on the research and development of all-solid-state batteries, a technology proposal that was chosen for the NEDO Green Innovation Fund. GS Yuasa will strive to meet the project's objectives as soon as feasible, while also continuing to contribute to the goal of carbon neutrality through the development of next-generation battery technologies for use in electric vehicles and a variety of other applications.

- In October 2020, Murata introduces Alkaline Manganese Batteries (LR) and Silver Oxide Batteries (SR) for Medical Devices. When compared to standard versions, the new products have superior load characteristics and support stable High Drain. Furthermore, our revolutionary mercury-free technique achieves superior leakage resistance and exceptional safety. Because these mercury-free batteries are safe and secure, they are suitable for medical applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Battery Market based on the below-mentioned segments:

Japan Battery Market, By Battery Type

- Primary

- Secondary

Japan Battery Market, By Product Type

- Lead Acid

- Lithium Ion

- Nickel Metal Hydride

- Nickel Cadmium

- Lithium Titanate Oxide (LTO)

- Others

Japan Battery Market, By Application

- Automotive Batteries

- Industrial Batteries

- Portable Batteries

Japan Battery Market, By End-Users

- Aerospace

- Automobile

- Electronics

- Energy Storage

- Military & Defense

- Others

Need help to buy this report?