Japan Construction Equipment Rental Market Size, Share, and COVID-19 Impact Analysis, By Type (Earthmoving Equipment, Road Construction Equipment, Material Handling Equipment, Others), By End-Users (Construction, Mining, Logistics & Warehouse, Others) and Japan Construction Equipment Rental Market Insights Forecasts to 2032

Industry: Machinery & EquipmentJapan Construction Equipment Rental Market Insights Forecasts to 2032

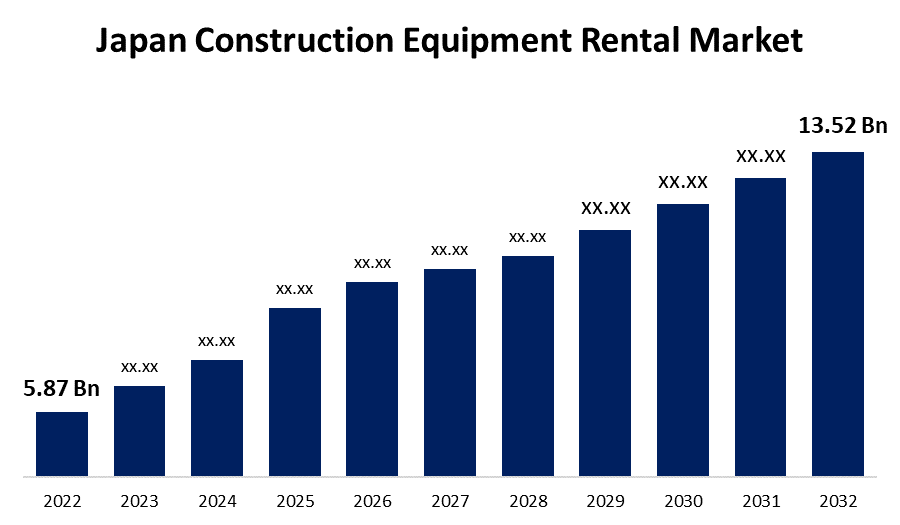

- The Japan Construction Equipment Rental Market Size was valued at USD 5.87 Billion in 2022.

- The Market Size is growing at a CAGR of 8.7% from 2022 to 2032.

- The Japan Construction Equipment Rental Market Size is expected to reach USD 13.52 Billion by 2032.

- Japan is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Japan Construction Equipment Rental Market Size is expected to reach USD 13.52 Billion by 2032, at a CAGR of 8.7% during the forecast period 2022 to 2032.

Market Overview

In the Japanese construction equipment rental market, increased clean energy sources development is predicted to boost growth in renting material-handling machinery. The steadily increasing need for reconditioned forklifts and tractor-trailers in the Japanese construction equipment rental market is supported by growth in the logistics industry and e-commerce industry as a result of rising demand for commodities in both global and local markets. In the manufacturing industry, using automated systems and robotics briefly alleviate the labor shortage problem. In Japan, demand for new-generation excavators equipped with ICT and telemetry technology is rapidly increasing. Trained labor shortages and an increase in construction incidents in Japan are driving the adoption of automated rental construction equipment. An increase in government expenditure for the National Resilience Plan, including sustaining infrastructure and expressway construction, is anticipated to boost demand for Japan's construction equipment rental market. The leasing of construction equipment has the advantage of reducing high upfront expenses, high-priced construction breakdowns, and the availability of modern technology-equipped construction machinery.

Report Coverage

This research report categorizes the market for Japan Construction Equipment Rental Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Construction Equipment Rental Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Construction Equipment Rental Market.

Japan Construction Equipment Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.87 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.7% |

| 2032 Value Projection: | USD 13.52 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Type, By End-Users, and COVID-19 Impact Analysis |

| Companies covered:: | AKTIO Corporation, Kanomoto, Nishio, Kawasaki Heavy Industries, Nikken Corporation, Taiyo Kenki Rental, Hitachi Construction Machinery, Japan Construction Equipment Manufacturers Association, Mitsubishi Heavy Industries, Sumitomo Heavy Industries, Tadano Limited, Takeuchi Manufacturing, Kubota, Rent Corporation, Komatsu Limited, and Others |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

With regard to its aging population, Japan is confronting a scarcity of youthful worker labor. Digitalization is becoming more popular in a variety of industries to increase productivity, especially in the Japanese construction equipment leasing market. In addition, the government has begun to spend on infrastructure renovation around the country. Investment decisions are also being made in preventing and minimizing disasters, strengthening the nation's resilience, and other public works projects.

