Japan Credit Risk Management Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Consulting, Software Solutions, and Outsourcing Services), By Application (Banking, Financial Services, Insurance, Retail, and Others), and Japan Credit risk management services Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialJapan Credit Risk Management Services Market Insights Forecasts to 2033

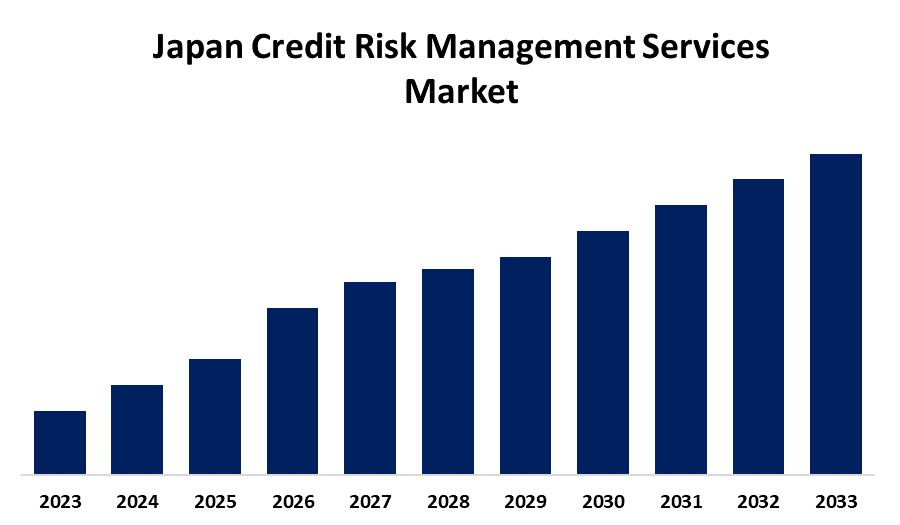

- The Japan Credit Risk Management Services Market Size is Growing at a CAGR of 5.9% from 2023 to 2033

- The Japan Credit Risk Management Services Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Japan Credit Risk Management Services Market Size is Anticipated to hold a significant share by 2033, Growing at a CAGR of 5.9% from 2023 to 2033.

Market Overview

The Japan credit risk management services market refers to the industry focused on technologies and solutions that help financial institutions and businesses in Japan assess, mitigate, and manage credit risks effectively. The complexity of Japan’s financial markets, increased regulatory oversight in Japan, and the growing need for sophisticated risk management solutions across industries in Japan are all factors contributing to this expansion. Effective credit risk management services are now essential for maintaining both Japan’s financial stability and operational effectiveness, as businesses in Japan deal with more possible credit risks as a result of evolving economic conditions. As Japan continues to advance in financial technology and regulatory frameworks, companies in Japan are prioritizing robust credit risk management solutions to safeguard their operations and ensure long-term stability in Japan’s dynamic financial ecosystem.

Report Coverage

This research report categorizes the market for the Japan credit risk management services based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan credit risk management services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan credit risk management services market.

Japan Credit Risk Management Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.9% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Service Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Mizuho Information & Research Institute, Advantage Risk Management, Integratto Inc., TMR, Nikkei Financial Technology Research Institute, KYC Consulting Corporation, Intersoft KK, and Others Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The rise in automation and digitization in Japan's financial services industry is one of the main development factors propelling the country's credit risk management services market. Japanese financial institutions are making significant investments in cutting-edge technologies like machine learning (ML) and artificial intelligence (AI) to automate credit evaluation procedures, increase accuracy, and lower human error. These developments improve the accuracy of creditworthiness assessments unique to Japan's banking and financial environment by allowing businesses there to process massive amounts of data quickly. Additionally, Japan's adoption of big data analytics is enabling businesses to extract valuable insights from consumer data, which improves decision-making and reduces possible credit risks.

Restraining Factors

There are some risks facing the credit risk management services market that could affect how quickly it grows. A major obstacle is the growing intricacy of regulatory mandates, which can pose difficulties for entities aiming to establish and sustain efficient

Market Segmentation

The Japan credit risk management services market share is classified into service type and application.

- The consulting segment is expected to hold a significant market share through the forecast period.

The Japan credit risk management services market is segmented by service type into consulting, software solutions, and outsourcing services. Among these, the consulting segment is expected to hold a significant market share through the forecast period. Consulting services are essential for helping businesses create strategies for managing credit risk. These services cover a variety of tasks, such as developing policies, implementing best practices, and assessing risks.

- The banking segment is expected to hold a significant market share through the forecast period.

The Japan credit risk management services market is segmented by application into banking, financial services, insurance, retail, and others. Among these, the banking segment is expected to hold a significant market share through the forecast period. This is due to the necessity for strong risk management frameworks to protect financial stability and guarantee regulatory compliance, the banking industry accounts for a sizeable share of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan credit risk management services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mizuho Information & Research Institute

- Advantage Risk Management

- Integratto Inc.

- TMR

- Nikkei Financial Technology Research Institute

- KYC Consulting Corporation

- Intersoft KK

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Credit Risk Management Services Market based on the below-mentioned segments:

Japan Credit Risk Management Services Market, By Platform

- Consulting

- Software Solutions

- Outsourcing Services

Japan Credit Risk Management Services Market, By End-User

- Banking

- Financial Services

- Insurance

- Retail

- Others

Need help to buy this report?