Japan Hemostats Market Size, Share, and COVID-19 Impact Analysis, By Product (Thrombin-Based Hemostats, Oxidized Regenerated Cellulose-Based Hemostats, Combination Hemostats, and Others), By Formulation (Matrix & Gel Hemostats, Powder Hemostats, and Others), By End-Use (Hospitals & Clinics, Ambulatory Surgical Centers, Casualty Care Centers, and Others), By Application (Orthopedic Surgery, General Surgery, Neurological Surgery, Cardiovascular Surgery, and Others), and Japan Hemostats Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareJapan Hemostats Market Insights Forecasts to 2033

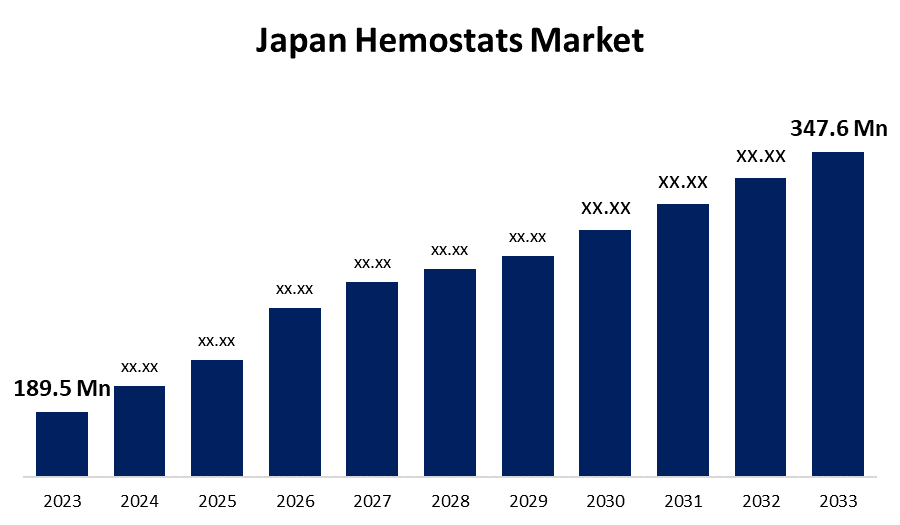

- The Japan Hemostats Market Size was valued at USD 189.5 Million in 2023.

- The Market Size is Growing at a CAGR of 6.25% from 2023 to 2033

- The Japan Hemostats Market Size is expected to reach USD 347.6 Million by 2033

Get more details on this report -

The Japan Hemostats Market is anticipated to exceed USD 347.6 Million by 2033, growing at a CAGR of 6.25% from 2023 to 2033. The growing prevalence of chronic diseases, the increasing aging population, and a growing number of surgical procedures are driving the growth of the hemostats market in the Japan.

Market Overview

Hemostats are surgical tools utilized for controlling bleeding during surgery that are similar in design to both pillars and scissors. These tools keep the blood within a damaged blood vessel, overall improving the hemostasis procedure outcomes, thereby enhancing patient care. During major surgery, a hemostat is used to regulate blood loss or halt bleeding. It serves as a first incision closure technique used in the early phases of surgery to seal blood vessels until they are ligated. It has a range of tools, including pivots, clamps, needle holders, and clamps. Research released in December 2023 by the PLOS states that between 2014 and 2021, 142,931 cruciate ligament (CL) procedures were performed in Japan. The study also notes that throughout the past seven years, there has been an increase in the frequency of CL surgery in Japan. Furthermore, the rising patient population as well as healthcare expenditure are anticipated to offer lucrative market opportunities for hemostats.

Report Coverage

This research report categorizes the market for the Japan hemostats market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan hemostats market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan hemostats market.

