Japan Engineering Plastics Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Fluoropolymer, Polyoxymethylene (POM), Liquid Crystal Polymer (LCP), Polyethylene Terephthalate (PET), Polyamide (PA), Polybutylene Terephthalate (PBT), Polymethyl Methacrylate (PMMA), Styrene Copolymers (ABS and SAN), Polycarbonate (PC), Polyether Ether Ketone (PEEK), and Polyimide (PI)), By End-Use Industry (Aerospace, Building and Construction, Electrical and Electronics, Automotive, Industrial and Machinery, Packaging, and Others), and Japan Engineering Plastics Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsJapan Engineering Plastics Market Insights Forecasts to 2033

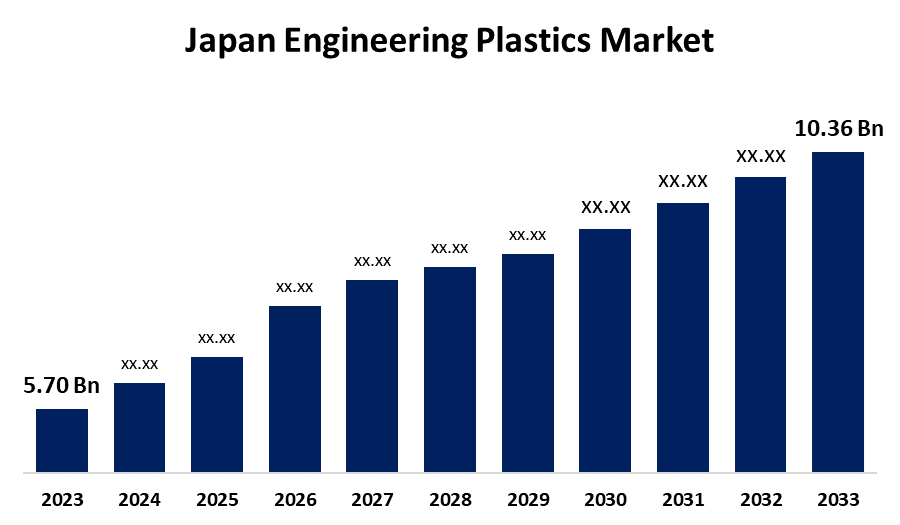

- The Japan Engineering Plastics Market Size was estimated at USD 5.70 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.16% from 2023 to 2033

- The Japan Engineering Plastics Market Size is Expected to Reach USD 10.36 Billion by 2033

Get more details on this report -

The Japan Engineering Plastics Market Size is Expected to Reach USD 10.36 billion by 2033, growing at a CAGR of 6.16% from 2023 to 2033.

Market Overview

The industry focused on the manufacture and usage of high-performance plastic materials utilized in a variety of industries, including automotive, aerospace, electronics, and packaging, is referred to as the Japan engineering plastics market. In addition to their exceptional mechanical qualities, resilience, and thermal stability, these polymers are applicable for demanding applications where more conventional materials such as metals and ceramics might not be enough. The market is growing due to high-performance engineering plastics for chemical and thermal resistance, electronic devices, and electric measuring devices, which are all growing as a result of 5G adoption, vehicle integration, and the export of electronic components. In addition, key players are spending on research and development of sustainable alternatives, while preserving the high-performance attributes required by end-user industries. Furthermore, the government's plastic resource circulation strategy, which aims to recycle or reuse all plastic waste by 2035, is driving innovation in manufacturing techniques and compositions for recyclable engineering plastics.

Report Coverage

This research report categorizes the market for the Japan engineering plastics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan engineering plastics market.

Japan Engineering Plastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.70 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.16% |

| 2033 Value Projection: | USD 10.36 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Resin Type, By End-Use Industry and COVID-19 Impact Analysis |

| Companies covered:: | Daicel Corporation, Techno-UMG Co., Ltd., Mitsubishi Chemical Corporation, MCT PET Resin Co Ltd, Sumitomo Chemical Co., Ltd., Kureha Corporation, Teijin Limited, UBE Corporation and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan engineering plastics market is growing as a result of increasing defense expenditures to increase the manufacture of aerospace components. In addition, the market is expanding due to superior manufacturing techniques and ongoing advancements in resin technology. Additionally, the automobile industry's demand for lightweight, high-performance materials and the trend toward electric vehicles are important in driving the market expansion. Furthermore, Japan's engineering plastics industry is changing as a result of sustainability programs and legislative frameworks. Since of the nation's dedication to environmental conservation, recyclable plastics and bio-based engineered plastics are receiving more attention.

Restraining Factors

Japan engineering plastics market faces significant constraints because engineering plastics are more expensive to produce than normal plastics, because they frequently require sophisticated processes and premium raw materials. In addition, the market share of engineering plastics may be constrained by competition from materials including metals, ceramics, and biodegradable plastics.

Market Segmentation

The Japan engineering plastics market share is classified into the resin type and end-use industry.

- The polyethylene terephthalate (PET) segment accounted for the largest share of 35% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the resin type, the Japan engineering plastics market is divided into fluoropolymer, polyoxymethylene (POM), liquid crystal polymer (LCP), polyethylene terephthalate (PET), polyamide (PA), polybutylene terephthalate (PBT), polymethyl methacrylate (PMMA), styrene copolymers (ABS AND SAN), polycarbonate (PC), polyether ether ketone (PEEK), and polyimide (PI). Among these, the polyethylene terephthalate (PET) segment accounted for the largest share of 35% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is primarily driving this significant market presence due to PET's wide range of uses in the packaging sector, especially in the production of bottles and containers. In addition, the ideal option for food and beverage packaging applications is the material's transparent, robust, lightweight, and 100% recyclable qualities.

- The electrical and electronics segment accounted for the largest share of 33% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use industry, the Japan engineering plastics market is divided into aerospace, building and construction, electrical and electronics, automotive, industrial and machinery, packaging, and others. Among these, the electrical and electronics segment accounted for the largest share of 33% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to engineering plastics like ABS/SAN, PC, and PA, which are widely used in sophisticated and intelligent electrical devices, contributing to this segment's importance. Additionally, the dominance of the segment is strengthened by Japan's superiority in manufacturing devices and components, especially in vital technology like medical cameras and all-solid batteries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan engineering plastics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daicel Corporation

- Techno-UMG Co., Ltd.

- Mitsubishi Chemical Corporation

- MCT PET Resin Co Ltd

- Sumitomo Chemical Co., Ltd.

- Kureha Corporation

- Teijin Limited

- UBE Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, global leader in engineering plastics Polyplastics Co., Ltd. announced the introduction of LAPEROS (R) bG-LCP, a sustainable solution that lowers CO2 emissions and increases the ratio of renewable content. It is based on biomass-derived materials (mass balancing approach). In addition to DURACON (R) bG-POM, the introduction broadens the company's DURACIRCLE (R) strategy.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan engineering plastics market based on the below-mentioned segments:

Japan Engineering Plastics Market, By Resin Type

- Fluoropolymer

- Polyoxymethylene (POM)

- Liquid Crystal Polymer (LCP)

- Polyethylene Terephthalate (PET)

- Polyamide (PA)

- Polybutylene Terephthalate (PBT)

- Polymethyl Methacrylate (PMMA)

- Styrene Copolymers (ABS and SAN)

- Polycarbonate (PC)

- Polyether Ether Ketone (PEEK)

- Polyimide (PI)

Japan Engineering Plastics Market, By End-Use Industry

- Aerospace

- Building and Construction

- Electrical and Electronics

- Automotive

- Industrial and Machinery

- Packaging

- Others

Need help to buy this report?