Japan Contract Development and Manufacturing Organization (CDMO) Market Size, Share, and COVID-19 Impact Analysis, By Product (API and Drug Products), By Workflow (Clinical and Commercial), By Application (Oncology, Hormonal, Glaucoma, Cardiovascular Disease, Diabetes, & Others), and Japan Contract Development and Manufacturing Organization Market Insights, Industry Trend, Forecasts to 2032.

Industry: HealthcareJapan Contract Development and Manufacturing Organization (CDMO) Market Insights Forecasts to 2032

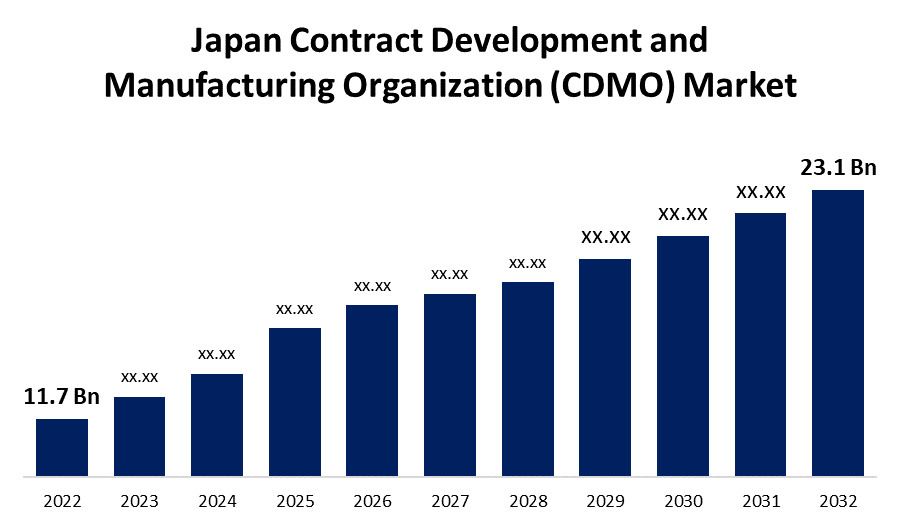

- The Japan Contract Development and Manufacturing Organization (CDMO) Market Size was valued at USD 11.7 Billion in 2022.

- The Market is growing at a CAGR of 7.0% from 2022 to 2032

- The size is expected to reach USD 23.1 Billion by 2032.

Get more details on this report -

The Japan Contract Development and Manufacturing Organization (CDMO) Market Size was valued at USD 11.7 Billion in 2022 and is expected to grow to USD 23.1 Billion by 2032, at a CAGR of 7.0% from during the forecast period (2022-2032).

Market Overview

The pharmaceutical industry's healthcare contract development and manufacturing organizations provide a wide range of services, from drug discovery to medication manufacture, under a contract basis. The bulk of pharmaceutical businesses is now able to outsource those aspects of their operations that can enable scalability or allow them to focus more on developing new drugs and marketing them. Clinical trials, scale-up, formal stability, commercial production, and registration batches are only a few of the services provided by pre-formulation, stability studies, formulation development, method development, and registration batches. The goal of service providers is to focus on a particular technology or dosage form while also encouraging end-to-end efficiency and continuity for all of their outsourced clients. Major strategic projects include facility expansion, collaboration, collaborations, the launch of new services, and mergers and acquisitions are ongoing among market participants. For example, in July 2022 Catalent announced that it will build a high-speed blister packaging factory in Shiga, Japan. This will be in addition to the factory's automated fill-and-finish process.

Report Coverage

This research report categorizes the market of Japan contract development and manufacturing organization market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan contract development and manufacturing organization market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan contract development and manufacturing organization market.

Japan Contract Development and Manufacturing Organization (CDMO) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.7 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.0% |

| 2032 Value Projection: | USD 23.1 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application, By Workflow, and COVID-19 Impact |

| Companies covered:: | CordenPharma International, WuXi AppTec, Cambrex Corporation, Recipharm AB, Lonza, Catalent, Inc., Laboratory Corporation of America Holdings, Thermo Fisher Scientific, Inc., Samsung BioLogics, FUJIFILM Corporation, Sumitomo Chemical Company, Limited, CMIC HOLDINGS Co., LTD., Bushu Pharmaceuticals Ltd., Nipro Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is mainly driven by Japan's high elderly population and rising illness burden, and the cheap costs of outsourcing drug manufacturing and development services. Some of the main growth factors are an increase in the demand for biopharmaceuticals. Additionally, numerous contract development and manufacturing organizations (CDMOs) are boosting their investments in facility and service growth. For the diagnosis and treatment of several chronic illnesses, there is an increasing need in Japan for biologic medications. Japan is one of the major pharmaceutical marketplaces in the world, accounting for USD 109.6 million in 2020, according to the International Trade Administration (ITA). And aggressively works to increase access to biopharmaceutical medicines.

