Japan Peptic Ulcer Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Proton Pump Inhibitors (PPI), H2 Antagonists, Antibiotics, Others), By Ulcer Type (Gastritis, Gastric Ulcer, Duodenal Ulcer, Gastroesophageal Reflux Disease (GERD)), and Japan Peptic Ulcer Drugs Market Insights Forecasts to 2033

Industry: HealthcareJapan Peptic Ulcer Drugs Market Insights Forecasts to 2033

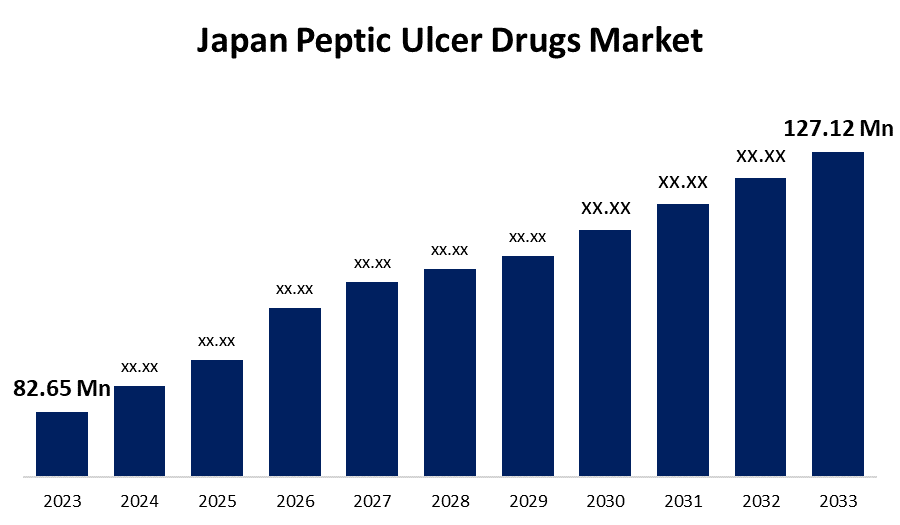

- The Japan Peptic Ulcer Drugs Market Size was valued at USD 82.65 Million in 2023.

- The Market Size is Growing at a CAGR of 4.4% from 2023 to 2033.

- The Japan Peptic Ulcer Drugs Market Size is Expected to Reach USD 127.12 Million by 2033.

Get more details on this report -

The Japan Peptic Ulcer Drugs Market Size is expected to reach USD 127.12 Million by 2033, at a CAGR of 4.4% during the forecast period 2023 to 2033.

Market Overview

Japan's pharmaceutical industry has long been a leader in developing cutting-edge drugs to treat a variety of medical conditions. Peptic ulcers have gotten a lot of attention because of their prevalence and impact on patients' quality of life. Peptic ulcers, which include gastric and duodenal ulcers, are open sores on the stomach, upper small intestine, or esophagus lining. These ulcers can cause discomfort, pain, and potentially fatal complications. Peptic ulcer treatment has advanced significantly, making the Japan peptic ulcer drugs market a dynamic and evolving sector within the pharmaceutical landscape. In recent years, the Japanese peptic ulcer drugs market has grown significantly, owing to factors such as an aging population, changing dietary habits, and increased healthcare awareness. Peptic ulcers are more common in Japan's rapidly aging society, as older people are more susceptible to developing these conditions due to factors such as decreased stomach mucus production and weakened immune systems. The adoption of Western dietary patterns, stress, and the prevalence of Helicobacter pylori infection have all contributed to an increase in the number of peptic ulcer cases.

Report Coverage

This research report categorizes the market for Japan peptic ulcer drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan peptic ulcer drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan peptic ulcer drugs market.

