Japan Online Gambling Market Size, Share, and COVID-19 Impact Analysis, By Gaming Type (Sports Betting, Casinos, Poker, Bingo, Lottery, and Others), By Device Type (Mobile Devices and Desktops), and Japan Online Gambling Market Insights, Industry Trend, Forecasts to 2033.

Industry: Information & TechnologyJapan Online Gambling Market Insights Forecasts to 2033

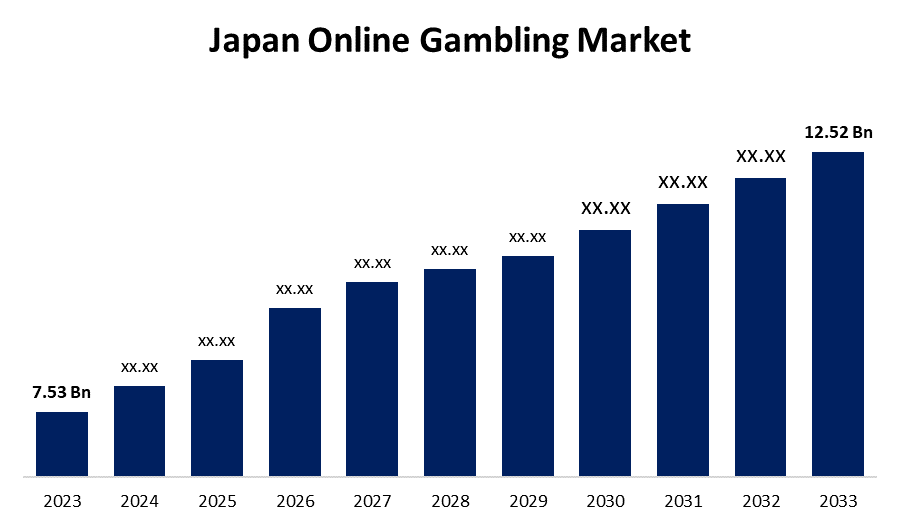

- The Japan Online Gambling Market Size was valued at USD 7.53 Billion in 2023.

- The Market is Growing at a CAGR of 5.22%from 2023 to 2033

- The Japan Online Gambling Market Size is Expected to Reach USD 12.52 Billion by 2033

Get more details on this report -

The Japan Online Gambling Market is Anticipated to exceed USD 12.52 Billion by 2033, growing at a CAGR of 5.22% from 2023 to 2033. The gradual legalization and loosening of rules around online gambling activities in Japan has been essential in fostering market growth.

Market Overview

Online gambling is the practice of engaging in various betting and gaming activities via the internet. Individuals can place bets, play casino games, poker, bingo, or participate in sports betting using online platforms that are available via computers, smartphones, or other internet-enabled devices. Players can bet real money or virtual currency on chance or skill games, with the results decided by generators of random numbers or live dealers in the case of live casino games. Online gambling is convenient and accessible, allowing players to enjoy gambling amusement from the convenience of their own homes or on the go, but it also necessitates ethical gaming habits to avoid the hazards of addiction and financial loss. The relaxation of laws and legalization of certain online gambling activities have contributed to their popularity in Japan. Furthermore, the increasing popularity of online sports betting and virtual casinos among Japanese consumers is driving industry expansion. Aside from that, several technology improvements, particularly increased mobile accessibility, have made online gambling more convenient and appealing to a wider audience, propelling the sector forward. Furthermore, various organizations that provide consumers with the option of playing online casino games for real money via mobile apps have fueled market growth.

Report Coverage

This research report categorizes the market for the Japan online gambling market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan online gambling market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan online gambling market.

Japan Online Gambling Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.53 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.22% |

| 2033 Value Projection: | USD 12.52 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Gaming Type |

| Companies covered:: | Consquestador, Lucky Block, Lilibet Casino, Megapari Safe, Rabona Casino, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The rise of the sector has been mostly driven by Japan's gradual legalization and loosening of laws about online gaming. As the government recognizes the potential economic benefits and answers consumer demand for online betting and gaming choices, it creates opportunities for both domestic and international operators to enter the industry. This favorable legal climate creates a solid and stable platform for operators to offer a broader range of online gaming services, attracting more players and boosting market growth. Japan's rapidly rising proficient in technology population, along with the spread of modern technologies, has accelerated the acceptance of online gambling platforms and services. The increased availability of high-speed internet and the widespread usage of smartphones have made online gambling more convenient and appealing to consumers, allowing them to enjoy betting and gaming activities while on the go.

Restraining Factors

The rise of the Japanese internet gambling sector is impeded by obstacles such as strict rules, notably those governing online gaming. Uncertainty produces uncertainty for both operators and customers, which limits market potential. Another barrier is the prevalence of problem gambling, which is influenced by cultural norms. To ensure responsible gambling practices, the government takes a cautious approach, which may result in additional restrictions and limitations.

Market Segmentation

The Japan online gambling market share is classified into gaming type and device type.

- The sports betting segment is expected to hold a significant share through the forecast period.

The Japan online gambling market is segmented by gaming type into sports betting, casinos, poker, bingo, lottery, and others. Among these, the sports betting segment is expected to hold a significant share through the forecast period. "Toto," which is run by the Japanese government and enables betting on a range of sports such as football, baseball, and horse racing, is one of the most popular sports gambling sites in Japan. Another recognized sports betting service that embraces Japanese consumers is "Bet365," operated by a UK-based corporation. Lotto 6 and Lotto 7 are Japan's two most popular lottery games, and both may be played online through permitted methods.

- The mobile devices segment is expected to dominate the Japan online gambling market during the forecast period.

Based on the device type, the Japan online gambling market is divided into mobile devices and desktops. Among these, the mobile devices segment is expected to dominate the Japan online gambling market during the forecast period. Due to the widespread usage of mobile devices, individuals can now access online gambling services at any time and from any location. In fact, a large number of Japanese online casinos have developed mobile applications, especially for smartphones, giving consumers a comfortable and easy-to-use gambling experience while they are on the road. Japan's online gambling sector has grown tremendously thanks in large part to the country's widespread use of mobile devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan online gambling market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Consquestador

- Lucky Block

- Lilibet Casino

- Megapari Safe

- Rabona Casino

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, The Osaka casino plan, which hopes to open in 2029, was approved after "adequate scrutiny from many perspectives," land and transport minister Tetsuo Saito told reporters.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Online Gambling Market based on the below-mentioned segments:

Japan Online Gambling Market, By Gaming Type

- Sports Betting

- Casinos

- Poker

- Bingo

- Lottery

- Others

Japan Online Gambling Market, By Device Type

- Mobile Devices

- Desktops

Need help to buy this report?