The expansion of the Japanese construction equipment rental market is being driven by rising demand in the region's building and mining operations. Furthermore, supplementary costs offered as a result of the upkeep of equipment, exorbitant operational costs, and the high pay of professional operators can be avoided by renting equipment for the appropriate time, which contributes significantly to Japan's construction equipment rental market growth. Furthermore, the implementation of loT will aid in overcoming the shortage of specialized manpower as well as improving the safety of operators and end users. As a result, all of these factors are expected to boost the demand for the growth of the Japanese construction equipment rental market over the forecasted time frame.

Market Segment

- In 2022, the earthmoving equipment segment is witnessing a higher growth rate over the forecast period.

Based on the type, the Japan Construction Equipment Rental Market is segmented into earthmoving equipment, road construction equipment, material handling equipment, and others. Among these, the earthmoving equipment segment is witnessing a higher growth rate over the forecast period. The rising use of earthmoving excavators in the agricultural, mining, and construction industries greatly aids in business expansion. Backhoe loaders, crawler excavators, skid-steer loaders, and compact excavators, on the other hand, have a higher load capacity and greater engine performance. These characteristics of earthmoving equipment allow them to be used in severe operating settings. As a result, the demand for construction equipment rental in Japan is increasing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Construction Equipment Rental Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AKTIO Corporation

- Kanomoto

- Nishio

- Kawasaki Heavy Industries

- Nikken Corporation

- Taiyo Kenki Rental

- Hitachi Construction Machinery

- Japan Construction Equipment Manufacturers Association

- Mitsubishi Heavy Industries

- Sumitomo Heavy Industries

- Tadano Limited

- Takeuchi Manufacturing

- Kubota

- Rent Corporation

- Komatsu Limited

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On March 2023, Hitachi Construction Machinery Co., Ltd. and First Quantum Minerals Ltd. announce the signing of a Letter of Intent ("LOI") to promote the development of sustainable mining solutions at First Quantum's flagship mining operations in Zambia. This collaboration marks a significant milestone for both companies, with Hitachi Construction Machinery accelerating the validation of its zero emission mining product as part of its technology roadmap and First Quantum progressing toward reducing operational greenhouse gas (GHG) emissions and achieving long-term sustainability goals by implementing this battery-electric technology at one of its largest mine sites.

- In May 2022, AKTIO Corporation and GIKEN LTD. have formed a rental business collaboration. AKTIO Corporation is one of the industry's leading construction equipment rental firms. GIKEN sees this commercial cooperation as a significant step toward our goal of reaching 100 billion yen in sales in ten years, as described in our Mid-term Management Plan 2024.

- In October 2022, Marubeni Corporation and Rent Corporation formed a joint venture firm in the Socialist Republic of Vietnam. With Vietnam's consistent economic growth, investment in the building and industrial sectors has increased. However, on the actual locations of those industries, the number of machines accessible is restricted, and safe working conditions for the workers are not adequately ensured. Through the rental service activities of various machineries of this new joint venture company, Marubeni and Rent will multiply their functions and networks, respond to demand in the construction and manufacturing sectors, and contribute to the improvement of safety and efficiency of actual sites in Vietnam.

- In December 2022, JICA stated that it has signed a loan agreement with the Egyptian government to offer a Japanese ODA loan of up to 41,000 million Japanese yen ($306 million) for the Greater Cairo Metro Line No. 4 Phase 1 Project II. According to a news release from JICA, the project intends to meet transportation demand, reduce traffic congestion, and improve air pollution in the Greater Cairo Area by creating a new metro in the south-west of Greater Cairo and in Cairo's city center.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Construction Equipment Rental Market based on the below-mentioned segments:

Japan Construction Equipment Rental Market, By Type

- Earthmoving Equipment

- Road Construction Equipment

- Material Handling Equipment

- Others

Japan Construction Equipment Rental Market, By End-Users

- Construction

- Mining

- Logistics & Warehouse

- Others

Need help to buy this report?