Japan Diabetes Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Insulin, GLP-1 Receptor Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), By Diabetes Type (Type 1 and Type 2), By Route of Administration (Oral, Subcutaneous, and Intravenous), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, and Retail Pharmacies), and Japan Diabetes Drugs Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareJapan Diabetes Drugs Market Insights Forecasts to 2033

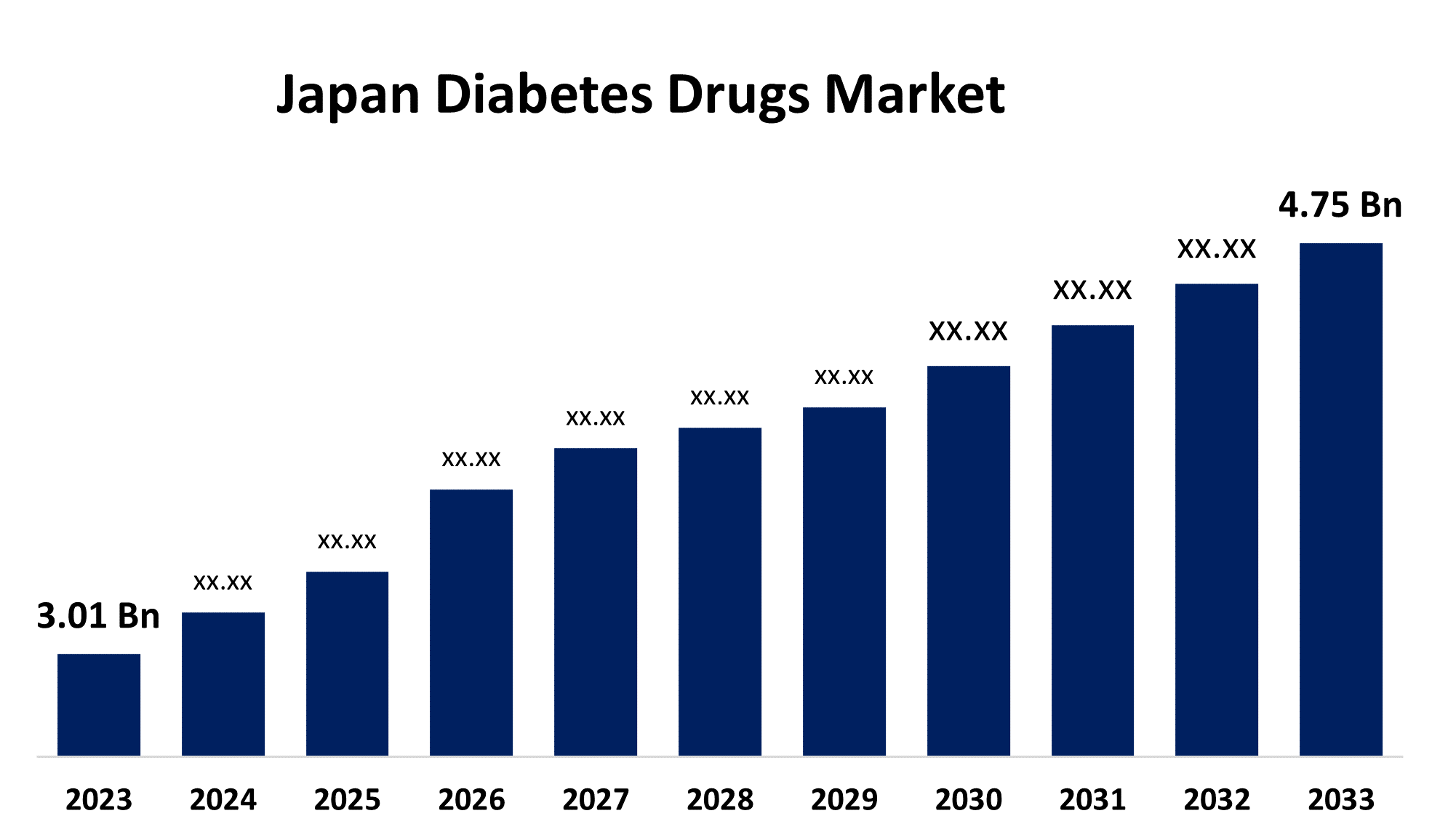

- The Japan Diabetes Drugs Market Size was valued at USD 3.01 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.67% from 2023 to 2033

- The Japan Diabetes Drugs Market Size is Expected to reach USD 4.75 Billion by 2033

Get more details on this report -

The Japan Diabetes Drugs Market is anticipated to exceed USD 4.75 billion by 2033, growing at a CAGR of 4.67% from 2023 to 2033. The growing aging population and the conduction of disease management programs are driving the growth of the diabetes drugs market in the Japan.

