Japan Oleochemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Fatty Acids, Fatty Alcohols, Methyl Esters, and Glycerin), By Feedstock (Palm, Soy, Rapeseed, Sunflower, Tallow, Palm Kernel, Coconut, and Others) and Japan Oleochemicals Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsJapan Oleochemicals Market Insights Forecasts to 2033

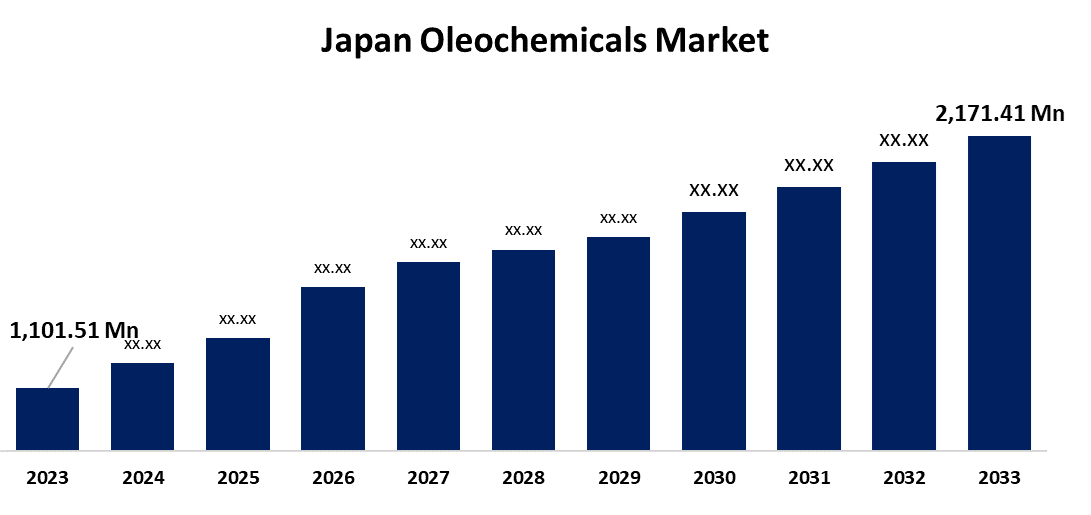

- The Japan Oleochemicals Market Size was valued at USD 1,101.51 Million in 2023

- The Market is Growing at a CAGR of 7.02% from 2023 to 2033

- The Japan Oleochemicals Market Size is Expected to Reach USD 2,171.41 Million by 2033

Get more details on this report -

The Japan Oleochemicals Market is Anticipated to Reach USD 2,171.41 Million by 2033, growing at a CAGR of 7.02% from 2023 to 2033.

Market Overview

Oleochemicals are a class of compounds that are made from natural fats and oils, mostly from plants and animals. As fatty acids, glycerin, fatty alcohols, and esters, these substances are obtained through a variety of chemical processes, such as the esterification or hydrolysis of triglycerides present in oils and fats. Oleochemicals have sustainable, eco-friendly qualities and are versatile, which helps to lower pollution levels in the environment. They thus find widespread use in industries like the making of soap and detergent, cosmetics, medicines, plastics, rubber, and paper. Additionally, the market expansion in Japan is being greatly aided by the growing use of oleochemicals in the production of surfactants, cleaning agents, emulsifiers, foam boosters, and degreasers. Additionally, one element driving expansion is Japan's increasing use of oleochemicals in the manufacturing of food packaging materials and sanitizers for surfaces in contact with food.

Report Coverage

This research report categorizes the market for the Japan oleochemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan oleochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan oleochemicals market.

Japan Oleochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1,101.51 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.02% |

| 2033 Value Projection: | USD 2,171.41 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Feedstock and COVID-19 Impact Analysis |

| Companies covered:: | Kao Corporation, Nippon Shokubai Co., Ltd., Mitsubishi Chemical Corporatio, Sumitomo Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., New Japan Chemical Co.,, NOF Corporation and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industry is expanding mostly due to growing consumer demand in skincare and cosmetics made from bio-based ingredients, growing concerns about sustainability, and encouraging government initiatives that boost the use of renewable chemicals to cut carbon emissions. Personal care and cosmetics are the most significant end-use segments in the Japanese oleochemical market. Cosmetics, skincare products, and hair care products are all made with oleochemicals such as glycerin, fatty acids, and fatty alcohols. Prominent firms in this sector, including Shiseido and Kao Corporation, use their expertise to combine oleochemicals to create high-end, cutting-edge personal care products. In Japan, another significant end-use market for oleochemicals is the food and beverage sector. Additionally, in their skincare regimens, more than 60% of Japanese consumers give priority to natural ingredients, according to research by the Japan Cosmetic Industry Association. The increased use of oleochemicals in cosmetic goods due to the growing trend in Japan toward natural and environmentally friendly components in skincare and everyday cosmetic products is driving the oleochemical market in Japan. This is because oleochemicals are made of natural substances that are taken from natural resources, such as vegetable and animal fats and oils.

Restraining Factors

The growth of the oleochemicals market is anticipated to be constrained by price volatility for raw materials. Important feedstocks including tallow, palm kernel oil, and soybean oil are heavily reliant on farming circumstances, which are impacted by seasonal fluctuations, weather conditions, and catastrophic events.

Market Segmentation

The Japan oleochemicals market share is classified into type and feedstock

- The fatty acids segment is expected to dominate the Japan oleochemicals market during the forecast period.

Based on the type, the Japan oleochemicals market is divided into fatty acids, fatty alcohols, methyl esters, and glycerin. Among these, the fatty acids product segment is expected to dominate the Japan oleochemicals market during the forecast period. Fatty acids are used as detergents in laundry detergents and soaps due to their amphipathic properties. A variety of downstream derivatives, such as elastic materials, toiletries, biological agents, softeners, and wax for a variety of sectors, are produced using fatty acid as a vital raw material.

- The palm segment is expected to hold a significant market share through the forecast period.

The Japan oleochemicals market is segmented by feedstock into palm, soy, rapeseed, sunflower, tallow, palm kernel, coconut, and others. Among these, the palm segment is expected to hold a significant market share through the forecast period. The main source for a variety of oleochemical compounds is palm oil and its derivatives. The fruit of oil palm trees yields palm oil, which is both plentiful and reasonably priced. Triglycerides, which are abundant in it, can hydrolyze to produce glycerin and fatty acids.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan oleochemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kao Corporation

- Nippon Shokubai Co., Ltd.

- Mitsubishi Chemical Corporatio

- Sumitomo Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- New Japan Chemical Co.,

- NOF Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Oleochemicals Market based on the below-mentioned segments:

Japan Oleochemicals Market, By Type

- Fatty Acids

- Fatty Alcohols

- Methyl Esters

- Glycerin

Japan Oleochemicals Market, By Feedstock

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

Need help to buy this report?