Japan Home Appliances Market Size, Share, and COVID-19 Impact Analysis, By Type (Major Appliances, Small Appliances, Smart Appliances), By Distribution Channel (Supermarket & Hypermarket, Specialty Store, Manufacturer Store, E-commerce, Others), and Japan Home Appliances Market Insights Forecasts to 2032

Industry: Semiconductors & ElectronicsJapan Home Appliances Market Insights Forecasts to 2032

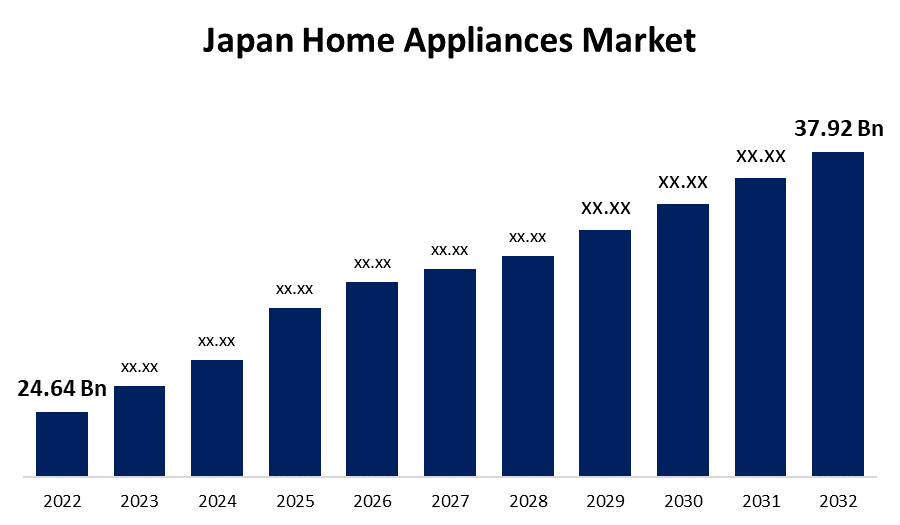

- The Japan Home Appliances Market Size was valued at USD 24.64 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.4% from 2022 to 2032.

- The Japan Home Appliances Market Size is Expected to reach USD 37.92 Billion by 2032.

- Japan is Expected To Grow the fastest during the forecast period.

Get more details on this report -

The Japan Home Appliances Market Size is Expected to reach USD 37.92 Billion by 2032, at a CAGR of 4.4% during the forecast period 2022 to 2032.

Market Overview

The home appliance is a device that helps with household chores including cooking, cleaning, and food preservation. It may be referred to as a domestic appliance, an electric appliance, or a household appliance. Home appliances are classified into three types: major appliances, small appliances, and consumer electronics. The major appliances are large home appliances utilized for routine household chores such as meals, laundry, food preservation, and so on. Small appliances are equipment that is semi-portable or portable and are typically employed on surfaces such as worktops and tabletops. Air purifiers, humidifiers, dehumidifiers, food processors, clothes steamers and irons, electric kettles and coffee makers, and other small appliances are examples of small appliances. Consumer electronics encompass gadgets used for leisure, communication, and home-office operations such as televisions, audio systems, and others.

Japan is a major market for household appliances. The favorable state of financial markets and a rise in consumer spending are significant factors driving the expansion of the Japanese home appliances industry. Increased financial freedom has a significant impact on customers' lives and purchasing power. In general, the demand for home appliances has grown among urban households since they reduce time spent, simplify work, and boost comfort. As a result, a higher standard of lifestyle, an increase in demand for devices to simplify everyday activities, and an increase in financial flexibility will likely drive home appliances penetration, thus fueling Japan's home appliances market growth.

Furthermore, the major drivers driving the development of the Japan home appliance market are the advancement of technology, increasing urbanization, expansion of residential construction, an upsurge in income per capita, a rise in the cost of living, an increase in demand for ease in domestic tasks, shifts in consumer lifestyle, and a growth in the number of smaller households in Japan. Moreover, customer preference for environmentally friendly and energy-efficient appliances is contributing to the robust development of the Japanese home appliances market. In addition, initiatives such as government subsidies for appliances that are energy-efficient implemented across Japan in recent years are projected to boost the widespread use of energy-efficient appliances.