Market Overview

Diabetes drugs are medications used to manage diabetes by reducing glucose levels in the body. Diabetes is a chronic, life-threatening disease with no known cure. The various kinds of anti-diabetic drugs involved in the treatment of diabetes for treating type 1 and type 2 diabetes mellitus. These drugs are administered via oral route, intravenous, or subcutaneous route of administration. Japan has one of the world’s largest elderly populations, making it more prone to the emergence of type 2 diabetes. Diabetes is becoming prevalent in Japan as the country’s population ages. IDF forecasts for 2021 state that 11 million adults in Japan suffer from diabetes. The high incidence of diabetes is linked to substantial financial burdens and can be explained by longer lifespans and lifestyle modifications. Technological developments in diabetes devices, such as high-end insulin pumps and pens, are driving up the market growth. Further, the leading manufacturing companies are focusing on creating innovative products and technological advancements are leveraging market opportunity.

Report Coverage

This research report categorizes the market for the Japan diabetes drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Diabetes Drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the diabetes drugs market.

Japan Diabetes Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.01 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.67% |

| 2033 Value Projection: | USD 4.75 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Drug Class, By Diabetes Type, By Route of Administration, By Distribution Channel |

| Companies covered:: | Novo Nordisk A/S, Eli Lilly, AstraZeneca, Takeda, Novartis, Janssen Pharmaceuticals, Astellas, Boehringer Ingelheim, Merck And Co., Sanofi Aventis, Bristol Myers Squibb, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The prevalence of diabetes is increasing among the population, particularly in the elderly population, because of unhealthy diets, obese population, and sedentary lifestyles which leads to drive the market demand for diabetes drugs. The country supports public awareness and preventative measures that emphasize dietary and lifestyle changes to lower the risk of adult-onset diabetes are driving the Japan diabetes drugs market. The increasing government initiatives to screen diabetes and intervention programs are further contributing to propelling the market.

Restraining Factors

The stringent regulatory environment and the time-consuming approval process of the new anti-diabetic drugs are hampering the market growth.

Market Segmentation

The Japan Diabetes Drugs Market share is classified into drug class, diabetes type, route of administration, and distribution channel.

- The GLP-1 receptor agonists segment dominates the market with the largest market share in 2023.

The Japan diabetes drugs market is segmented by drug class into insulin, GLP-1 receptor agonists, DPP-4 inhibitors, SGLT2 inhibitors, and others. Among these, the GLP-1 receptor agonists segment dominates the market with the largest market share in 2023. GLP-1 receptor agonist drugs are used to treat type 2 diabetes mellitus and obesity. The increasing R&D investments for the development of novel drugs with enhanced safety and high glycemic efficacy are driving the market growth.

- The type 2 segment accounted for the largest share of the Japan diabetes drugs market during the forecast period.

Based on the diabetes type, the Japan diabetes drugs market is divided into type 1 and type 2. Among these, the type 2 segment accounted for the largest share of the Japan diabetes drugs market during the forecast period. Type 2 diabetes mellitus is characterized by hyperglycemia that can be regulated by drug treatment along with a healthy diabetes diet. The development of anti-diabetic drugs for type 2 diabetes with the growing prevalence of type 2 diabetes are driving the market growth.

- The oral anti-diabetic drugs segment dominates the market with the largest market share in 2023.

The Japan diabetes drugs market is segmented by route of administration into oral, subcutaneous, and intravenous. Among these, the oral segment dominates the market with the largest market share in 2023. Since oral drugs have a wide variety of efficaciousness, safety, and mechanisms of action, they are usually the first prescribed medications for type 2 diabetes. The easier management, lower cost, and better acceptance over insulin for controlling blood glucose levels are driving the market in the oral anti-diabetic drugs segment.

- The retail pharmacies segment held the largest market share during the forecast period.

The Japan diabetes drugs market is segmented by distribution channel into online pharmacies, hospital pharmacies, and retail pharmacies. Among these, the retail pharmacies segment held the largest market share during the forecast period. Retail pharmacies offer a wide variety of products and often offer over-the-counter pharmaceuticals, and health supplements along with the benefit of acquiring expert advice from healthcare providers. The accessibility and affordability of anti-diabetic drugs in retail pharmacies bolster the diabetes drug market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan diabetes drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk A/S

- Eli Lilly

- AstraZeneca

- Takeda

- Novartis

- Janssen Pharmaceuticals

- Astellas

- Boehringer Ingelheim

- Merck And Co.

- Sanofi Aventis

- Bristol Myers Squibb

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, Health2Sync announced that its latest version of the Health2Sync app integrates insulin data from Mallya Cap, the connected device dedicated to insulin pens developed by Biocorp and marketed in Japan by Novo Nordisk.

- In July 2022, Eli Lilly Japan and Mitsubishi Tanabe Pharma Corporation signed a sales collaboration agreement in Japan for GIP/GLP-1 receptor agonist “Tirzepatide”.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Diabetes Drugs Market based on the below-mentioned segments:

Japan Diabetes Drugs Market, By Drug Class

- Insulin

- GLP-1 Receptor Agonists

- DPP-4 Inhibitors

- SGLT2 Inhibitors

- Others

Japan Diabetes Drugs Market, By Diabetes Type

- Type 1

- Type 2

Japan Diabetes Drugs Market, By Route of Administration

- Oral

- Subcutaneous

- Intravenous

Japan Diabetes Drugs Market, By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Need help to buy this report?