Japan Defence Market Size, Share, and COVID-19 Impact Analysis, By Armed Forces (Army, Navy, Air Force), and By Type (Personnel Training & Protection, C4ISR and EW, Vehicles, Weapons and Ammunition), and Japan Defence Market Insights, Industry Trend, Forecasts to 2032

Industry: Aerospace & DefenseJapan Defence Market Insights Forecasts to 2032

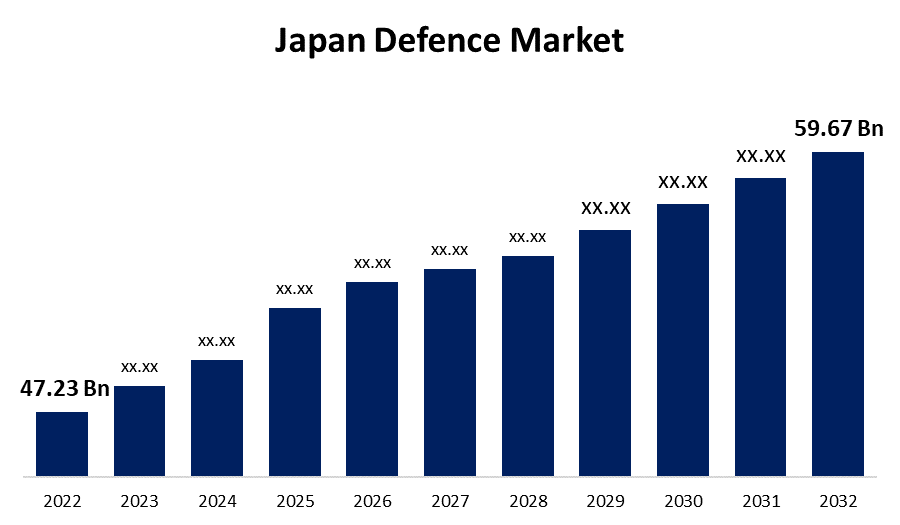

- The Japan Defence Market Size was valued at USD 47.23 Billion in 2022.

- The Market Size is Growing at a CAGR of 2.37% from 2022 to 2032.

- The Japan Defence Market Size is expected to reach 59.67 Billion by 2032.

Get more details on this report -

The Japan Defence Market Size is expected to reach USD 59.67 Billion by 2032, at a CAGR of 2.37% during the forecast period 2022 to 2032.

Market Overview

Defence refers to a variety of activities such as the manufacture of air-based, sea-, and land-based military equipment, as well as support and auxiliary equipment such as radar, satellites, sonars, and other auxiliary equipment, as well as the maintenance, repair, and overhaul of defence-related machinery. Several factors influence the Japanese defence industry, including the country's regional security environment, technological advancements, and domestic policies. Because of its proximity to North Korea, territorial disputes with China over the East China Sea, and concerns about Korean Peninsula stability, the country faces security challenges. Because of these factors, there has been a strong emphasis on Defence capabilities and modernization efforts. Furthermore, Japan's commitment to international peacekeeping missions, as well as its alliances, particularly with the United States, have a significant impact on its defence market, emphasizing interoperability and collaborative development. Another emerging trend is a greater emphasis on domestic defence manufacturing and research, which fosters self-reliance while decreasing reliance on foreign suppliers. Japan’s defence market is being shaped by a combination of factors and patterns that work together to create a cohesive force that responds to security and regional challenges while also maintaining a high level of innovation.

Report Coverage

This research report categorizes the market for Japan defence market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan defence market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japanese defence market.

Japan Defence Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 47.23 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 2.37% |

| 2032 Value Projection: | USD 59.67 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Armed Forces and By Type |

| Companies covered:: | Kawasaki Heavy Industries Ltd, Mitsubishi Heavy Industries Ltd, Lockheed Martin Corporation, The Boeing Company, BAE Systems PLC, ShinMaywa Industries Ltd, The Japan Steel Works Ltd, Toshiba Corporation, Subaru Corporation, Komatsu Ltd, Raytheon Technologies, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The primary driver of the Japanese market is ensuring national security and protecting the country's interests. Japan is confronted with several security issues, including boundary disputes, nuclear threats, cyber warfare, and conflicts in the region. Investment in Defence capabilities is driven by the need to protect its sovereignty and maintain a credible Defence posture. The domestic Defence industry in Japan drives the market, contributing to the country's industrial base and technological advancements. The Defence industry promotes job creation, encourages innovation, and contributes to economic growth. The government's support for domestic Defence companies, as well as investments in Defence-related R&D, stimulate industry growth in Japan.

Restraining Factors

Japan has financial restrictions that may limit its ability to spend on Defence. The government must allocate funds to various sectors and prioritize competing demands, such as social welfare, infrastructure development, and economic initiatives. This has the potential to constrain the quantity of resources available for Defence investments and procurement.

Market Segment

- In 2022, the army segment accounted for the largest revenue share over the forecast period.

Based on the armed forces, the Japanese defence market is segmented into the army, navy, and air force. Among these, the army segment has the largest revenue share over the forecast period. The army is primarily a land-based force that engages in ground warfare and territorial Defence. In comparison, the army's equipment primarily consists of tanks, artillery, and land vehicles.

- In 2022, the C4ISR & EW segment accounted for the largest revenue share over the forecast period.

Based on type, the Japan defence market is segmented into personnel training & protection, C4ISR & EW, vehicles, weapons and ammunition. Among these, the C4ISR & EW segment has the largest revenue share over the forecast period. Several technological advancements in communication and computing are also boosting market growth. AI and machine learning integration into C4ISR systems has improved their analytical capabilities, allowing for faster and more accurate decision-making. Furthermore, the growing adoption of network-centric warfare strategies by Japanese military forces has increased the demand for interconnected C4ISR solutions that enable real-time data sharing among various units and platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan defence market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kawasaki Heavy Industries Ltd

- Mitsubishi Heavy Industries Ltd

- Lockheed Martin Corporation

- The Boeing Company

- BAE Systems PLC

- ShinMaywa Industries Ltd

- The Japan Steel Works Ltd

- Toshiba Corporation

- Subaru Corporation

- Komatsu Ltd

- Raytheon Technologies

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Japan and Australia signed a new bilateral security contracted covering military, intelligence, and cybersecurity cooperation to offset the deteriorating security outlook caused by China's growing assertiveness.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Defence market based on the below-mentioned segments:

Japan Defence Market, By Armed Forces

- Army

- Navy

- Air Force

Japan Defence Market, By Type

- Personnel Training & Protection

- C4ISR and EW

- Vehicles

- Weapons and Ammunition

Need help to buy this report?