Japan Peptic Ulcer Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 82.65 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.4% |

| 2033 Value Projection: | USD 127.12 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Drug Type, By Ulcer Type |

| Companies covered:: | Takeda Pharmaceuticals Company limited, AstraZeneca, Novartis Pharmaceutical corporation, Pfizer limited, GlaxoSmithKline pharmaceuticals ltd, Mylan pharmaceutical Inc, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Japan, a country known for its technological advancements and rich cultural heritage, is experiencing a significant demographic shift that is reshaping its healthcare landscape. The combination of an aging population and an increased disease burden has resulted in an increase in demand for various medical interventions, with a particular emphasis on peptic ulcer drugs. The prevalence of peptic ulcers has increased significantly as the elderly population grows and lifestyles change, propelling the expansion of the peptic ulcer drug market in Japan. Peptic ulcers, which are painful sores that develop on the stomach, small intestine, or esophagus lining, have become a major health concern in Japan. In Japan, the aging population and increased disease burden have combined to drive demand for peptic ulcer drugs. As the elderly population grows, healthcare providers and pharmaceutical companies must collaborate to meet the challenges posed by peptic ulcers and other age-related health conditions. The peptic ulcer drugs market exemplifies the dynamic nature of healthcare industries, adapting to changing societal needs and demonstrating the Japanese healthcare system's innovative capacity.

Restraining Factors

Despite the rising prevalence of peptic ulcer disease, certain factors are expected to stymie Japan's market growth. One such factor is the negative side effects of peptic ulcer medications. Proton pump inhibitors, for example, can cause nutritional deficiencies (magnesium, vitamin B12), an increased risk of gastroenteritis, bowel upset, diarrhea, gastric ulcers, and duodenal ulcers, while anticholinergic drugs can cause urinary retention, dry mouth, and constipation.

Market Segment

- In 2023, the antibiotics segment accounted for the largest revenue share over the forecast period.

Based on the drug type, the Japan peptic ulcer drugs market is segmented into proton pump inhibitors (PPI), H2 antagonists, antibiotics, and others. Among these, the antibiotics segment has the largest revenue share over the forecast period. This prominence stems primarily from the role of Helicobacter pylori (H. pylori) infection in the development of peptic ulcers. H. pylori is a bacterium that lives in the stomach lining and is a major cause of ulcers. Antibiotics are extremely effective at eliminating this bacterium, addressing the underlying cause of peptic ulcers, and preventing their recurrence. The Japanese peptic ulcer drugs market is dominated by a few key players, with antibiotics playing a central role. Leading domestic and international pharmaceutical companies have invested significant resources in research and development to produce effective antibiotic-based treatments for peptic ulcers.

- In 2023, the duodenal ulcer segment accounted for the largest revenue share over the forecast period.

Based on the ulcer type, the Japan peptic ulcer drugs market is segmented into gastritis, gastric ulcer, duodenal ulcer, and gastroesophageal reflux disease (GERD). Among these, the duodenal ulcer segment has the largest revenue share over the forecast period. The continuous evolution of treatment approaches is one of the key factors driving the duodenal ulcer segment's dominance in Japan's peptic ulcer drugs market. Significant progress has been made in understanding the underlying causes of duodenal ulcers over the years. This has resulted in the development of targeted and effective pharmaceutical interventions that specifically address the factors that contribute to the formation of duodenal ulcers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan peptic ulcer drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda Pharmaceuticals Company limited

- AstraZeneca

- Novartis Pharmaceutical corporation

- Pfizer limited

- GlaxoSmithKline pharmaceuticals ltd

- Mylan pharmaceutical Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2021, Sun Pharma should conduct a phase 3 clinical study comparing esomeprazole dual release gastro resistant tablets 80mg vs esomeprazole gastro resistant tablets 40mg, according to the CDSCO, which oversees the Subject Matter Committee SEC.

- In August 2021, Dr. Reddy's Laboratories announced the introduction of generic capsules containing Chlordiazepoxide Hydrochloride and Clidinium Bromide. These capsules are utilized to treat conditions such as stomach ulcers, irritable bowel syndrome, and colon inflammation.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the Japan peptic ulcer drugs market based on the below-mentioned segments:

Japan Peptic Ulcer Drugs Market, By Drug Type

- Proton Pump Inhibitors (PPI)

- H2 Antagonists

- Antibiotics

- Others

Japan Peptic Ulcer Drugs Market, By Ulcer Type

- Gastritis

- Gastric Ulcer

- Duodenal Ulcer

- Gastroesophageal Reflux Disease (GERD)

Need help to buy this report?