Japan Cold Chain Logistics Market Size, Share, and COVID-19 Impact Analysis, By Type (Refrigerated Warehouse and Refrigerated Transport), By Temperature Type (Frozen and Chilled), By Technology (Dry Ice, Gel Packs, Eutectic Plates, Liquid Nitrogen, and Quilts), By Application (Dairy & Frozen Desserts, Pharmaceuticals, Process Food, Meat, Fish & Seafoods, Bakery & Confectionary, Fruits & Vegetables, and Others), and Japan Cold Chain Logistics Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationJapan Cold Chain Logistics Market Insights Forecasts to 2033

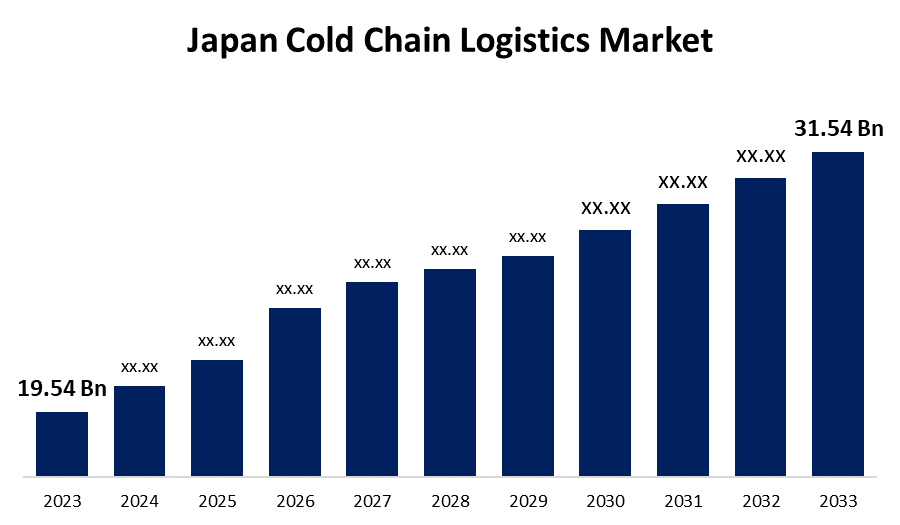

- The Japan Cold Chain Logistics Market Size was valued at USD 19.54 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.90% from 2023 to 2033

- The Japan Cold Chain Logistics Market Size is expected to reach USD 31.54 Billion by 2033

Get more details on this report -

The Japan Cold Chain Logistics Market is anticipated to exceed USD 31.54 billion by 2033, growing at a CAGR of 4.90% from 2023 to 2033. The growing criticality of the healthcare sector and increased consumer demand for fresh foods are driving the growth of the cold chain logistics market in the Japan.

Market Overview

Cold chain logistics includes transporting temperature-sensitive products, such as foods, equipment, and biopharmaceutical medicines. The primary objective of cold chain logistics is the prompt delivery of goods in an environment where humidity and temperature are consistently regulated. The R&D capabilities of Japanese companies have an immense impact on the cold chain industry as they create innovative solutions that enhance the transportation and preservation of temperature-sensitive products. Japan’s growing demand for frozen food is a reflection of shifting consumer preferences and lifestyles, driven by year-round demands for a range of food options, convenience, and longer shelf life. Further, there is rapid advancements in regenerative medicine and biopharmaceuticals have led to an increase in demand for cold pharmaceutical chains. Japan’s convenience store culture and retail preferences for fresh, ready-to-eat foods, and efficient chilled delivery networks are required. Technological advancements such as automation, IoT technology, advanced refrigeration, and temperature-monitoring systems have enabled cold chain logistics technical management and real-time tracking.

Report Coverage

This research report categorizes the market for the Japan cold chain logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cold chain logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cold chain logistics market.

Japan Cold Chain Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 19.54 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.90% |

| 023 – 2033 Value Projection: | USD 31.54 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Temperature Type, By Technology, By Application |

| Companies covered:: | Nippon Express, Yamato Holdings, Sagawa, DHL, Kintetsu World Express, K line Logistics, Kuehne Nagel, Nichirei Logistics Group, Inc., Sojitz Corporation, Itochu Logistics Corp., Kokubu Goup, CEVA Logistics, Agility, SF Express, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The expansion of the pharmaceutical industry and an increase in refrigerated storage capacity are anticipated to propel the Japan cold chain logistics market. Japan's frozen food consumption volume is approximately 2.9 million tons in 2021. Modern-age solutions like independent elderly citizens, an increase in dual-income homes, and single people as well as the danger of food loss are driving the demand for chilled/frozen foods that leads to drive the market demand.

