Japan LED Market Size, Share and COVID-19 Impact Analysis By Product Type (Panel Lights, Down Lights, Street Lights, Tube Lights, Bulbs, Others), By Installation Type (New Installation, Retrofit Installation), By Application (Commercial, Residential, Institutional, Industrial), and Japan LED Market Insights Forecasts to 2032

Industry: Electronics, ICT & MediaJapan LED Market Insights Forecasts to 2032

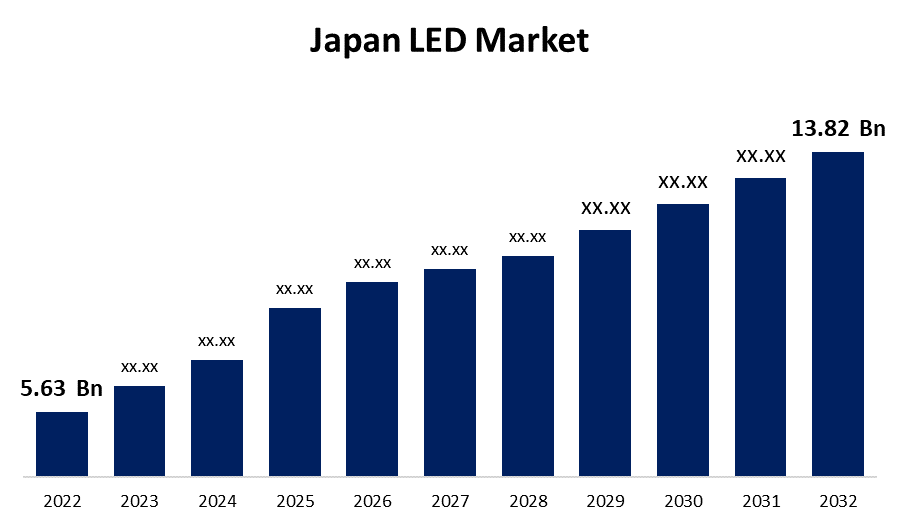

- The Japan LED Market Size was valued at USD 5.63 Billion in 2022.

- The Market Size is Growing at a CAGR of 9.4% from 2022 to 2032.

- The Japan LED Market Size is expected to reach USD 13.82 Billion by 2032.

- Japan is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Japan LED Market Size is expected to reach USD 13.82 billion by 2032, at a CAGR of 9.4% during the forecast period 2022 to 2032.

Market Overview

LEDs, or light-emitting diodes, have transformed the lighting business due to their efficiency, longevity, and extensive applicability. LEDs use up to 90% less energy than traditional incandescent bulbs. LEDs have a lifespan of 25,000 hours or more, which is up to 25 times longer than ordinary light bulbs. Japan's LED sector has a long history dating back to the mid-twentieth century. Japanese companies were among the first to develop and commercialize LED technology. The first LEDs made were simple indicators in electronic equipment, but they evolved over time to suit a wide range of uses, from lighting to screens to complicated communication systems. In addition, the country has transitioned away from traditional lighting solutions and toward LED solutions, particularly in the residential and commercial sectors. LED advantages, including energy efficiency, longer lifespan, and lower pricing due to economies of scale and sophisticated production techniques, have all contributed to this transformation. Some of the leading Japanese LED manufacturers have established themselves as world leaders in terms of not only production capacity but also technological developments.

Report Coverage

This research report categorizes the market for Japan LED Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan LED Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan LED Market.

Japan LED Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.63 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.4 % |

| 2032 Value Projection: | USD 13.82 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product type ,by installation, by application and COVID-19 Impact Analysis |

