Japan Pig Feed Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Grower, Starter, Sow, and Others), By Feed Essence (Vitamins, Antioxidants, Feed Acidifiers, Feed enzymes, Amino acids, and Others), and Japan Pig Feed Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesJapan Pig Feed Market Insights Forecasts to 2033

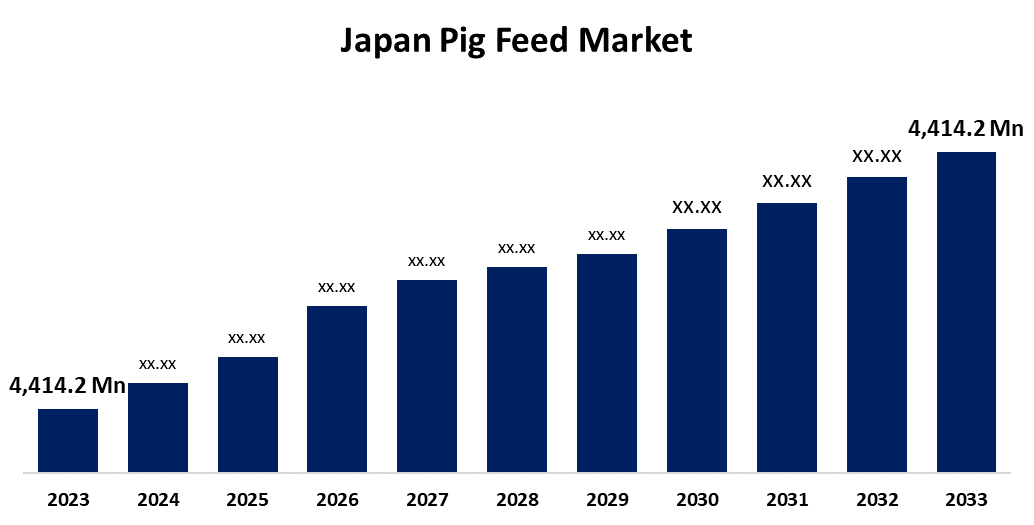

- The Japan Pig Feed Market Size was valued at USD 4,414.2 Million in 2023.

- The Market is Growing at a CAGR of 5.01% from 2023 to 2033

- The Japan Pig Feed Market Size is Expected to Reach USD 7,195.4 Million by 2033.

Get more details on this report -

The Japan Pig Feed Market is Anticipated to Reach USD 7,195.4 Million by 2033, growing at a CAGR of 5.01% from 2023 to 2033.

Market Overview

Pigs are given specialized nourishment called swine feed, which is designed to support their growth, development, and general health. A variety of grains, proteins, vitamins, and minerals are usually included in this feed, which is designed to meet the nutritional needs of pigs at various stages of life. Pig health, weight gain, and production efficiency are all directly impacted by swine feed, which is why it is so important to the swine industry. Pig feed composition might change depending on age, breed, and intended use, including breeding and meat production. In the swine farming industry, feeding pigs balanced, high-quality feed is crucial to ensuring their best possible growth and productivity. Additionally, the market for swine feed is expanding rapidly due to the rising demand for pork and pork products, especially in developing nations. This raises the need for effective swine farming methods, which in turn increases the demand for high-quality swine feed. Rising protein consumption in Japan is a result of urbanization and population growth, which increases demand for pig production and, in turn, swine feed.

Report Coverage

This research report categorizes the market for the Japan pig feed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan pig feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan pig feed market.

Japan Pig Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4,414.2 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.01% |

| 2033 Value Projection: | USD 7,195.4 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Feed Essence and COVID-19 Impact Analysis |

| Companies covered:: | Nutreco NV, KYODO INTERNATIONAL, INC., Alltech Inc., JAPAN NUTRITION Co. Ltd, Nosan Corporation., Feedone Co., Ltd and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for pork and pork products, especially in emerging nations, has increased the need for effective swine farming methods, which in turn has increased the demand for high-quality swine feed. As a result, the swine feed industry in Japan is expanding rapidly. Furthermore, Japan's urbanization and population growth are increasing protein intake, which in turn is driving up demand for swine feed and pig output. Additionally, Japanese pork meat consumption increased from about 11.8 kilograms per person in fiscal year 2013 to about 13.1 kilograms per person in fiscal year 2023. In the Japanese market, pork is a basic meat along with chicken. In Japan, the market for pork feed is being driven by the country's growing use of pork flesh as a source of protein and key nutrients. Additionally, the latest recent figures from the Ministry of Agriculture, Forestry and Fisheries (MAFF) show that as of February 1, 2023, the number of pigs in Japan had grown by 0.4%. This notable increase in the number of pigs is driving the pig feed industry in Japan by raising the requirement for pig feed. Furthermore, farmers can now tailor nutrition to the unique needs of pigs, increasing growth and decreasing waste, due to advancements in precision feeding systems. These recent changes show how committed Japan is to improving food security and sustainability in its pig farming sector, positioning the market for expansion and resilience in the face of impending difficulties.

Restraining Factors

The market's expansion gets hampered by the high price volatility of the additives and raw materials required to prepare feed. For instance, small- and medium-sized pig farm operators may find it more difficult to afford maize if its price rises significantly. It is anticipated that the growing number of people choosing vegan and vegetarian diets and avoiding animal products will reduce demand for pig meat, further harming the industry.

Market Segmentation

The Japan pig feed market share is classified into product type and feed essence.

- The grower segment is expected to hold a significant market share through the forecast period.

The Japan pig feed market is segmented by product type into grower, starter, sow, and others. Among these, the grower segment is expected to hold a significant market share through the forecast period. Maximizing the development potential and efficiency of pigs during the critical growth phase is the main factor driving the need for swine feed, specifically grower feed. Grower feed is designed to give young pigs the nutrition they need and promote their quick development, maximizing their passage from the starting stage to adulthood.

- The amino acids segment is expected to dominate the Japan pig feed market during the forecast period.

Based on the feed essence, the Japan pig feed market is divided into vitamins, antioxidants, feed acidifiers, feed enzymes, amino acids, and others. Among these, the amino acids segment is expected to dominate the Japan pig feed market during the forecast period. Increasing product usage due to the importance of amino acids for swine nutrition and growth is one of the main reasons driving market expansion. The building blocks of proteins, amino acids, are necessary for the growth of muscles and the general health of pigs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan pig feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nutreco NV

- KYODO INTERNATIONAL, INC.

- Alltech Inc.

- JAPAN NUTRITION Co. Ltd

- Nosan Corporation.

- Feedone Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In Augst 2024, the Japan Food Ecology Center's founder, Koichi Takahashi, has created a process for turning leftover human food into premium pig feed.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Pig Feed Market based on the below-mentioned segments:Japan Pig Feed

Market, By Product Type

- Grower

- Starter

- Sow

- Others

Japan Pig Feed Market, By Feed Essence

- Vitamins

- Antioxidants

- Feed Acidifiers

- Feed enzymes

- Amino acids

- Others

Need help to buy this report?