Japan Home Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 24.64 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.4% |

| 2032 Value Projection: | USD 37.92 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Distribution Channel, and COVID-19 Impact Analysis |

| Companies covered:: | Sharp Corporation, Mitsubishi Electric, Rinnai, Zojirushi, Toshiba, Haier, Panasonic, Akai, Hitachi, Samsung, Daikin, Twinbird Corporation, LG Electronics Inc., Tiger Corporation |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for Japan Home Appliances Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Home Appliances Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Home Appliances Market.

Market Segment

- In 2022, the smart appliances segment is witnessing a higher growth rate over the forecast period.

Based on the type, the Japan Home Appliances Market is segmented into major appliances, small appliances, and smart appliances. Among these, the smart appliances segment is witnessing a higher growth rate over the forecast period. A significant percentage of high-income consumers have spent on home appliances, particularly luxury and smart appliances. Appliances that are currently available on the market are currently smart in certain ways since they are operated by microcontrollers; on the other hand, the capacity to interface with the Internet will make devices more perceptive. Smart appliances are meant to transmit data automatically to the utility provider in order to make the most effective and efficient utilization of electricity. These home appliances are also referred to as intelligent appliances because they are able to monitor and adjust their energy consumption. The Internet of Things is a new market trend, and smart home appliances are one category of IoT. The Internet of Things facilitates the integration of digital and wireless connectivity in residential or appliance installations in the kitchen.

- In 2022, the specialty stores segment accounted for the largest revenue share of more than 47.8% over the forecast period.

On the basis of distribution channel, the Japan Home Appliances Market is segmented into supermarkets & hypermarkets, specialty stores, Manufacturer stores, e-commerce, and others. Among these, the industrial batteries segment is dominating the market with the largest revenue share of 47.8% over the forecast period. Consumers typically like to explore and evaluate a product before purchasing it, which boosts the overall sale of home appliances through specialty stores. Potential consumers inspect the operation of appliances in stores as well as the types of accessories that are appropriate for themselves. As a result, specialty stores are expected to grow in popularity in the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Home Appliances Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sharp Corporation

- Mitsubishi Electric

- Rinnai

- Zojirushi

- Toshiba

- Haier

- Panasonic

- Akai

- Hitachi

- Samsung

- Daikin

- Twinbird Corporation

- LG Electronics Inc.

- Tiger Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, Mitsubishi Electric Corporation announced an investment of 167 million Turkish liras (about 18 million USD) to boost production capacity at Mitsubishi Electric Air Conditioning Systems Manufacturing Turkey (MACT), the company's air-conditioner manufacturing facility in Turkey. The combined annual production of newly introduced air-to-water (ATW) heat pumps and yearly production of room air conditioners would eventually total one million units, compared to the current solitary production of 500,000 room air conditioners.

- In January 2021, Panasonic plans to expand its AC business in the next three years in order to invest in domestic production in India. The company, which released the HU series of ACs with the recently revealed nanoeX technology, expects 35% sales growth in the segment this year due to pent-up demand. According to the business, nanoeX technology generates hydroxyl radicals found in water, which are also known as "nature's detergent" and are capable of suppressing bacteria and viruses, including 99.99% of attached new coronavirus.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Home Appliances Market based on the below-mentioned segments:

Japan Home Appliances Market, By Type

- Major Appliances

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Ovens

- Air Conditioners

- Others

- Small Appliances

- Coffee/Tea Makers

- Food Processors

- Grills & Roasters

- Vacuum Cleaners

- Other

- Smart Appliances

- Touch-Screen Refrigerator

- Smart Oven

- Smart Wi-Fi Pressure Cooker

- Automatic Coffee Maker

- Robot Vacuum

- Robot Mop

- Smart Lighting

- Others

Japan Home Appliances Market, By Distribution Channel

- Supermarket & Hypermarket

- Specialty Store

- Manufacturer Store

- E-commerce

- Others

Need help to buy this report?