Japan Patient Care Monitoring Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type of Devices (Hemodynamic monitoring devices, Neuromonitoring devices, Cardiac monitoring devices, Multi-parameter monitors, Respiratory monitoring devices, Remote patient monitoring devices, and Others), By Application (Cardiology, Neurology, Respiratory, Fetal and Neonatal, Weight Management and Fitness Monitoring, and Others), By End Users (Hospitals, Home Settings, and Ambulatory Surgery Centers), and Japan Patient Care Monitoring Equipment Market Insights Forecasts 2022 – 2032

Industry: HealthcareJapan Patient Care Monitoring Equipment Market Insights Forecasts to 2032

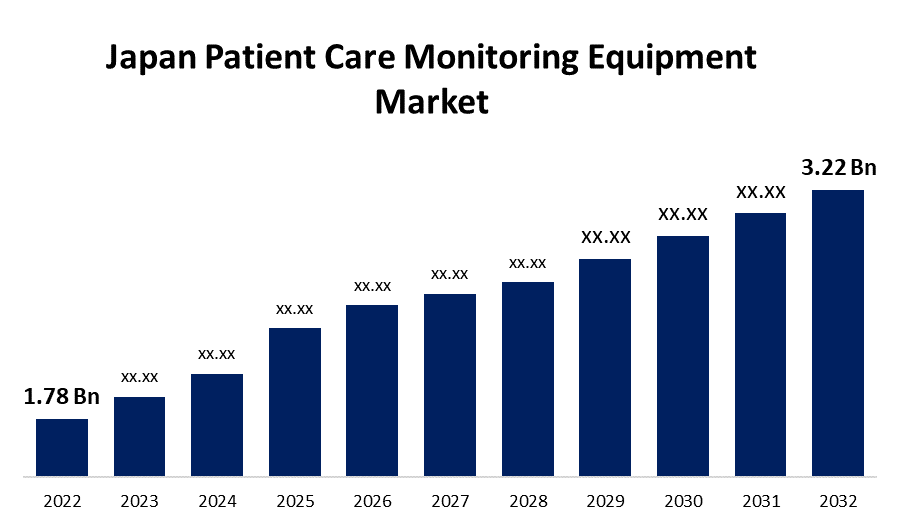

- The Japan Patient Care Monitoring Equipment Market Size was valued at USD 1.78 Billion in 2022.

- The Market Size is Growing at a CAGR of 6.11% from 2022 to 2032.

- The Japan Patient Care Monitoring Equipment Market Size is Expected to Reach 3.22 Billion by 2032.

Get more details on this report -

The Japan Patient Care Monitoring Equipment Market Size is Expected to Reach USD 3.22 Billion by 2032, at a CAGR of 6.11% during the forecast period 2022 to 2032.

Market Overview

The patient monitoring system measures, records, distributes and displays biometric data such as heart rate, blood oxygen saturation (SPO2), blood pressure, and temperature. They are used to continuously monitor patients, which aids in the prevention of serious problems. Digital technologies are used to communicate to a healthcare provider patients' current health status and other types of health data collected through remote patient monitoring. The information could be gathered at the patient's home to save money on care and hospitalization. Even though most markets are declining, the COVID-19 outbreak has had a positive impact on several health-related markets, including patient monitors. Patient monitors (including heart rate monitors, ventilators, and temperature monitors) are in high demand due to epidemics and patient monitoring. In recent years, there has been an increase in the need for healthcare infrastructure improvements, telehealth cost savings, and remote patient monitoring technology due to the rapidly expanding Japan population and rise in chronic diseases.

Report Coverage

This research report categorizes the market for Japan's patient care monitoring equipment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan patient care monitoring equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan patient care monitoring equipment market.

Japan Patient Care Monitoring Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.78 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.11% |

| 2032 Value Projection: | USD 3.22 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type of Devices, By Application, By End Users. |

| Companies covered:: | Abbott Laboratories, General Electric Company (GE Healthcare), Boston Scientific Corporation, Nihon Kohden Corporation, Siemens Healthcare GmbH, Koninklijke Philips N.V., Baxter International Inc, Becton, Dickinson, and Company, Omron Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing demand for wearable patient monitoring devices is expected to drive the market during the forecast period. The rapid growth of the healthcare industry as a result of the Covid-19 outbreak and an aging population are major factors driving the market. The market is expected to be fueled by rising demand for telehealth services and continuous patient monitoring systems. Furthermore, R&D investment and technological advancement in patient monitoring systems for home care settings, as well as continuous data transmission to healthcare professionals for monitoring, are expected to provide significant opportunities for market participants.

