Japan Car Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Third-Party Liability Coverage, Collision, Comprehensive, and Others), By Distribution Channel (Direct Sales, Individual Agents, Brokers, Banks, Online, and Others), and Japan Car Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationJapan Car Insurance Market Insights Forecasts to 2033

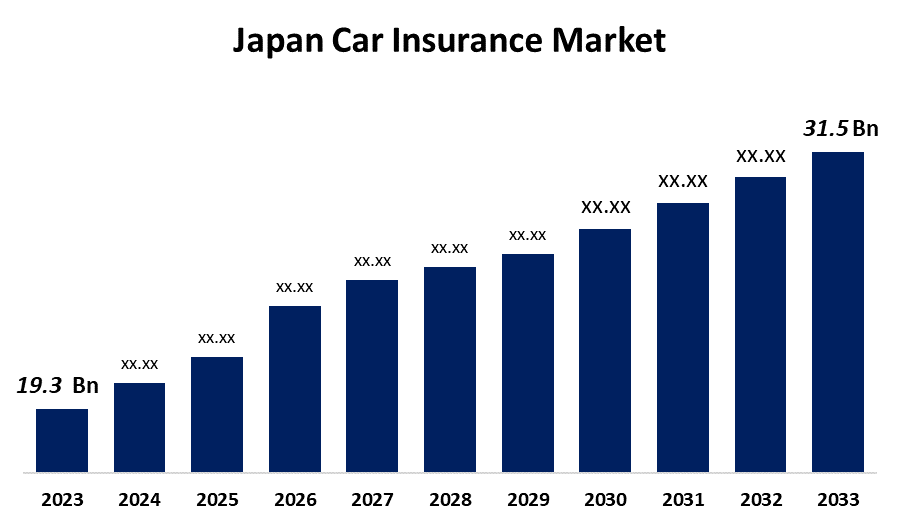

- The Japan Car Insurance Market Size was valued at USD 19.3 billion in 2023.

- The Market is growing at a CAGR of 5.02% from 2023 to 2033

- The Japan Car Insurance Market Size is expected to reach USD 31.5 billion by 2033

Get more details on this report -

The Japan Car Insurance Market is anticipated to exceed USD 31.5 billion by 2033, growing at a CAGR of 5.02% from 2023 to 2033. The growing gross written premium with declining insurance premium rates and digital innovation are driving the growth of the car insurance market in Japan.

Market Overview

Car insurance is a contract between the car owner and the insurance company for financial protection in the event of any damage or loss to the car, where the car owner agrees to pay a certain premium amount over a period. The primary purpose of car insurance is to provide financial security and peace of mind to vehicle owners by transferring the risk of potential losses to insurance companies. Car insurance products are becoming accessible to all car owners due to the growing digital insurance and product innovations in the market. Under the law of Japan, all registered automobiles are required to carry automobile liability insurance to protect third parties from accidental injuries. Telematics or usage-based insurance calculates premium rates of insurance based on driving profile by using telematics devices. This helps to minimize asymmetric information and moral hazard issues between buyers and insurers.

Report Coverage

This research report categorizes the market for the Japan car insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the car insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the car insurance market.

Japan Car Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.3 billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 5.02% |

| 2033 Value Projection: | USD 31.5 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 88 |

| Segments covered: | By Coverage, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Mitsui Sumitomo Insurance, Tokio Marine & Nichido Fire Insurance, Sompo Japan Insurance, Chubb, Aioi Nissay Dowa Insurance, Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In Japan, the unit sales volume of new passenger cars in Japan is increasing, with SUVs, mini cars, and medium cars accounting for 60% of overall sales, resulting rising focus on specific segments of cars by car insurance providers. The continuous decline in car insurance premium rates by insurance companies resulted in increasing gross written premium products. Furthermore, the integration of artificial intelligence-enabled tools, data analytics, and other online platforms for designing the products is driving the market growth. Online channels of direct insurance websites and application platforms for car insurance are also responsible for driving the market. The integration of metaverse-based solutions for communication during sales of car insurance products is leveraging market growth.

Restraining Factors

The cost of repairs, medical bills, and legal fees are some of the factors driving insurance companies' claim payouts. This may result in higher premiums for policyholders, which may affect affordability and deter some people from purchasing or renewing car insurance policies. In addition, fraud includes false claims and insurance scams resulting in increased costs for insurers, which can impact premiums and profitability, impacting the market environment and thus driving up the premiums.

Market Segmentation

The Japan Car Insurance Market share is classified into coverage and distribution channel.

- The third-party liability coverage segment dominates the market with the largest market share during the forecast period.

The Japan car insurance market is segmented by coverage into third-party liability coverage, collision, comprehensive, and others. Among these, the third-party liability coverage segment dominates the market with the largest market share during the forecast period. The affordability of third-party liability coverage makes it appealing to cost-conscious consumers. The awareness of legal requirements and mandatory auto insurance regulations is driving the market demand.

- The direct sales segment dominates the market with the largest revenue share during the forecast period.

Based on the distribution channel, the Japan car insurance market is divided into direct sales, individual agents, brokers, banks, online, and others. Among these, the direct sales segment dominates the market with the largest revenue share during the forecast period. Direct communication with the insurance company in direct sales enables tailored support and expedited procedures as well as builds brand loyalty and trust. It is the cost-saving way for both the insurer and the customer which makes it an attractive choice.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan car insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui Sumitomo Insurance

- Tokio Marine & Nichido Fire Insurance

- Sompo Japan Insurance

- Chubb

- Aioi Nissay Dowa Insurance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2022, OCTO Telematics, the leader in data analytics for the insurance sector, Smart Mobility, and Fleet Management, announced the opening of a new office in Tokyo, Japan, to strengthen its presence in a strategic hub for technology, robotics, and automation.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Car Insurance Market based on the below-mentioned segments:

Japan Car Insurance Market, By Coverage

- Third-Party Liability Coverage

- Collision

- Comprehensive

- Others

Japan Car Insurance Market, By Distribution Channel

- Direct Sales

- Individual Agents

- Brokers

- Banks

- Online

- Others

Need help to buy this report?