Japan Cyber Security Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Hardware, and Services), By Security Type (Infrastructure Protection, Data Security, Cloud Security, Network Security, Application Security, and Others), By Organization Size (Small and Medium Enterprises (SMEs) and Large Enterprises), End Use (IT and Telecommunications, BFSI, Healthcare, Retail & E-commerce, Manufacturing, and Others), and Japan Cyber Security Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologyJapan Cyber Security Market Insights Forecasts to 2033

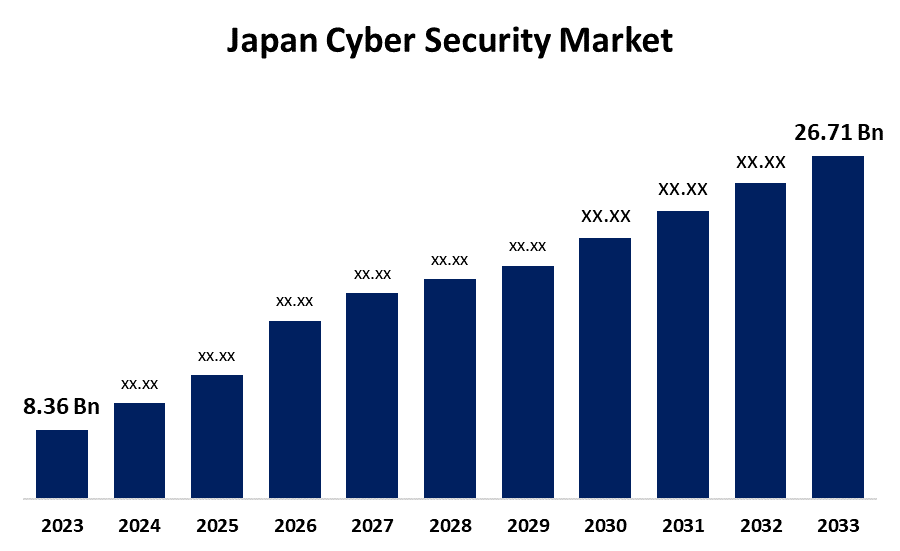

- The Japan Cyber Security Market Size Was Estimated at USD 8.36 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.32% from 2023 to 2033

- The Japan Cyber Security Market Size is Expected to Reach USD 26.71 Billion by 2033

Get more details on this report -

The Japan Cyber Security Market Size is Expected to reach USD 26.71 Billion by 2033, Growing at a CAGR of 12.32% from 2023 to 2033.

Market Overview

The cybersecurity industry in Japan includes government programs, private sector investments, and a rising need for specialized services and qualified personnel to secure digital assets and systems from cyber threats. Japan's cybersecurity market is primarily driven by the growing sophistication of cyber threats. Businesses, governmental organizations, and critical infrastructure sectors are giving top priority to putting strong security measures in place as cyberattacks get more sophisticated. The increase in ransomware, state-sponsored cyberattacks, and data breaches that target both public and private organizations has raised awareness of cybersecurity threats. In addition, The Japanese cybersecurity sector is being shaped in large part by government initiatives and regulatory frameworks. To improve data security and privacy requirements, the Japanese government has passed a number of frameworks and legislation. Additionally, the need for cutting-edge cybersecurity solutions to safeguard vital industries like finance, healthcare, and energy has grown as a result of Japan's quick digital transition.

Report Coverage

This research report categorizes the market for the Japan cyber security market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan cyber security market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan cyber security market.

Japan Cyber Security Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 8.36 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.32% |

| 2033 Value Projection: | USD 26.71 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Security Type, By Organization Size, By End Use |

| Companies covered:: | Acalvio Technologies, Inc., Akamai Technologies, Allure Security Technology, Appier Inc., Dell Inc., F5 Inc., FFRI Security, Inc., Netpoleon Group, BBS Technology (BBSEC), CDNetworks Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The Japan cyber security market is anticipated to increase over the projected period due to the growing use of enterprise security solutions in manufacturing, banking, financial services, insurance (BFSI), and healthcare. Additionally, Internet security solutions in a network architecture have been enhanced by the growth of e-commerce platforms and technological developments like blockchain, cloud computing, and artificial intelligence. Furthermore, network security solutions are being adopted by e-commerce enterprises in their electronic security and IT systems.

Restraining Factors

The Japan cyber security market faces challenges including a lack of qualified cybersecurity experts, the high cost of implementing cutting-edge security solutions, and reluctance to embrace new technologies. Further impeding the general adoption of strong cybersecurity measures is the fact that small and medium-sized businesses frequently lack resources and awareness.

Market Segmentation

The Japan cyber security market share is classified into component, security type, organization size, and end use.

- The hardware segment accounted for the largest market share of 42.50% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the component, the Japan cyber security market is divided into software, hardware, and services. Among these, the hardware segment accounted for the largest market share of 42.50% in 2023 and is expected to grow at a significant CAGR during the forecast period. The increase is fueled by growing cyber threats that target government agencies, financial institutions, and vital infrastructure. In addition to improving security, businesses make significant investments in intrusion detection systems, firewalls, and encrypted storage.

- The infrastructure protection segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the security type, the Japan cyber security market is classified into infrastructure protection, data security, cloud security, network security, application security, and others. Among these, the infrastructure protection segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is expanding due to energy, transportation, and telecommunications are among the industries that have become very vulnerable to cyberattacks due to the growing digitization of their infrastructure.

- The large enterprises segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the organization size, the Japan cyber security market is classified into small and medium enterprises (SMEs) and large enterprises. Among these, the large enterprises segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to the increasing security threats posed by cloud computing, the Internet of Things, and remote work options, large enterprises are investing in next-generation firewalls, artificial intelligence, and real-time monitoring.

- The BFSI segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the end use, the Japan cyber security market is classified into IT and telecommunications, BFSI, healthcare, retail & e-commerce, manufacturing, and others. Among these, the BFSI segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is expanding due to the growing use of fintech services, mobile payments, and digital banking, financial institutions are more susceptible to ransomware, phishing, and account takeovers. Biometric authentication, AI-powered fraud detection, and multi-layered security frameworks are becoming more and more necessary to counteract changing cyber threats. Additionally, financial institutions spend money on endpoint security and real-time transaction monitoring to safeguard private client information and maintain regulatory compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan cyber security market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Acalvio Technologies, Inc.

- Akamai Technologies

- Allure Security Technology

- Appier Inc.

- Dell Inc.

- F5 Inc.

- FFRI Security, Inc.

- Netpoleon Group

- BBS Technology (BBSEC)

- CDNetworks Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Rapid7 launched the PACT Partner Program to give partners resources, training, and tools to help them deal with cybersecurity issues. This effort aims to improve cooperation and foster expansion by launching a new Partner Training Academy, specific engagement initiatives, and an updated Partner Portal.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan cyber security market based on the below-mentioned segments:

Japan Cyber Security Market, By Component

- Software

- Hardware

- Services

Japan Cyber Security Market, By Security Type

- Infrastructure Protection

- Data Security

- Cloud Security

- Network Security

- Application Security

- Others

Japan Cyber Security Market, By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Japan Cyber Security Market, By End Use

- IT and Telecommunications

- BFSI

- Healthcare

- Retail & E-commerce

- Manufacturing

- Others

Need help to buy this report?