Restraining Factors

Irregular distribution of cold storage capacity, lack of proper logistical connectivity support, and the need for high capital investment are impeding the market growth for cold chain logistics.

Market Segmentation

The Japan Cold Chain Logistics Market share is classified into type, temperature type, technology, and application.

- The refrigerated transport segment is anticipated to grow at the fastest CAGR during the forecast period.

The Japan cold chain logistics market is segmented by type into refrigerated warehouse and refrigerated transport. Among these, the refrigerated transport segment is anticipated to grow at the fastest CAGR during the forecast period. Refrigeration transport is needed for the delivery of pharmaceutical products like temperature-sensitive drugs, vaccines, and biologics to medical facilities. Further, the increasing consumer demand for freshness and chilled transport guarantees fruits, vegetables, and other perishable items for home delivery and the expansion of e-commerce platforms are driving the market growth.

- The chilled segment is expected to witness the fastest CAGR growth through the forecast period.

The Japan cold chain logistics market is segmented by temperature type into frozen and chilled. Among these, the chilled segment is expected to witness the fastest CAGR growth through the forecast period. Chilled temperature is the temperature above freezing temperature that maintains the quality of the product, and maintains the nutritional value, freshness, and flavor of perishable goods during storage and transport. The popularity of chilled foods in Japan due to busier lifestyles and the need for convenience, that are readily available and ready to eat are contributing to market growth.

- The dry ice segment dominates the market with the largest market share during the forecast period.

The Japan cold chain logistics market is segmented by technology into dry ice, gel packs, eutectic plates, liquid nitrogen, and quilts. Among these, the dry ice segment dominates the market with the largest market share during the forecast period. The adaptability of dry ice to fit in a wide range of container shapes and sizes makes it appropriate for a broad spectrum of product transportation by being customized to meet different needs for storage and packaging. Further, modern dry ice technology offers improved insulation and temperature monitoring.

- The pharmaceuticals segment dominates the Japan cold chain logistics market during the forecast period.

Based on the application, the Japan cold chain logistics market is divided into dairy & frozen desserts, pharmaceuticals, process food, meat, fish & seafoods, bakery & confectionary, fruits & vegetables, and others. Among these, the pharmaceuticals segment dominates the Japan cold chain logistics market during the forecast period. Cold chain logistics assure compliance with stringent regulations and quality standards, guaranteeing that medications and vaccines remain within specified temperature limits to meet regulatory requirements. It is useful for the storage and transit of vaccines, preventing their degradation and ensuring effectiveness, especially for immunization programs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cold chain logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Express

- Yamato Holdings

- Sagawa

- DHL

- Kintetsu World Express

- K line Logistics

- Kuehne Nagel

- Nichirei Logistics Group, Inc.

- Sojitz Corporation

- Itochu Logistics Corp.

- Kokubu Goup

- CEVA Logistics

- Agility

- SF Express

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, GLP Pte Ltd. (GLP) announced that it had started construction of fully refrigerated cold storage facilities in Japan totaling 55,000 SQM. GLP Kobe Sumiyoshihama and GLP Rokko V would be GLP’s purpose-built logistics developments in Japan to provide much-needed capacity to support the continued growth of the cold chain industry.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Cold Chain Logistics Market based on the below-mentioned segments:

Japan Cold Chain Logistics Market, By Type

- Refrigerated Warehouse

- Refrigerated Transport

Japan Cold Chain Logistics Market, By Temperature Type

- Frozen

- Chilled

Japan Cold Chain Logistics Market, By Technology

- Dry Ice

- Gel Packs

- Eutectic Plates

- Liquid Nitrogen

- Quilts

Japan Cold Chain Logistics Market, By Application

- Dairy & Frozen Desserts

- Pharmaceuticals

- Process Food

- Meat, Fish & Seafoods

- Bakery & Confectionary

- Fruits & Vegetables

- Others

Need help to buy this report?