Restraining Factors

The high cost of patient monitoring systems is expected to limit market growth. Furthermore, a lack of reimbursement strategies and a stringent government framework for the healthcare sector are major factors that could stymie market growth during the forecast period.

Market Segment

- In 2022, the remote patient monitoring devices segment accounted for a significant revenue share over the forecast period.

Based on the type of devices, the Japan patient care monitoring equipment market is segmented into hemodynamic monitoring devices, neuromonitoring devices, cardiac monitoring devices, multi-parameter monitors, respiratory monitoring devices, remote patient monitoring devices, and others. Among these, the remote patient monitoring devices segment accounted for a significant revenue share over the forecast period. RPM devices enable providers to monitor, report, and analyze their patients' acute or chronic conditions outside of the hospital or clinic setting. They allow the practitioner to comprehend the patient's disease state and take preventative clinical measures. Diabetes-related high blood sugar levels can harm the nerves that control the heart and blood vessels, leading to a variety of cardiovascular diseases such as coronary artery disease and stroke, both of which can narrow the arteries. This is expected to increase the demand for monitoring glucose levels, blood pressure, and other activities, thereby driving market growth.

- In 2022, the cardiology segment is expected to hold a significant market share over the forecast period

Based on application, the Japan patient care monitoring equipment market is segmented into cardiology, neurology, respiratory, fetal and neonatal, weight management and fitness monitoring, and others. Among these, the cardiology segment is expected to hold a significant market share over the forecast period. The country's high prevalence of cardiovascular diseases is expected to drive segment growth over the analysis period. In the management and monitoring of cardiovascular diseases, patient care monitoring equipment is critical. Heart attacks, strokes, and cardiac arrhythmias are among the diseases. Cardiovascular rhythm management devices are among the equipment used in cardiological monitoring. The high prevalence of CVD (cardiovascular diseases) and smoking in Japan is expected to increase the use of patient care monitoring equipment for proper treatment and prevention of the condition, driving segment growth over the forecast period.

- In 2022, the hospitals segment accounted for the largest revenue share over the forecast period.

Based on the end user, the Japan patient care monitoring equipment market is segmented into hospitals, home settings, and ambulatory surgery centers. Among these, the hospitals segment has the largest revenue share over the forecast period. The segmental growth is being fueled by an increase in the number of patients admitted to hospitals due to injuries, chronic diseases, and other circumstances. Multiparameter patient monitors are frequently used in general wards and intensive care units to continuously track patients' health using various human vital parameters such as oxygen saturation, respiration rate, blood pressure, and heart rate.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan patient care monitoring equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- General Electric Company (GE Healthcare)

- Boston Scientific Corporation

- Nihon Kohden Corporation

- Siemens Healthcare GmbH

- Koninklijke Philips N.V.

- Baxter International Inc

- Becton, Dickinson, and Company

- Omron Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, In Japan, Terumo Corporation changed the indication for the Dexcom G6 CGM System. With this additional indication, the system becomes Japan's only real-time continuous glucose monitoring (RT-CGM) system capable of managing blood glucose levels daily without the use of a blood glucose meter.

- In March 2022, SoftBank Corp. and Pear Therapeutics agreed to collaborate on the development of a Japanese-language digital therapeutic for the treatment of sleep/wake disorders for the Japanese market.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Patient Care Monitoring Equipment Market based on the below-mentioned segments:

Japan Patient Care Monitoring Equipment Market, By Type of Devices

- Hemodynamic monitoring devices

- Neuromonitoring devices

- Cardiac monitoring devices

- Multi-parameter monitors

- Respiratory monitoring devices

- Remote patient monitoring devices

- Other

Japan Patient Care Monitoring Equipment Market, By Application

- Cardiology

- Neurology

- Respiratory

- Fetal and Neonatal

- Weight Management

- Fitness Monitoring

- Others

Japan Patient Care Monitoring Equipment Market, By End User

- Hospitals

- Home Settings

- Ambulatory Surgery Centers

Need help to buy this report?