Japan Calcium Chloride Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid, Hydrated Solid, Anhydrous Solid), By Application (De-Icing, Dust Control and Road Stabilization, Drilling Fluids, Construction, Industrial Processing, Others), and Japan Calcium Chloride Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsJapan Calcium Chloride Market Insights Forecasts to 2033

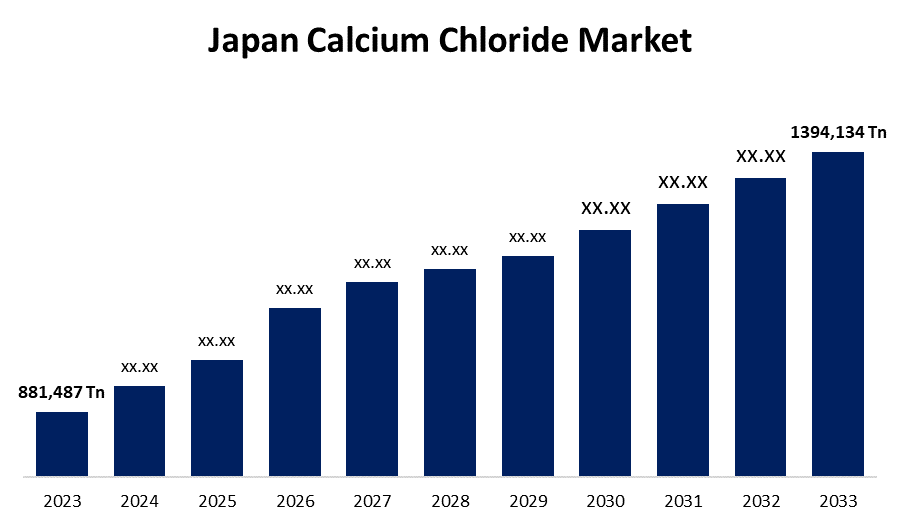

- The Japan Calcium Chloride Market Size was valued at USD 881,487 Tons in 2023.

- The Market Size is Growing at a CAGR of 4.69% from 2023 to 2033.

- The Japan Calcium Chloride Market Size is Expected to Reach USD 1394,134 Tons by 2033.

Get more details on this report -

The Japan Calcium Chloride Market Size is expected to reach USD 1394,134 Tons by 2033, at a CAGR of 4.69% during the forecast period 2023 to 2033.

Market Overview

An ionic salt composed of calcium and chlorine is called calcium chloride (CaCl2). An industrial product made of these naturally occurring minerals is highly soluble in water and solid at room temperature. In periods of good climate, it can also be naturally obtained from brine wells or seawater. Because calcium chloride is hygroscopic, it can absorb atmospheric moisture and stop ice from reforming. Accordingly, the market is growing stronger as more products are used to improve road safety while lowering the likelihood of accidents caused by slick surfaces. Aside from this, the market is seeing lucrative growth prospects due to the introduction of several government rules and policies pertaining to road safety throughout the winter. Furthermore, calcium chloride is a hygroscopic substance, which is why it is kept as a drying agent in sealed containers. It is also widely used in the paint, transportation, food preservation, and medical sectors. Calcium chloride is utilized as a flavor enhancer, preservative, and firming agent in ready-to-eat (RTE) food products due to the growing working population and their busy schedules. This is contributing to the growth-promoting effect. In addition, the growing quantity of untapped oil and gas reserves has expedited the utilization of calcium chloride as a necessary component for drilling fluids, so fostering a favorable perspective for the industry.

Report Coverage

This research report categorizes the market for Japan calcium chloride market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan calcium chloride market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan calcium chloride market.

Japan Calcium Chloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 881,487 Tons |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.69% |

| 2033 Value Projection: | USD 1394,134 Tons |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Tokuyama, Fuji Kasei, Weifang Taize Chemical Industry Co. Ltd, Ward Chemical, Inc., Tiger Calcium Services Inc., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The growing use of the product as a concrete accelerator in the construction industry, which quickens the hydration process and produces high initial concrete strength, is primarily driving the calcium chloride market in Japan. Growing building activity and increased national infrastructure development spending provide more evidence for this. Furthermore, calcium chloride is widely used in the mining industry as a maintenance material for haul road projects due to its liquefiable character.

Restraining Factors

The market is limited by some boundaries, such as strict regulatory requirements, which might hinder its growth in addition to its driving forces. As an example, the market for calcium chloride is governed by strict and ever-changing laws industrial chemicals, and production and consumption of calcium chloride can be greatly impacted by compliance with these regulations. Adherence to these guidelines might necessitate adjustments to production procedures, which could impact the expansion of the market.

Market Segment

- In 2023, the hydrated solid segment accounted for the largest revenue share over the forecast period.

Based on the type, the Japan calcium chloride market is segmented into liquid, hydrated solid, and anhydrous solid. Among these, the hydrated solid segment has the largest revenue share over the forecast period. With widespread applications in a wide range of sectors, hydrated solid has the most market share. Furthermore, the market is expanding because of the increasing use of hydrated solids because of their stability and simplicity of storage. In addition, a growth-promoting aspect is the food industry's ubiquitous need for hydrated solids as a firming agent for canned vegetables. Furthermore, the building industry's use of it for moisture control and soil stability is supporting market expansion. In addition, the pharmaceutical industry's broad need for hydrated solids for a range of medicinal uses, such as electrolyte replenishment, is driving the market's expansion.

- In 2023, the de-icing segment accounted for the largest revenue share over the forecast period.

On the basis of application, the Japan calcium chloride market is segmented into de-icing, dust control and road stabilization, drilling fluids, construction, industrial processing, and others. Among these, the de-icing segment has the largest revenue share over the forecast period. Its broad acceptance by governments and municipalities, as well as its rapid ice-melting capabilities, effectiveness at lower temperatures, and low environmental impact, are driving market expansion. In addition, a growth-inducing aspect is the growing emphasis on public safety and the requirement to maintain uninterrupted commerce and transportation during the winter. In addition, the market is growing because calcium chloride is becoming a more essential part of winter road maintenance programs because of its affordability and dependability in de-icing applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan calcium chloride market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tokuyama

- Fuji Kasei

- Weifang Taize Chemical Industry Co. Ltd

- Ward Chemical, Inc.

- Tiger Calcium Services Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Japan calcium chloride market based on the below-mentioned segments:

Japan Calcium Chloride Market, By Type

- Liquid

- Hydrated Solid

- Anhydrous Solid

Japan Calcium Chloride Market, By Application

- De-Icing

- Dust Control and Road Stabilization

- Drilling Fluids

- Construction

- Industrial Processing

- Others

Need help to buy this report?