Japan Cocoa Powder Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Blended Cocoa Powder, Natural Cocoa Powder, and Dutch-Processed Cocoa Powder), By End-Use Industry (Food and Beverage, Cosmetics and Personal Care, and Pharmaceuticals) and Japan Cocoa Powder Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesJapan Cocoa Powder Market Insights Forecasts to 2033

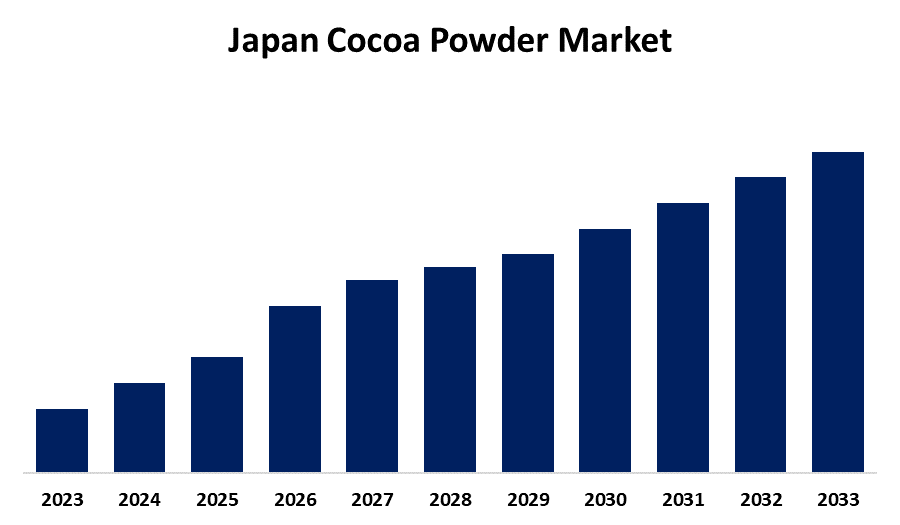

- The Market Size is Growing at a CAGR of 3.2% from 2023 to 2033

- The Japan Cocoa Powder Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Japan Cocoa Powder Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 3.2% from 2023 to 2033

Market Overview

Theobroma cacao beans are the source of cocoa powder, which includes a variety of consumables and ingredients used in food and drink. Chocolate, cocoa butter, and cocoa powder are the three primary goods made from cocoa. Often used in baking and drinks, cocoa powder is made by grinding roasted cacao beans and removing the majority of the oil. Additionally. The changing preferences of Japanese consumers have forced food and beverage producers to increase the use of cocoa powder and generate chocolate-flavored products, which has increased demand for the cocoa powder industry. The development of e-commerce channels and Japan's growing emphasis on using cocoa powder to innovate new culinary and beverage products are fueling industry expansion. Furthermore, several health advantages linked to cocoa powder, including improved blood circulation and a lower risk of heart attack, are contributing to the market's expansion in Japan.

Report Coverage

This research report categorizes the market for the Japan cocoa powder market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cocoa powder market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cocoa powder market.

Japan Cocoa Powder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 161 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By Product Type |

| Companies covered:: | Meiji Co., Ltd., Morinaga & Co., Ltd., Lotte Co., Ltd., Ezaki Glico Co., Ltd., Calbee, Inc., Fujiya Co., Ltd., Yamazaki Baking Co., Ltd., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Growing consumer awareness of the dangers of consuming artificial ingredients and their increased health conscience are driving sales of organic and sugar-free cocoa powder in the Japanese market. Additionally, in Japan, chocolate and confections, baking, refreshments, nutritious foods, pharmaceuticals, and skincare are just a few of the businesses that employ cocoa powder. Cocoa powder is most commonly used in Japan's chocolate and confectionery industries. Chocolate is extremely popular among Japanese customers, and brands like Meiji, Morinaga, and Lotte control a large portion of this industry. Chocolate, truffles, and other confections are frequently made with cocoa powder. The market is expanding due to the extensive use of cocoa powder in Japan. The cocoa powder sector in Japan is still growing and thriving as a result of the rising demand for different cocoa-based goods in the Japanese market.

Restraining Factors

The market for cocoa powder has two main obstacles: the price fluctuation of cocoa beans and sustainability issues in cocoa farming.

Market Segmentation

The Japan cocoa powder market share is classified into product type and end-use industry

- The natural cocoa powder segment is expected to dominate the Japan cocoa powder market during the forecast period.

Based on the product type, the Japan cocoa powder market is divided into blended cocoa powder, natural cocoa powder, and dutch-processed cocoa powder. Among these, the natural cocoa powder segment is expected to dominate the Japan cocoa powder market during the forecast period. The need for natural cocoa powder is demonstrated by several connected factors that reflect consumers' more general objectives for health, sustainability, and culinary flexibility. Individuals who are looking for less processed and natural food options are starting to like it more and more.

- The food and beverage segment is expected to hold a significant market share through the forecast period.

The Japan cocoa powder market is segmented by end-use industry into food and beverage, cosmetics and personal care, and pharmaceuticals. Among these, the food and beverage segment is expected to hold a significant market share through the forecast period. Cocoa powder is vital to the food and beverage industry due to its numerous applications and adaptability. It provides biscuits, cakes, brownies, and many other baked goods with a rich, chocolatey flavor and is a necessary ingredient.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cocoa powder market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Meiji Co., Ltd.

- Morinaga & Co., Ltd.

- Lotte Co., Ltd.

- Ezaki Glico Co., Ltd.

- Calbee, Inc.

- Fujiya Co., Ltd.

- Yamazaki Baking Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, Lotte Corporation and DLT Labs collaborated to advance ethical and sustainable supply chain methods for cacao beans. Lotte started its pilot project on blockchain-based child labor monitoring and the traceability of Ghanaian cacao beans.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Cocoa Powder Market based on the below-mentioned segments:

Japan Cocoa Powder Market, By Product Type

- Blended Cocoa Powder

- Natural Cocoa Powder

- Dutch-Processed Cocoa Powder

Japan Cocoa Powder Market, By End-Use Industry

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

Need help to buy this report?