Japan Containerboard Market Size, Share, and COVID-19 Impact Analysis, By Material (Virgin and Recycled), By End-User (Food & Beverage, Personal Care & Cosmetics, Industrial, and Others), and Japan Containerboard Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsJapan Containerboard Market Insights Forecasts to 2033

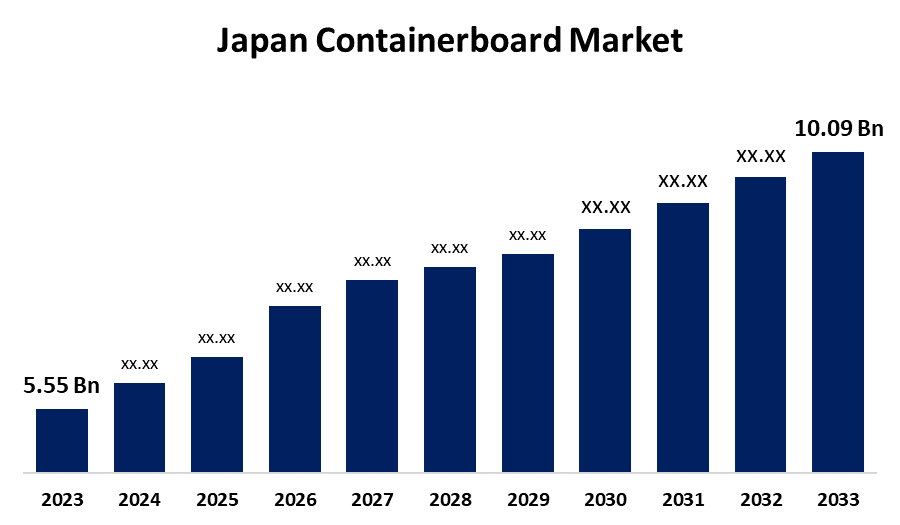

- The Japan Containerboard Market Size was valued at USD 5.55 Billion in 2023

- The Market is Growing at a CAGR of 6.16% from 2023 to 2033

- The Japan Containerboard Market Size is Expected to Reach USD 10.09 Billion by 2033.

Get more details on this report -

The Japan Containerboard Market Size is Anticipated to Reach USD 10.09 Billion By 2033, Growing at a CAGR of 6.16% from 2023 to 2033.

Market Overview

The durable and long-lasting paperboard known as containerboard is made mostly from recycled mixed paper and old corrugated containers (OCC), along with virgin fibers derived from wood pulp. These fiberboards have many benefits, such as strength and durability, which guarantee dependable product protection during storage and transportation, thus lowering the chance of damage. Additionally, these containerboards have a lightweight design that reduces transportation expenses and their negative effects on the environment. From tiny boxes to big containers, its adaptability enables customisation to satisfy a range of packaging requirements. Additionally, Japan's B2C eCommerce sales increased by 5.37% in 2022 to reach USD 162.4 billion, according to METI's annual eCommerce Market Survey (August 2023). This continued upswing is anticipated to further stimulate the Japanese containerboard market.

Report Coverage

This research report categorizes the market for the Japan containerboard market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan containerboard market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan containerboard market.

Japan Containerboard Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.55 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.16% |

| 2033 Value Projection: | USD 10.09 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Material, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Nippon Unipac Holdings Corporation, Rengo Co., Ltd., Daio Paper Corporation, Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Mitsubishi Paper Mills Limited, Hokuetsu Paper Mills Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese food and beverage sector is a major factor in Japan's containerboard demand. These boxes are perfect for packaging and delivering a wide variety of food items since they are sturdy and resistant to crushing, vibration, and stacking. This helps to propel the expansion of the containerboard industry in Japan. Additionally, the U.S. Department of Agriculture estimates that the retail food and beverage market in Japan was worth approximately USD 327 billion in 2022, demonstrating the strong demand for a variety of food and beverage products and the critical role that the food and beverage sector plays in driving the expansion of the Japanese containerboard market. Furthermore, the demand for containerboard is also anticipated to be increased by Japan's thriving e-commerce industry. Containerboard's lightweight and flexibility make handling and shipment simple, which is essential for the e-commerce sector. A number of causes, including increased industrial activity in the manufacturing sector that needs containerboard packaging to carry and safeguard goods, are projected to contribute to Japan's expected strong growth.

Restraining Factors

The government's strict limitations on the utilization of natural resources are the main factor impeding market expansion. The use of virgin wood fiber in the production of virgin containerboards adds to the environmental load.

Market Segmentation

The Japan containerboard market share is classified into material and end-user.

- The recycled segment is expected to hold a significant market share through the forecast period.

The Japan containerboard market is segmented by material into virgin and recycled. Among these, the recycled segment is expected to hold a significant market share through the forecast period. Recycling materials are in greater demand as a result of consumer product makers' growing desire for recyclable materials. The food and beverage industry's strong desire for sustainable and environmentally friendly packaging options has also propelled the market.

- The food & beverage segment is expected to dominate the Japan containerboard market during the forecast period.

Based on the end-user, the Japan containerboard market is divided into food & beverage, personal care & cosmetics, industrial, and others. Among these, the food & beverage segment is expected to dominate the Japan containerboard market during the forecast period. The food and beverage industry needs corrugated boxes manufactured of containerboards for storage and shipping. This is due to its durability, capacity to withstand vibration and stacking, and resistance to crushing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan containerboard market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Unipac Holdings Corporation

- Rengo Co., Ltd.

- Daio Paper Corporation

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Mitsubishi Paper Mills Limited

- Hokuetsu Paper Mills Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, Rengo Co., Ltd. declared that Marufuku was a Rengo subsidiary after acquiring all of the company's shares. The Rengo Group intended to strengthen its partnership with Marufuku and grow its flexible packaging and folding carton operations in each area going forward.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Containerboard Market based on the below-mentioned segments:

Japan Containerboard Market, By Material

- Virgin

- Recycled

Japan Containerboard Market, By End-User

- Food & Beverage

- Personal Care & Cosmetics

- Industrial

- Others

Need help to buy this report?