Japan Hemostats Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 189.5 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.25% |

| 023 – 2033 Value Projection: | USD 347.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Formulation, By End-Use, By Application |

| Companies covered:: | Johnson & Johnson Services, Inc., Integra LifeSciences Corporation, Cohera Medical, Inc., CryoLife, Inc, Pfizer, Baxter, B. Braun Melsungen AG, Medtronic, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Hemostatic drugs are used in these surgeries to halt bleeding. The increase in chronic illnesses surges the need for surgery which leads to driving the Japan hemostats market. Around 222,642 surgical treatments were carried out in Japan in 2020, according to an article published by Asian Plastic Surgery Sydney in April 2022. Further, technological advancement and substantial growth in the development of innovative products are significantly contributing to driving market growth. In addition, the adoption of MIS procedures is propelling the market demand for hemostats.

Restraining Factors

The lack of skilled surgeons for managing homostats leads to restrictions on the adoption of these products resulting in restraining the market growth. Further, the growth in technological advancements is also responsible for impeding the market since physicians need to acquire the skills for advanced hemostats.

Market Segmentation

The Japan Hemostats Market share is classified into product, formulation, end-use, and application.

- The oxidized regenerated cellulose-based hemostats segment dominated the market with the largest market share in 2023.

The Japan hemostats market is segmented by product into thrombin-based hemostats, oxidized regenerated cellulose-based hemostats, combination hemostats, and others. Among these, the oxidized regenerated cellulose-based hemostats segment dominated the market with the largest market share in 2023. Oxidized regenerated cellulose is a modified version of cellulose that is very helpful for managing diffuse bleeding from large surfaces. The product's effectiveness, biocompatibility, widespread application, and cost-effectiveness are responsible for driving the market.

- The matrix & gel hemostats segment dominates the Japan hemostats market during the forecast period.

Based on the formulation, the Japan hemostats market is divided into matrix & gel hemostats, powder hemostats, and others. Among these, the matrix & gel hemostats segment dominates the Japan hemostats market during the forecast period. Matrix & gel hemostats are user-friendly, economical in nature, and biocompatible. The adoption of this hemostat formulation in different surgical procedures for effective control of bleeding is responsible for propelling the market.

- The hospitals & clinics segment accounted for the largest market share in 2023.

Based on the end-use, the Japan hemostats market is divided into hospitals & clinics, ambulatory surgical centers, casualty care centers, and others. Among these, the hospitals & clinics segment accounted for the largest market share in 2023. Hemostatic agents are crucial for efficiently controlling bleeding during a variety of surgical procedures in varied medical specialties. The widespread application of hemostats in surgeries including general surgery, orthopedics, neurosurgery, cardiovascular surgery, obstetrics, and gynecology is driving the market demand in the hospitals & clinics segment.

- The orthopedic surgery segment accounted for the largest revenue share of Japan hemostats market in 2023.

Based on the application, the Japan hemostats market is divided into orthopedic surgery, general surgery, neurological surgery, cardiovascular surgery, and others. Among these, the orthopedic surgery segment accounted for the largest revenue share of Japan hemostats market in 2023. Orthopedic surgery entails intricate procedures that carry a high risk of substantial bleeding, such as joint replacements, fracture repairs, or spine surgery requiring hemostatic drugs for managing bleeding. The increased number of surgeries conducted in Japan is responsible for driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan hemostats market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

- Cohera Medical, Inc.

- CryoLife, Inc

- Pfizer

- Baxter

- B. Braun Melsungen AG

- Medtronic

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Ethicon, a Johnson & Johnson MedTech company, announced the approval of ETHIZIATM. This adjunctive hemostat solution has been clinically proven to achieve sustained hemostasis in difficult-to-control bleeding situations.

- In December 2022, Integra LifeSciences Holding Corporation, a leading global medical technology company, announced that it entered into a definitive agreement to acquire Surgical Innovation Associates (SIA), which develops, markets, and sells DuraSorb, a resorbable synthetic matrix for plastic and reconstructive surgery.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Hemostats Market based on the below-mentioned segments:

Japan Hemostats Market, By Product

- Thrombin-Based Hemostats

- Oxidized Regenerated Cellulose-Based Hemostats

- Combination Hemostats

- Others

Japan Hemostats Market, By Formulation

- Matrix & Gel Hemostats

- Powder Hemostats

- Others

Japan Hemostats Market, By End-Use

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Casualty Care Centers

- Others

Japan Hemostats Market, By Application

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Others

Need help to buy this report?