Japan Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life and Non-life), By Channel (Sales Personnel and Insurance Agencies), and Japan Insurance Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialJapan Insurance Market Insights Forecasts to 2033

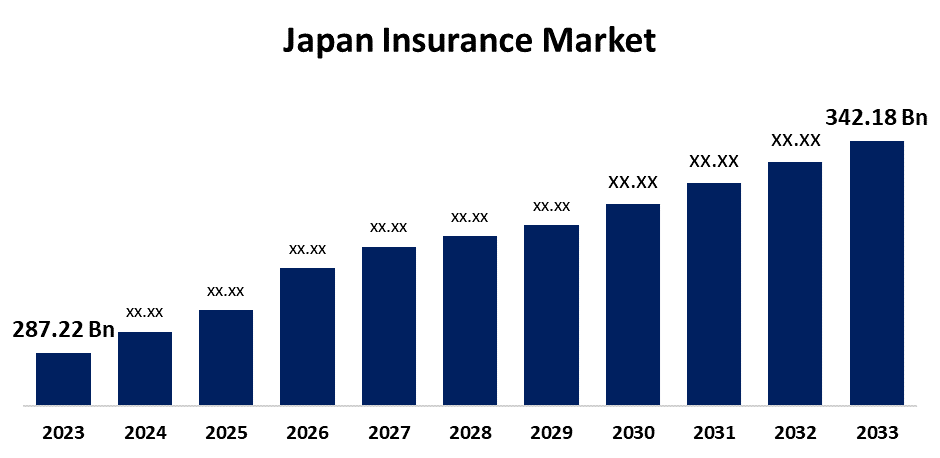

- The Japan Insurance Market Size was valued at USD 287.22 Billion in 2023

- The Market is Growing at a CAGR of 1.77% from 2023 to 2033

- The Japan Insurance Market Size is Expected to Reach USD 342.18 Billion by 2033

Get more details on this report -

The Japan Insurance Market Size is Anticipated to Reach USD 342.18 Billion by 2033, Growing at a CAGR of 1.77% from 2023 to 2033.

Market Overview

Insurance is an agreement, symbolized by a policy, in which an insurance provider offers a policyholder with monetary security or payment against losses. In terms of insurance premiums, Japan has the third-largest insurance market globally. Approximately 90% of Japanese families have life insurance, making it a well-established and well-penetrated market. The country has some of the highest premiums for both life and non-life insurance worldwide. It also receives high marks for insurance penetration in Japan, which calculates the ratio of total insurance premiums to GDP in a given year. Furthermore, the aging population in Japan is driving up the cost of long-term care insurance since older people need assistance with everyday tasks because of age-related or health-related conditions. To keep elders from burdening their families financially, this insurance is crucial. The insurance market is dominated by life insurance due to Japan's high household ownership rate. Additionally, Japan is a group of islands that frequently experiences typhoons and earthquakes, and it has a high rate of car ownership. Because of this, the majority of insurance portfolios consist of fire and vehicle insurance contracts. The insurance market is driven by the rising number of natural disasters in Japan as well as the country's growing car ownership.

Report Coverage

This research report categorizes the market for the Japan insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan insurance market.

Japan Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 287.22 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.77% |

| 2033 Value Projection: | USD 342.18 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Channel, COVID-19 Empact, Challenges, Future, Growth, & Analysis |

| Companies covered:: | Nippon Life Insurance Company, Japan Post Insurance Co., Ltd., Dai-ichi Life Insurance Company, Limited, Meiji Yasuda Life Insurance Company, Sumitomo Life Insurance Company, Tokio Marine & Nichido Fire Insurance Co., Ltd., Sompo Japan Insurance Inc., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aging population in Japan is driving up the cost of long-term care insurance, as older individuals require assistance with daily duties due to age-related or health-related issues. In order to keep elders from burdening their families financially, this insurance is crucial. The demand for savings and retirement products, such as annuities, has increased concurrently with the approaching retirement age of a large segment of the population in order to guarantee retirement stability. Additionally, after the US and China, the Japanese life insurance market is the third largest worldwide. In Japan, around 90% of households have life insurance. This is one of the key elements that propels the Japanese industry.

Restraining Factors

One of the biggest obstacles facing insurance companies in the Japan market is complying with regulations. Insurers must negotiate a complicated network of rules, laws, and regulatory structures from several jurisdictions because their sector is heavily regulated.

Market Segmentation

The Japan insurance market share is classified into type and channel.

- The life segment is expected to hold a significant market share through the forecast period.

The Japan insurance market is segmented by type into life and non-life. Among these, the life segment is expected to hold a significant market share through the forecast period. Japan's aging population is one of the main factors driving demand for life insurance products, especially long-term care insurance.

- The sales personnel segment is expected to dominate the Japan insurance market during the forecast period.

Based on the channel, the Japan insurance market is divided into sales personnel and insurance agencies. Among these, the sales personnel segment is expected to dominate the Japan insurance market during the forecast period. Insurance industry sales personnel outperform insurance agencies because they offer individualized service, customizing policies to fit each client's particular circumstances such as family needs, financial situation, and health conditions building relationships and trust over time.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Life Insurance Company

- Japan Post Insurance Co., Ltd.

- Dai-ichi Life Insurance Company, Limited

- Meiji Yasuda Life Insurance Company

- Sumitomo Life Insurance Company

- Tokio Marine & Nichido Fire Insurance Co., Ltd.

- Sompo Japan Insurance Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, a deal has been made between Nippon Life Insurance business (Nippon Life), the largest life insurance business in Japan, with Corebridge Financial and its parent organization American International Group (AIG) to purchase a 20% equity position in Corebridge.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Insurance Market based on the below-mentioned segments:

Japan Insurance Market, By Type

- Life

- Non-life

Japan Insurance Market, By Channel

- Sales Personnel

- Insurance Agencies

Need help to buy this report?