Japan Mortgage/Loan Brokers Market Size, Share, and COVID-19 Impact Analysis, By Enterprise Size (Large Enterprises and Small & Medium-Sized Enterprises (SMEs)), By Application (Home Loans, Commercial & Industrial Loans, Vehicle Loans, Loans to Government, and Others), By End-Users (Businesses and Individuals), and Japan Mortgage/Loan Brokers Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialJapan Mortgage/Loan Brokers Market Insights Forecasts to 2033

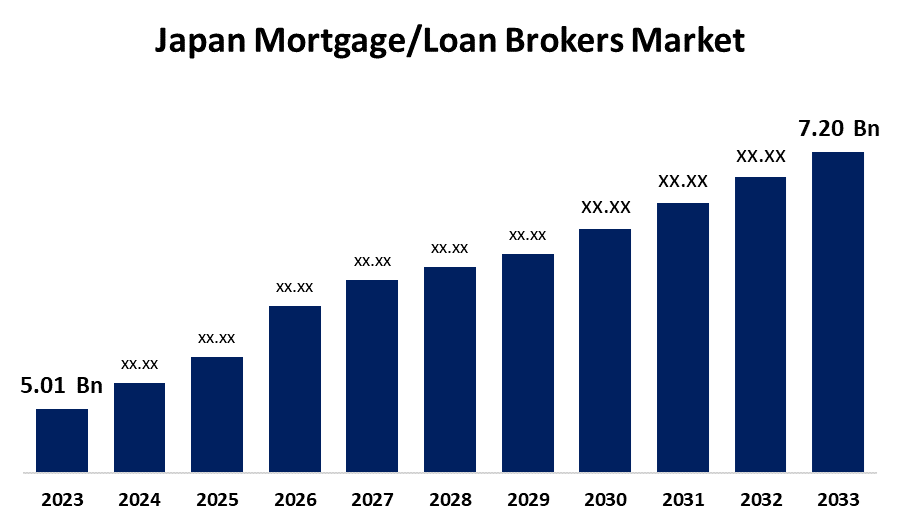

- The Japan Mortgage/Loan Brokers Market Size was valued at USD 5.01 Billion in 2023.

- The Market is Growing at a CAGR of 3.69% from 2023 to 2033

- The Japan Mortgage/Loan Brokers Market Size is expected to reach USD 7.20 Billion by 2033

Get more details on this report -

The Japan Mortgage/Loan Brokers Market Size is anticipated to exceed USD 7.20 Billion by 2033, growing at a CAGR of 3.69% from 2023 to 2033. The growth in real investment and a rise in asset price, digital transformation in the mortgage loan industry, and a rise in the real house price index are driving the growth of the mortgage/loan brokers market in Japan.

Market Overview

A mortgage/loan broker is a specialist who serves as an intermediary between lenders who authorize loans and companies looking to borrow money. They explore other possibilities or negotiate with lenders to get loan approval. A bank loan officer provides mortgage plans and pricing from a single provider. The main purpose of the mortgage/loan broker is to make the transaction process run smoothly and efficiently, assisting clients obtain a mortgage that suits their unique needs and financial situation. Mortgage loan brokers in Japan have an enormous number of business prospects, especially in assisting first-time homebuyers and those who want to relocate or upgrade residences. The increasing use of technology by brokers to streamline processes, enhance customer experiences, and offer online mortgage application platforms indicates the digital transformation of the mortgage loan industry. Fintechs innovative products are driving the market expansion. Further, the partnership between banks and fintech makes financial services more affordable, accessible, and convenient, thereby leveraging market opportunity.

Report Coverage

This research report categorizes the market for the Japan mortgage/loan brokers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the mortgage/loan brokers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the mortgage/loan brokers market.

Japan Mortgage/Loan Brokers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.01 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.69% |

| 2033 Value Projection: | USD 7.20 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Enterprise Size, By Application and By End-Users |

| Companies covered:: | United Overseas Bank, Overseas- Chinese Banking Corporation, Limited, Orix, SMBC, SBI Shinsei Bank, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased loans for homes and real estate account for almost half of the credit during the past decade. Private debt accumulated and active investment increased along with an increase in asset price as a result of increased real investment and increase in asset price. The surge in digital transformation in the mortgage loan industry is positively influencing market growth. Further, factors such as diverse financing options, regulatory changes, customized solutions, and refinancing opportunities are significantly contributing to driving the market. The continuous rise in the real house price index leads to increasing mortgage value for a home loan is also contributing to driving the Japan mortgage/loan broker market.

Restraining Factors

The increased brokerage service charges and commissions are restraining the market. The evolving regulations and compliance requirements are impeding the market. In addition, the uncertainty in economic conditions affects the demand for mortgage and loan products, thereby hindering market growth.

Market Segmentation

The Japan Mortgage/Loan Brokers Market share is classified into enterprise size, application, and end-users.

- The small and medium-sized enterprises (SMEs) segment is expected to grow at the fastest CAGR in the Japan mortgage/loan broker market during the forecast period.

Based on the enterprise size the Japan mortgage/loan broker market is divided into large enterprises and small and medium-sized enterprises (SMEs). Among these, the small and medium-sized enterprises (SMEs) segment is expected to grow at the fastest CAGR in the Japan mortgage/loan broker market during the forecast period. Small and medium-sized businesses (SMEs) can obtain commercial real estate more quickly for use in their operations. However, it can be challenging for an investor to buy or refinance an investment property or for a business looking to refinance its current mortgage. The broker for mortgages and loans locates the fit and offers it to SMEs.

- The home loans segment is expected to hold the largest market share during the forecast period.

The Japan mortgage/loan brokers market is segmented by application into home loans, commercial & industrial loans, vehicle loans, loans to government, and others. Among these, the home loans segment is expected to hold the largest market share during the forecast period. For many people and families, having a home is their top priority, which motivates them to accumulate savings for a down payment or meet mortgage eligibility criteria. The high property sales and demand for homes across the UK increase the need for residential property loans among individuals propelling the market demand.

- The individual segment is expected to grow at the fastest CAGR in the Japan mortgage/loan broker market during the forecast period.

Based on the end-users, the Japan mortgage/loan broker market is divided into businesses and individuals. Among these, the individual segment is expected to grow at the fastest CAGR in the Japan mortgage/loan broker market during the forecast period. There will probably be a rise in the demand for mortgage/loan broker services from individuals as their desire to own a home grows. The individual segment of the mortgage/loan broker market is expanding at the fastest rate because individuals look for brokers to assist them in finding the best mortgage options that suit their needs and financial circumstances.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan mortgage/loan brokers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- United Overseas Bank

- Overseas- Chinese Banking Corporation, Limited

- Orix

- SMBC

- SBI Shinsei Bank

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, Matsui Securities Co., Ltd., a leading online securities broker in Japan, announced its collaboration with global fintech company Broadridge Financial Solutions, Inc. to enhance its stock lending business through Broadridge’s cloud-based SaaS post-trade processing solution.

- In July 2023, Mitsubishi UFJ Financial Group and Morgan Stanley announced a revamp of their nearly 15-year-old partnership.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Mortgage/Loan Brokers Market based on the below-mentioned segments:

Japan Mortgage/Loan Brokers Market, By Enterprise Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

Japan Mortgage/Loan Brokers Market, By Application

- Home Loans

- Commercial & Industrial Loans

- Vehicle Loans

- Loans to Government

- Others

Japan Mortgage/Loan Brokers Market, By End-Users

- Businesses

- Individuals

Need help to buy this report?