Restraining Factors

The demand for CDMO services in Japan is growing, particularly in areas such as biologics and advanced therapies. However, there may be limitations in manufacturing capacities, especially for specialized processes like cell and gene therapies. Meeting the increasing demand while maintaining high-quality standards and quick turnaround times can be challenging for CDMOs. Also, The Japanese pharmaceutical industry operates under strict regulations and compliance requirements, which may restrain market growth.

COVID 19 Impacts

The COVID-19 epidemic increased demand for CDMO products. Even amid the epidemic, some CDMOs in Japan were working to increase their capacity by building new facilities. To store temperature-controlled sterile pharmaceuticals and biologics, for instance, Bushu Pharmaceuticals built its Misato manufacturing facility in Japan in August 2020. Similar to this, CMIC Group opened a new facility in Japan in July 2020 specifically for processing research and GMP production of antibody medicines. Such efforts by CDMOs in the nation are anticipated to have a favorable effect on the market.

Market Segment

- In 2022, the API segment is dominating the largest market share over the forecast period.

On the basis of product, the Japan contract development and manufacturing organization market are bifurcated into API and drug products. Among these, the API segment accounted for the largest revenue share during the forecast period owing to the increasing prevalence of sickness in Japan and the rising need for novel medications both contributing to the segment's market expansion. Also, the government's growing interest in promoting the use of generic medications and the industry’s ongoing facility expansions are two additional factors contributing to the segment's growth. For instance, in March 2022, Sumitomo Chemical Company, Limited upgraded its plant to increase its ability to produce API and intermediates for small-molecule medicines.

- In 2022, the commercial segment is influencing a higher growth rate over the forecast period

Based on the workflow, the Japan contract development and manufacturing organization market are classified into clinical and commercial. Among these, the commercial segment is expected to have a higher market share value during the forecast period, due to the country's rising demand for generic medications, as well as the rising number of biosimilar and regenerative medicine approvals, which are some of the drivers boosting the segment's rise. The prevalence of diseases that fuel the urge for excessive drug use is fostering the growth of this phenomenon.

The clinical segment is expected to grow at the fastest CAGR during the forecast period, owing to this segment covering CDMO clinical trial services, such as the production of clinical trial doses and other trial supplies. A sizable number of pharmaceutical firms are located in Japan. To increase their profit margin, several pharmaceutical corporations are having CDMO outperform them in clinical trial dose manufacture.

- In 2022, the oncology segment is leading the largest market share over the forecast period.

Based on the application, the Japan contract development and manufacturing organization market are bifurcated into oncology, hormonal, glaucoma, cardiovascular disease, diabetes, & others. Among these, the oncology segment accounted for the highest growth over the forecast period owing to the because the country has a high cancer burden. The market's expansion is also being aided by the approval of virotherapy and regenerative products for cancer treatment.

Glaucoma is expected to register the second-fastest segment during the forecast period. This is because there are more elderly people living in Japan, which is anticipated to increase the demand for glaucoma medications there and boost the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan contract development and manufacturing organization market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CordenPharma International

- WuXi AppTec

- Cambrex Corporation

- Recipharm AB

- Lonza

- Catalent, Inc.

- Laboratory Corporation of America Holdings

- Thermo Fisher Scientific, Inc.

- Samsung BioLogics

- FUJIFILM Corporation

- Sumitomo Chemical Company, Limited

- CMIC HOLDINGS Co., LTD.

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, to accelerate the manufacturing of adeno-associated viruses for creating medications for cell and gene therapy, WuXi AppTec introduced Tetracycline-Enabled Self-Silencing Adenovirus (TESSA) technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Japan Contract Development and Manufacturing Organization Market based on the below-mentioned segments:

Japan Contract Development and Manufacturing Organization Market, By Product

API

- Type

- Traditional Active Pharmaceutical Ingredient (Traditional API)

- Highly Potent Active Pharmaceutical Ingredient (HP-API)

- Antibody Drug Conjugate (ADC)

- Others

- Synthesis

- Synthetic

- Solid

- Liquid

- Biotech

- Drug

- Innovative

- Generic

- Manufacturing

- Continuous Manufacturing

- Batch Manufacturing

Drug Product

- Oral Solid Dose

- Semi-Solid Dose

- Liquid Dose

- Others

Japan Contract Development and Manufacturing Organization Market, By Workflow

- Clinical

- Commercial

Japan Contract Development and Manufacturing Organization Market, By Application

- Oncology

- Hormonal

- Glaucoma

- Cardiovascular Disease

- Diabetes

- Others

Need help to buy this report?