Japan Life & Non-Life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life and Non-Life), By Distribution Channel (Direct, Agency, Banks, and Others), and Japan Life & Non-Life Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialJapan Life & Non-Life Insurance Market Insights Forecasts to 2033

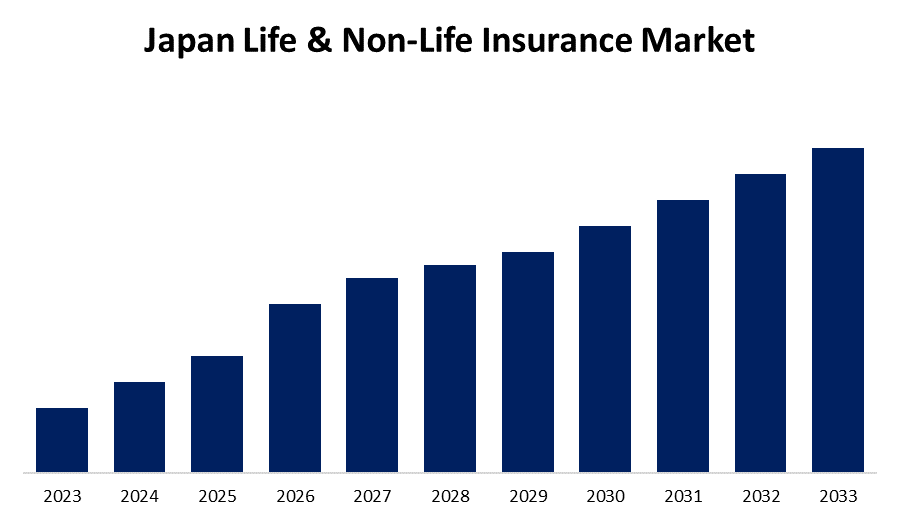

- The Market is growing at a CAGR of 1.8% from 2023 to 2033

- The Japan Life & Non-Life Insurance Market Size is expected to Hold a Significant Share by 2033

Get more details on this report -

The Japan Life & Non-Life Insurance Market is anticipated to hold a significant share by 2033, growing at a CAGR of 1.8% from 2023 to 2033. The growing integration of innovative insurance products, the growing geriatric population, and the vulnerability to natural disasters are driving the growth of the life & non-life insurance market in the Japan.

Market Overview

A life & non-life insurance policy is a contract that provides financial protection or reimbursement from an insurance company to a person or entity. Insurance policies serve as a safeguard against the possibility of both significant and minor monetary losses brought on by harm to the insured's property or by liability for the property or bodily harm of third parties. Japan has one of the largest insurance marketplaces in the world. The country came in second place in terms of total yearly premiums after the United States, with life insurance volume valued at approximately JPY 35 trillion. Property and casualty (P&C) insurance was valued at around JPY 9 trillion, placing it in fourth place globally. The increase in automotive insurance in Japan due to mandatory regulations and an increasing chance of accidents and collisions, especially in urban areas due to high traffic congestion in Japan necessitates the insurance industry. Technology is used by insurtech businesses to speed up procedures, enhance client interactions, and offer innovative insurance solutions. The rapid growth of the insurtech business is leveraging market opportunity for life & non-life insurance.

Report Coverage

This research report categorizes the market for the Japan life & non-life insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the life & non-life insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the life & non-life insurance market.

Japan Life & Non-Life Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | NIPPON LIFE INSURANCE COMPANY, JAPAN POST INSURANCE CO. LTD, MEIJI YASUDA LIFE INSURANCE COMPANY, DAI-ICHI LIFE INSURANCE COMPANY LIMITED, NATIONAL MUTUAL INSURANCE FEDERATION OF AGRICULTURAL COOPERATIVES, TOKIO MARINE & NICHIDO FIRE INSURANCE CO. LTD, SUMITOMO LIFE INSURANCE COMPANY, AFLAC LIFE INSURANCE JAPAN LTD, SOMPO JAPAN NIPPONKOA INSURANCE INC., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

Japan is more vulnerable to a variety of dangers, such as health crises, natural disasters, and disruptions to industry. The insurance policy provides targeted coverage for such as wide variety of risks. Thus, it is expected to drive the market growth. Further, the increasing adoption and integration of innovative technologies such as Internet of Things (IoT), and data analysis by these companies that help in providing personalized offerings to customers are significantly contributing to the market growth.

Restraining Factors

With the advancement in technology, there is more prone to data breaches and cyber crimes. Thus, the vulnerability toward cybercrime is the key challenge hindering market growth.

Market Segmentation

The Japan life & non-life insurance market share is classified into type and distribution channel.

- The non-life segment dominated the market with the largest market share during the forecast period.

The Japan life & non-life insurance market is segmented by insurance type into life and non-life. Among these, the non-life segment dominated the market with the largest market share during the forecast period. The total direct premiums for non-life insurance, including the saving component, increased by 1.5% to JPY 9,414 billion in the 2018 fiscal year. Non-life insurance offers coverage for damages on an indemnity basis and safeguards people, companies, and property.

- The agency segment dominates the Japan life & non-life insurance market in 2023.

Based on the distribution channel, the Japan life & non-life insurance market is divided into direct, agency, banks, and others. Among these, the agency segment dominates the Japan life & non-life insurance market in 2023. Agents' ability to fulfill the higher customer satisfaction and retention rates, increases clients' knowledge and confidence about their options and advantages. Further, the benefits that come with customized advice and the guarantee of a reliable partnership are propelling the market's expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan life & non-life insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NIPPON LIFE INSURANCE COMPANY

- JAPAN POST INSURANCE CO. LTD

- MEIJI YASUDA LIFE INSURANCE COMPANY

- DAI-ICHI LIFE INSURANCE COMPANY LIMITED

- NATIONAL MUTUAL INSURANCE FEDERATION OF AGRICULTURAL COOPERATIVES

- TOKIO MARINE & NICHIDO FIRE INSURANCE CO. LTD

- SUMITOMO LIFE INSURANCE COMPANY

- AFLAC LIFE INSURANCE JAPAN LTD

- SOMPO JAPAN NIPPONKOA INSURANCE INC.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Life & Non-Life Insurance Market based on the below-mentioned segments

Japan Life & Non-Life Insurance Market, By Type

- Life

- Non-Life

Japan Life & Non-Life Insurance Market, By Distribution Channel

- Direct

- Agency

- Banks

- Others

Need help to buy this report?