Japan Industrial Chocolate Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cocoa Butter, Cocoa Powder, and Cocoa Liquor), By Application (Confectionery, Bakery, Dairy & Ice Cream, Beverages, and Other Industrial Uses), By Distribution Channel (B2B Direct Sales, Wholesalers & Distributors, and Specialty Ingredient Suppliers), and Japan Industrial Chocolate Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesJapan Industrial Chocolate Market Insights Forecasts to 2033

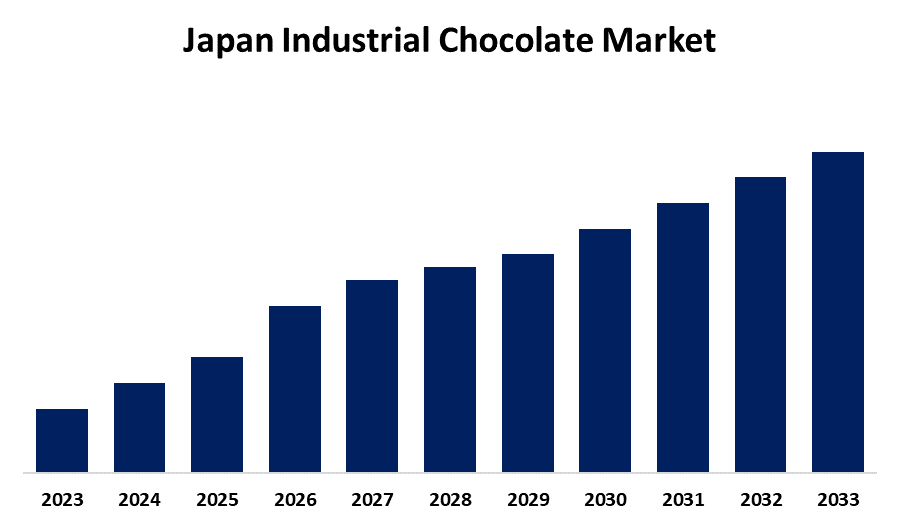

- The Japan Industrial Chocolate Market Size is Growing at a CAGR of 4.9% from 2023 to 2033

- The Japan Industrial Chocolate Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Japan Industrial Chocolate Market Size is anticipated to hold a Significant Share by 2033, Growing at a CAGR of 4.9% from 2023 to 2033.

Market Overview

The Japan industrial chocolate market is the industry engaged in the production, processing, and supply of chocolate for commercial use, such as confectionery, bakery, dairy, beverages, and other foods. Industrial chocolate is mostly used as an ingredient by manufacturers to create diverse products based on chocolate. The market is marked by superior production quality, intensive demand from consumers for premium and specialty chocolates, and the existence of well-established domestic and foreign chocolate makers. Several drivers are fueling the growth of the Japan industrial chocolate market. The rising demand for premium and artisanal chocolates, driven by consumer demand for high-quality cocoa-based products, is a key growth driver. Moreover, the growing bakery and confectionery sectors, combined with developments in chocolate formulations like sugar-free, organic, and single-origin chocolates, are further driving market growth. The increasing trend of using chocolate in non-traditional uses, including functional foods and drinks, is also helping to drive the market. Sustainable cocoa sourcing promotion by the government, food safety standards, and policies aimed at decreasing sugar levels in chocolate products are all affecting market forces. Trade agreements allowing for easier importation of quality cocoa and chocolate ingredients are also influencing the sector.

Report Coverage

This research report categorizes the market for the Japan industrial chocolate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan industrial chocolate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan industrial chocolate market.

Japan Industrial Chocolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.9% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Application, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Meiji Holdings Co., Ltd., Lotte Group, Ezaki Glico Co., Ltd., Morinaga & Company, Fuji Oil Co., Ltd., ROYCE’ Confect Co., Ltd., Yuraku Confectionery Company Limited, Mary Chocolate Co., Ltd., Sils Maria Co., Ltd., Rokkatei Confectionery Co., Ltd., and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Japan industrial chocolate market is driven by increasing demand for premium and specialty chocolates, fueled by consumer preferences for high-quality cocoa-based products. The expanding confectionery and bakery industries, along with innovations in chocolate formulations such as organic, sugar-free, and single-origin varieties, are further supporting market growth. Rising health consciousness has led to the incorporation of functional ingredients, boosting demand for dark and high-cocoa-content chocolates. Additionally, technological advancements in chocolate processing and the growing trend of chocolate-infused beverages and dairy products contribute to market expansion. Strong retail networks and the presence of leading international chocolate manufacturers also enhance market growth.

Restraining Factors

The Japan industrial chocolate market faces challenges such as fluctuating cocoa prices, stringent food safety regulations, high production costs, increasing consumer preference for low-sugar alternatives, and competition from substitute confectionery ingredients.

Market segmentation

The Japan industrial chocolate market share is classified into product type, application, and distribution channel.

- The cocoa liquor segment is expected to hold the largest market share through the forecast period.

The Japan industrial chocolate market is segmented by product type into cocoa butter, cocoa powder, and cocoa liquor. Among these, the cocoa liquor segment is expected to hold the largest market share through the forecast period. Cocoa liquor, also known as cocoa mass, is a key raw material used in chocolate production and is essential for manufacturing a wide range of chocolate-based products, including confectionery, bakery items, and beverages. The growing demand for premium and high-cocoa-content chocolates further supports the dominance of this segment.

- The confectionery segment is expected to hold the largest market share through the forecast period.

The Japan industrial chocolate market is segmented by application into confectionery, bakery, dairy & ice cream, beverages, and other industrial uses. Among these, the confectionery segment is expected to hold the largest market share through the forecast period. The strong consumer preference for high-quality chocolates, including premium, artisanal, and functional varieties, is a key factor driving this segment’s dominance. Japan’s well-established confectionery industry, characterized by continuous product innovation and a high demand for seasonal and limited-edition chocolates, further supports market growth.

- The B2B direct sales segment is expected to hold the largest market share through the forecast period.

The Japan industrial chocolate market is segmented by distribution channel into B2B direct sales, wholesalers & distributors, and specialty ingredient suppliers. Among these, the B2B direct sales segment is expected to hold the largest market share through the forecast period. Large chocolate manufacturers and food processing companies prefer direct procurement from producers to ensure consistent quality, customized formulations, and cost efficiency. This segment benefits from strong relationships between industrial chocolate suppliers and confectionery, bakery, and dairy product manufacturers, facilitating bulk purchasing and streamlined supply chain operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan industrial chocolate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Meiji Holdings Co., Ltd.

- Lotte Group

- Ezaki Glico Co., Ltd.

- Morinaga & Company

- Fuji Oil Co., Ltd.

- ROYCE' Confect Co., Ltd.

- Yuraku Confectionery Company Limited

- Mary Chocolate Co., Ltd.

- Sils Maria Co., Ltd.

- Rokkatei Confectionery Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, Lotte Corporation allied with DLT Labs to drive sustainability and ethical behavior in the supply chain of cacao beans. Lotte is starting its pilot project on the traceability of Ghanaian cacao beans and monitoring of child labor through blockchain technology.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan industrial chocolate market based on the below-mentioned segments:

Japan Industrial Chocolate Market, By Product Type

- Cocoa Butter

- Cocoa Powder

- Cocoa Liquor

Japan Industrial Chocolate Market, By Application

- Confectionery

- Bakery

- Dairy & Ice Cream

- Beverages

- Other Industrial Uses

Japan Industrial Chocolate Market, By Distribution Channel

- B2B Direct Sales

- Wholesalers & Distributors

- Specialty Ingredient Suppliers

Need help to buy this report?