Japan Personal Loans Market Size, Share, and COVID-19 Impact Analysis, By Type (Education Loan, Home Renovation Loan, Wedding Loan, Medical Emergency Loan, and Others), By Distribution Channel (Banks, Credit Unions, and Others), and Japan Personal Loans Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialJapan Personal Loans Market Insights Forecasts to 2033

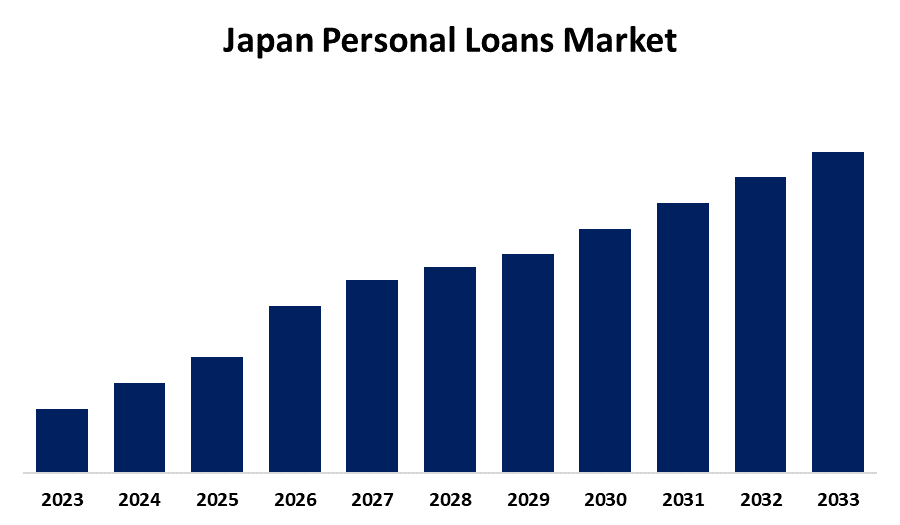

- The Market Size is Growing at a 23.6% CAGR from 2023 to 2033.

- The Japan Personal Loans Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The Japan Personal Loans Market Size is expected to Reach a Significant Share by 2033, Growing at a 23.6% CAGR from 2023 to 2033.

Market Overview

The financial industry in Japan that provides customers with a range of personal loan options is known as the "Japan personal loan market." These loans come in two varieties: secured loans, which need collateral, and unsecured loans, which do not but usually have higher interest rates. Personal loans are frequently popular among Japanese consumers because of their many advantages. In the majority of cases, the loan amount can be approved without any kind of collateral. The ability to manage many credit cards with different interest rates and due dates is another important benefit of personal loans in Japan. Additionally, if approved for a personal loan with an interest rate lower than their credit cards, Japanese borrowers can streamline their monthly payments and save money for unforeseen financial consequences. Consequently, one of the main factors driving the sector's expansion in Japan is the advantages that personal loans offer.

Report Coverage

This research report categorizes the market for the Japan personal loans market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan personal loans market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan personal loans market.

Japan Personal Loans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 23.6% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Aiful Corporation, ACOM, LINE Financial Corporation, Credit Engine, and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Increased use of personal loans across a range of industries in Japan, including healthcare and education, is driving the market's expansion. Personal loans in Japan are being used by these industries to cover personal needs such as schooling and medical bills. While unsecured personal loans in Japan do not require collateral but have higher interest rates, secured personal loans do and demand collateral. In order to facilitate loan approval for lenders in Japan, technology like artificial intelligence and machine learning is being used in the underwriting process. Additionally, according to a July 2023 study, approximately 34.3% of Japanese respondents said they have taken out loans from money-lending companies to use for entertainment and hobbies. The demand for personal loans in Japan is being driven by higher borrowing rates offered by different money lending companies. This pattern demonstrates the growing dependence on personal loans for a range of purposes, which is a major factor in the growth of the Japanese personal loan industry.

Restraining Factors

Higher fees and penalties associated with personal loans, as well as an increasing proportion of bad debts among borrowers, are some of the issues limiting market expansion.

Market Segmentation

The Japan personal loans market share is classified into type and distribution channel.

- The education loan segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe.

The Japan personal loans market is segmented by type into education loan, home renovation loan, wedding loan, medical emergency loan, and others. Among these, the education loan segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe. The amount of money borrowed to cover educational costs while obtaining a degree is known as an education loan. Additionally, there are several advantages to education loans, such as reduced interest rates, broad coverage of expenses, tax advantages, simple terms for repayment, and the ability to pay after study.

- The banks segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the Japan personal loans market is divided into banks, credit unions, and others. Among these, the banks segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the projected timeframe. The need for banks is primarily driven by a number of factors, such as the growing digitalization of the banking industry, the existence of a large number of banking organizations, and the availability of a wide variety of personal loan plans.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan personal loans market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aiful Corporation

- ACOM

- LINE Financial Corporation

- Credit Engine

- CoreForth

- LENDY

- Aiful

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Personal Loans Market based on the below-mentioned segments:

Japan Personal Loans Market, By Type

- Education Loan

- Home Renovation Loan

- Wedding Loan

- Medical Emergency Loan

- Others

Japan Personal Loans Market, By Distribution Channel

- Banks

- Credit Unions

- Others

Need help to buy this report?