Japan Blood Plasma Market Size, Share, and COVID-19 Impact Analysis, By Type (Albumin, Factor VIII, Factor IX, Immunoglobulin, Hyperimmune Globulin, and Others), By Application (Immunodeficiency Diseases, Primary immunodeficiency, and Hemophilia), and Japan Blood Plasma Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareJapan Blood Plasma Market Insights Forecasts to 2033

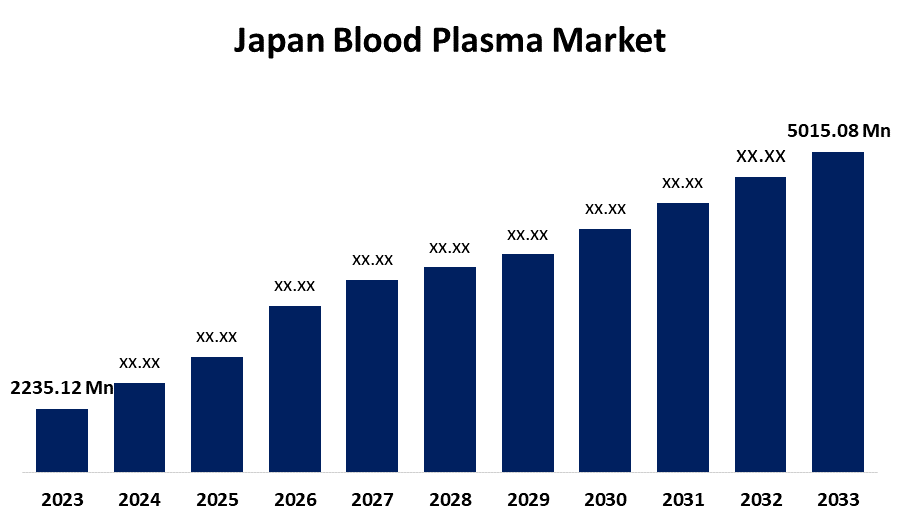

- The Japan Blood Plasma Market Size was valued at USD 2235.12 Million in 2023

- The Market is Growing at a CAGR of 8.42% from 2023 to 2033

- The Japan Blood Plasma Market Size is Expected to Reach USD 5015.08 Million by 2033

Get more details on this report -

The Japan Blood Plasma Market is Anticipated to Reach USD 5015.08 Million by 2033, growing at a CAGR of 8.42% from 2023 to 2033.

Market Overview

Blood plasma is the light amber-colored liquid portion of blood devoid of blood cells but still contains suspended proteins and other components of whole blood. It accounts for around 55% of the blood volume in the body. The fluid portion of blood called blood plasma is in charge of carrying different components of blood such as platelets, red and white blood cells, salts, enzymes, and proteins and antibodies made by the immune system to fight infections. Blood type A.B. individuals are especially sought after as plasma donors. Additionally, patients with burns, shock, and trauma, as well as those with serious liver deficits or many clotting factors, can all benefit from plasma therapy. It aids in raising blood volume, avoiding shock, and improving blood clotting. Pharmaceutical businesses use plasma to create immune deficiencies and therapies for bleeding problems.

Report Coverage

This research report categorizes the market for the Japan blood plasma market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan blood plasma market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan blood plasma market.

Japan Blood Plasma Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2,235.12 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.42% |

| 2033 Value Projection: | USD 5,015.08 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Takeda Pharmaceutical, Japan Blood Products Organization (JBPO), KM Biologics (Meiji Group), Mitsubishi Tanabe Pharma, Green Cross Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main factors increasing the need for blood plasma in Japan is the growing incidence of blood diseases. In Japan, treatments such as immunoglobulins, albumin, and clotting factors obtained from plasma are necessary for conditions like hemophilia, immunological deficiencies, and liver illnesses. Furthermore, developments in plasma-based therapies have increased these treatments' effectiveness and accessibility by enhancing their safety and efficiency. Through broad healthcare coverage and research efforts, the Japanese government supports this desire. Additionally, Hemophiliacs in Japan number about 5,000, and their condition is treated using clotting factors generated from plasma. In Japan, regular immunoglobulin therapy which is made from blood plasma is necessary for about 10% of patients with primary immunodeficiency disorders.

Restraining Factors

One of the main problems impeding the acceptance of plasma products is the expanding usage of recombinant factors and their increased application in preventive therapy.

Market Segmentation

The Japan blood plasma market share is classified into type and application.

- The immunoglobulin segment is expected to hold a significant market share through the forecast period.

The Japan blood plasma market is segmented by type into albumin, factor viii, factor ix, immunoglobulin, hyperimmune globulin, and others. Among these, the immunoglobulin segment is expected to hold a significant market share through the forecast period. Crucial proteins called immunoglobulins are present in blood plasma and are essential for the body's immunological response. The development of immunoglobulins is fueled by their extensive use in the management of numerous autoimmune and immunodeficiency diseases.

- The hemophilia segment is expected to dominate the Japan blood plasma market during the forecast period.

Based on the application, the Japan blood plasma market is divided into immunodeficiency diseases, primary immunodeficiency, and hemophilia. Among these, the hemophilia segment is expected to dominate the Japan blood plasma market during the forecast period. A lack or malfunction of clotting factors in the blood, mainly Factor VIII or Factor IX is a characteristic of the hereditary disorder hemophilia. The creation and accessibility of clotting factor replacement therapies which are made from blood plasma are crucial for the control and avoidance of bleeding episodes in hemophiliac patients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan blood plasma market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda Pharmaceutical

- Japan Blood Products Organization (JBPO)

- KM Biologics (Meiji Group)

- Mitsubishi Tanabe Pharma

- Green Cross Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Takeda declared that it will construct a new plasma-derived therapy (PDT) production plant in Osaka, Japan, at a cost of about 100 billion yen. This is Takeda's biggest-ever investment in increasing its manufacturing capacity in Japan.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Blood Plasma Market based on the below-mentioned segments:

Japan Blood Plasma Market, By Type

- Albumin

- Factor VIII

- Factor IX

- Immunoglobulin

- Hyperimmune Globulin

- Others

Japan Blood Plasma Market, By Application

- Immunodeficiency Diseases

- Primary immunodeficiency

- Hemophilia

Need help to buy this report?