Japan Loan Origination Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment Type (On-Premises and Cloud-Based), By Application (Residential Loans and Commercial Loans), and Japan loan origination software Market Insights, Industry Trend, Forecasts to 2033.

Industry: Information & TechnologyJapan Loan Origination Software Market Insights Forecasts to 2033

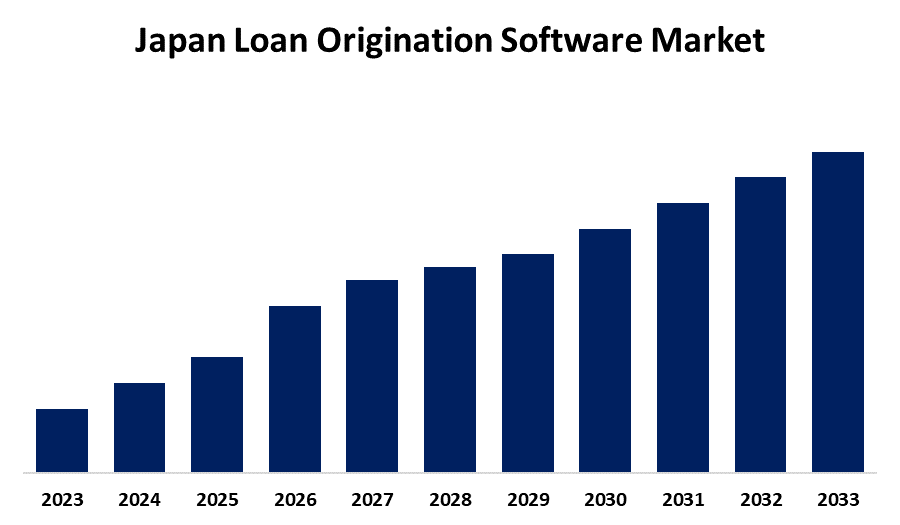

- The Market is Growing at a CAGR of XX% from 2023 to 2033

- The Japan Loan Origination Software Market Size is Expected to hold a Significant Share by 2033.

Get more details on this report -

The Japan Loan Origination Software Market Size is Anticipated to hold a significant Share by 2033, growing at a CAGR of XX% from 2023 to 2033

Market Overview

The industry in Japan that offers software solutions intended to automate and manage the loan processing workflow for financial institutions is known as the Japan loan origination software market. Automating and managing the workflow of several lending procedures is made possible by loan origination software for financial firms in Japan. The steps include loan application, underwriting, credit approval, documentation, funding, pricing, and either disbursement or application rejection. Because the program removes compliance risk and provides real-time activity monitoring, it also helps businesses in Japan process, reject, or decline loans more swiftly. The market for loan origination software is anticipated to develop in the future due to the increasing use of blockchain and artificial intelligence. While blockchain technology refers to accepting a decentralized and secure method of recording and verifying transactions, the adoption of AI refers to integrating artificial intelligence into numerous facets of our lives and companies. AI is quickly becoming more and more common in loan origination since it makes application processing more precise and efficient.

Report Coverage

This research report categorizes the market for the Japan loan origination software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan loan origination software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan loan origination software market.

Japan Loan Origination Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Deployment Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | ABLE Platform, Loan Assistant, ColdStoreApp, Nikasi Stocks, Tally ERP, Loan Manager, ABLE Platform, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The digital transformation of financial institutions, including credit unions, retail and commercial banks, central banks, and others, is one of the main factors driving the loan origination software market in Japan. Loan origination software is essential to enabling this shift towards digitization in Japan as lenders look to modernize their operations. The automation of manual processes, paperwork digitization, data analytics integration, and the entire lending process in Japan with advanced technologies like artificial intelligence and machine learning are all made possible by these software solutions. Furthermore, financial institutions are forming strategic partnerships with software companies in the loan origination process. These partnerships seek to advance the expertise of service providers in creating cutting-edge solutions that demonstrate the changing needs of lenders and borrowers alike.

Restraining Factors

The regulatory compliance is one of several restraining factors that hinder the Japan loan origination software market. Strict regulatory requirements about lending practices, data privacy, and consumer protection are imposed on financial organizations, which complicates the creation and implementation of loan origination software.

Market Segmentation

The Japan loan origination software market share is classified into deployment type and application.

- The on-premises segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe.

The Japan loan origination software market is segmented by deployment type into on-premises and cloud-based. Among these, the on-premises segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe. On-premises loan origination systems give businesses total control over their IT infrastructure because they are software programs that are set up and run on the lender's own servers and hardware.

- The residential loans segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe.

Based on the application, the Japan loan origination software market is divided into residential loans and commercial loans. Among these, the residential loans segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe. Individual borrowers looking to finance properties such as single-family homes, condominiums, or multi-family units are served by residential loans. A large frequency of transactions involving substantial regulatory compliance, credit checks, and risk assessments to ascertain borrower eligibility define this subsegment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan loan origination software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABLE Platform

- LoanAssistant

- ColdStoreApp

- Nikasi Stocks

- Tally ERP

- Loan Manager

- ABLE Platform

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Loan Origination Software Market based on the below-mentioned segments:

Japan Loan Origination Software Market, By Deployment Type

- On-Premises

- Cloud-Based

Japan Loan Origination Software Market, By Application

- Residential Loans

- Commercial Loans

Need help to buy this report?