Japan Freight and Logistics Market Size, Share, and COVID-19 Impact Analysis, By End-Users (Agriculture, Fishing & Forestry, Construction, Manufacturing, Oil & Gas, and Mining), By Logistics Function (Courier, Express & Parcel, Freight Forwarding, Warehousing & Storage, and Others), By Mode of Transportation (Road Freight, Rail Freight, Air Freight, Sea Freight, and Multimodal), and Japan freight and logistics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationJapan Freight and Logistics Market Insights Forecasts to 2033

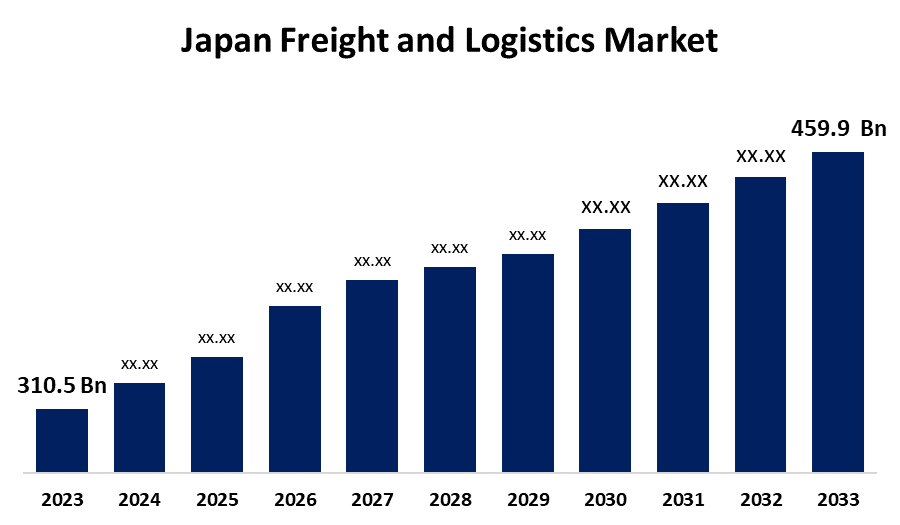

- The Japan Freight and Logistics Market Size was valued at USD 310.5 Billion in 2023.

- The Market is Growing at a CAGR of 4.01% from 2023 to 2033

- The Japan Freight and Logistics Market Size is Expected to reach USD 459.9 Billion by 2033

Get more details on this report -

The Japan freight and logistics Market Size is anticipated to exceed USD 459.9 Billion by 2033, growing at a CAGR of 4.01% from 2023 to 2033.

Market Overview

Freight logistics, often known as logistics, is the organized method of planning, executing, and controlling the effective transportation of goods and commodities from their point of production to their final destination. Freight is (typically) large, heavy commodities transported by land, sea, or air. Freight is defined as things that are too large or heavy to be conveyed using a package service. Logistics, as popularly understood, is the act of planning and managing the transfer of resources—including people, inventory, food, equipment, and liquids—from one location to the intended destination. It includes managing the transportation of commodities from a point of origin to a point of consumption to meet customer demand. This diverse profession includes a variety of tasks such as transportation, warehousing, inventory control, and information technology. At its foundation, freight logistics aims to simplify the transportation of goods while reducing costs and maximizing resources. Effective freight management is critical for firms to remain competitive, decrease operating costs, and exceed consumer expectations for on-time deliveries. It is critical to the economy, facilitating the movement of goods on a local scale and so promoting trade.

Report Coverage

This research report categorizes the market for the Japan freight and logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan freight and logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan freight and logistics market.

Japan Freight and Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 310.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.01% |

| 2033 Value Projection: | USD 459.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End-Users, By Logistics Function, By Mode of Transportation |

| Companies covered:: | Mitsui O.S.K. Lines, Ltd., Nippon Express, NYK (Nippon Yusen Kaisha) Line, SG Holdings Co., Ltd., Yamato Holdings Co. Ltd., DB Schenker, DSV A/S, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid expansion of local trade, together with rising demand for goods, is a main driver of the industry's growth. The growth of regional commerce demands the need for effective and affordable freight logistics services. Furthermore, technical innovations such as automation, IoT, and data analytics, that could streamline supply chain processes, improve transparency, and lower costs, are contributing to a positive market outlook. Furthermore, the rise of e-commerce is changing consumer behavior, resulting in an increase in last-mile delivery and stimulating improvements in transportation and warehousing. Aside from that, various strict emissions rules and an increasing emphasis on eco-friendly practices force businesses to invest in more environmentally friendly and sustainable transportation solutions, such as electric and hydrogen-powered automobiles.

Restraining Factors

The complicated and demanding regulatory system that governs the transportation of goods across borders and within the country is a major constraint on the Japan freight and logistics market. To import products into Japan, importers must get import permission and pay customs fees and excise tax.

Market Segmentation

The Japan freight and logistics market share is classified into product end-users, logistics function, and mode of transportation.

- The agriculture segment is expected to hold the largest market share through the forecast period.

The Japan freight and logistics market is segmented by end-users into agriculture, fishing & forestry, construction, manufacturing, oil & gas, and mining. Among these, the agriculture segment is expected to hold the largest market share through the forecast period. Due to the growing agricultural produce import and export businesses. According to the USDA Foreign Agriculture Service, Japan is the fourth-biggest export market for the US, with USD 14.2 billion in imports in 2021.

- The warehousing & storage segment dominates the market with the largest market share over the predicted period.

The Japan freight and logistics market is segmented by logistics function into courier, express & parcel, freight forwarding, warehousing & storage, and others. Among these, the warehousing & storage segment dominates the market with the largest market share over the predicted period. The growing e-commerce sector increases the demand for efficient logistics and distribution centers. The considerable increase in online shopping and consumer demand for quicker deliveries is leading merchants to build a dependable infrastructure to hold and process orders, which is driving the warehouse and storage industry.

- The sea freight segment is expected to dominate the Japan freight and logistics market during the forecast period.

Based on the mode of transportation, the Japan freight and logistics market is divided into road freight, rail freight, air freight, sea freight, and multimodal. Among these, the sea freight segment is expected to dominate the Japan freight and logistics market during the forecast period Roughly 90% of Japan's trade goes by sea, according to Seacon Logistics, a logistics chain controller based in Germany. As an island nation with four major islands and around 4,000 smaller islands, the country's topography greatly contributes to the expansion of marine freight.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan freight and logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui O.S.K. Lines, Ltd.

- Nippon Express

- NYK (Nippon Yusen Kaisha) Line

- SG Holdings Co., Ltd.

- Yamato Holdings Co. Ltd.

- DB Schenker

- DSV A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Accenture, a global IT major based in Ireland, and Mujin, a robotic solution provider based in Japan, formed a joint venture, to introduce AI and robots to the logistics and industrial sectors.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan freight and logistics market based on the below-mentioned segments:

Japan Freight and Logistics Market, By End-Users

- Agriculture

- Fishing & Forestry

- Construction

- Manufacturing

- Oil & Gas

- Mining

Japan Freight and Logistics Market, By Logistics Function

- Courier

- Express & Parcel

- Freight Forwarding

- Warehousing & Storage

- Others

Japan Freight and Logistics Market, By Mode of Transportation

- Road Freight

- Rail Freight

- Air Freight

- Sea Freight

- Multimodal

Need help to buy this report?