Japan Furniture Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Wood, Metal, Plastic, Others), By End-User (Residential, Office, Hotel, Others), and Japan Furniture Market Insights Forecasts 2022 – 2032

Industry: Consumer GoodsJapan Furniture Market Insights Forecasts to 2032

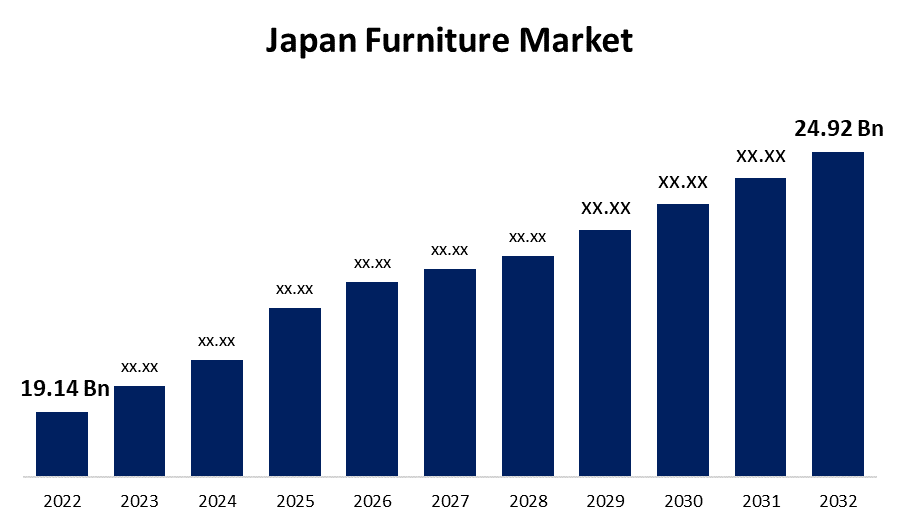

- The Japan Furniture Market Size was valued at USD 19.14 Billion in 2022.

- The Market Size is Growing at a CAGR of 2.67% from 2022 to 2032.

- The Japan Furniture Market Size is expected to reach 24.92 Billion by 2032.

Get more details on this report -

The Japan Furniture Market Size is expected to reach USD 24.92 Billion by 2032, at a CAGR of 2.67% during the forecast period 2022 to 2032.

Market Overview

Furniture is a term used to describe movable objects that are designed to support various human activities such as sitting, sleeping, or storing items. It includes a wide range of items such as chairs, tables, beds, and cabinets made of various materials such as wood, metal, plastic, and upholstery. It provides comfort and allows people to relax and perform activities in a relaxed manner. It contributes to the aesthetics of a room and the creation of a visually appealing atmosphere. It is commonly found in living rooms, bedrooms, kitchens, and dining rooms. House furnishings that are stylish effectively enhance the beauty of the living space. Growing home decoration and renovation trends among the Japanese population are primarily driving demand for such products. Consumers primarily prefer to purchase highly engineered items such as sofas, stools, chairs, and others to beautify their living and dining rooms. Also, by using sectional sofas in their offices, consumers can conduct meetings and discussions more flexibly. Rising demand among households for chairs and stools in various sculptural shapes, such as a pyramid, curves, and others, is likely to provide newer opportunities for market growth in Japan.

Report Coverage

This research report categorizes the market for Japan furniture market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japanese furniture market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japanese furniture market.

Japan Furniture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 19.14 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 2.67% |

| 2032 Value Projection: | USD 24.92 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Raw Material, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | IKEA Kobe, Cassina lxc, Hida Sangyo, Karimoku Furniture Co., Ltd., Nitori, Muji, Huasheng Furniture Group, CondeHouse, Miyazaki Chair Factory, Ariake, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan is experiencing increased construction activity, which has resulted in the expansion of residential real estate, as well as a significant increase in the number of households. Home furniture, such as living room and dining room furniture, bedroom furniture, and kitchen furniture, is currently in high demand in Japan. The country is experiencing increased construction activity, with new housing units being built across the country, as well as an increase in per capita disposable income among consumers, which is increasing demand for home furniture. This growth is also being fueled by an increase in the number of household units and population migration. Household spending on dining-room furniture in the country is also relatively stable, albeit small in comparison to spending on bedroom items. China, Vietnam, and other Southeast Asian countries supply nearly all of Japan's bedroom furniture.

Restraining Factors

The middle-class population prefers to buy used home furnishings and low-cost items over high-end items. This is expected to hamper Japan market growth. Furthermore, major companies' business growth is being hampered by intense competition from disorganized key players in various countries around the world.

Market Segment

- In 2022, the wood segment accounted for the largest revenue share over the forecast period.

Based on the raw material, the Japan furniture market is segmented into wood, metal, plastic, and others. Among these, the wood segment has the largest revenue share over the forecast period. The cost-effectiveness of such items in comparison to others. The associated companies' consistent supply of highly engineered wooden chairs and sofa sets is likely to reduce demand for such products in residential settings.

- In 2022, the residential segment accounted for the largest revenue share over the forecast period.

Based on end users, the Japan furniture market is segmented into residential, office, hotel, and others. Among these, the residential segment has the largest revenue share over the forecast period. A high demand for sofa sets and chairs among residential consumers for their home and backyard seating needs. Furthermore, the increasing urbanization rate and the rising number of nuclear families in Japan are driving segmental growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japanese furniture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IKEA Kobe

- Cassina lxc

- Hida Sangyo

- Karimoku Furniture Co., Ltd.

- Nitori

- Muji

- Huasheng Furniture Group

- CondeHouse

- Miyazaki Chair Factory

- Ariake

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, Inter IKEA Systems B.V. (Interogo Foundation) introduced three new transition collections, including Vivid Wonderland, Glorious Green, and Simple Serenity, to encourage households to make more sustainable purchases.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japanese furniture market based on the below-mentioned segments:

Japan Furniture Market, By Raw Material

- Wood

- Metal

- Plastic

- Others

Japan Furniture Market, By End User

- Residential

- Office

- Hotel

- Others

Need help to buy this report?