| Companies covered:: | NICHIA CORPORATION, ENDO Lighting Corp., STANLEY ELECTRIC CO., LTD, ATEX Co., Ltd., Panasonic Corporation, Toshiba Corporation, Toyoda Gosei Co., Ltd., ROHM Co., Ltd., Sharp Corporation, CITIZEN ELECTRONICS CO., LTD., Japan Focus Co., Ltd., KY TRADE CO., LTD., and others key venders. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan has been at the forefront of LED technological advances as a worldwide electronics leader, manufacturing high-quality and efficient LED products for both domestic and international markets. Japan's emphasis on energy conservation, particularly in the aftermath of the 2011 Fukushima tragedy, has accelerated the adoption of LEDs. Their energy-saving characteristics are in line with Japan's sustainability objectives. LEDs are in high demand in Japan, with uses ranging from residential and commercial lighting to automotive, backlights for screens and displays, and industrial applications. Several Japanese firms, including Nichia, Toshiba, and Panasonic, are major players in the global LED sector. Nichia, in particular, has been acknowledged as a pioneer in blue LED technology, which laid the groundwork for the creation of white LEDs utilized in general lighting today. In addition to meeting domestic demand, Japanese LED manufacturers export heavily, influencing the global LED context. Furthermore, Japan's dedication to R&D in the LED sector is palpable. With dedicated research facilities and industry-academia alliances, there is a constant drive for efficiency improvements, cost reductions, and new applications for LED technology. With the rise of smart homes and cities, the combination of LED technology with IoT and AI promises more flexible and efficient lighting solutions.

Market Segment

- In 2022, the LED bulbs segment is witnessing a higher growth rate over the forecast period.

Based on the product type, the Japan LED Market is segmented into panel lights, down lights, street lights, tube lights, bulbs, and others. Among these, the LED bulbs segment is witnessing a higher growth rate over the forecast period. LED bulbs are direct replacements for incandescent and CFL bulbs, and they have a longer lifespan and use less energy. LED bulbs have become standard in Japanese houses, as they have in many other nations, due to energy-saving norms and the population's growing environmental concern. Bulbs are used in every Japanese home, office, and public space, making them a product that is generally relevant. Furthermore, the Japanese government's energy-efficiency programs have accelerated the adoption of LED bulbs in homes and businesses.

- In 2022, the retrofit installation segment accounted for the largest revenue share of more than 54.6% over the forecast period.

On the basis of installation type, the Japan LED Market is segmented into new installation and retrofit installation. Among these, the retrofit installation segment is dominating the market with the largest revenue share of 54.6% over the forecast period. Japan has a large number of existing buildings and infrastructures, many of which were constructed prior to the emergence of LED technology. The potential for repurposing these areas is enormous. Retrofitting is a more cost-effective solution for many businesses and households to obtain energy savings without incurring the higher expenditures associated with new construction or large renovations. Furthermore, because LEDs have longer lifespans, they eliminate the inconvenience and cost of regular replacements.

- In 2022, The electronics segment accounted for the largest revenue share of more than 34.2% over the forecast period.

On the basis of application, the Japan LED Market is segmented into commercial, residential, institutional, and industrial. Among these, the electronics segment is dominating the market with the largest revenue share of 34.2% over the forecast period. Commercial buildings, particularly large ones like shopping malls, hotels, and office complexes, necessitate extensive lighting, which is frequently left on for extended periods of time, resulting in increased consumption. In commercial spaces, the return on investment from energy savings is achieved faster, promoting faster adoption rates. Modern businesses acknowledge the value of atmosphere and lighting in influencing customer behavior, making LEDs a favored choice with their customization choices, propelling the Japan LED market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan LED Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NICHIA CORPORATION

- ENDO Lighting Corp.

- STANLEY ELECTRIC CO., LTD

- ATEX Co., Ltd.

- Panasonic Corporation

- Toshiba Corporation

- Toyoda Gosei Co., Ltd.

- ROHM Co., Ltd.

- Sharp Corporation

- CITIZEN ELECTRONICS CO., LTD.

- Japan Focus Co., Ltd.

- KY TRADE CO., LTD.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On September 2022, Nichia, the world's largest LED manufacturer, and inventor of the high-brightness blue and white LED, kicked off mass production of another new high radiant flux UV-C LED in December to aid in the inactivation and sterilization of various bacteria and viruses in industrial water and air applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan LED Market based on the below-mentioned segments:

Japan LED Market, By Product Type

- Panel Lights

- Down Lights

- Street Lights

- Tube Lights

- Bulbs

- Others

Japan LED Market, By Installation Type

- New Installation

- Retrofit Installation

Japan LED Market, By Application

- Commercial

- Residential

- Institutional

- Industrial

Need help to buy this report?