Japan Plant-Based Milk Market Size, Share, and COVID-19 Impact Analysis, By Product (Almond Milk, Soy Milk, Coconut Milk, Oat Milk, and Rice Milk), By Flavor (Flavored and Non-Flavored), and Japan Plant-Based Milk Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesJapan Plant-Based Milk Market Insights Forecasts to 2033

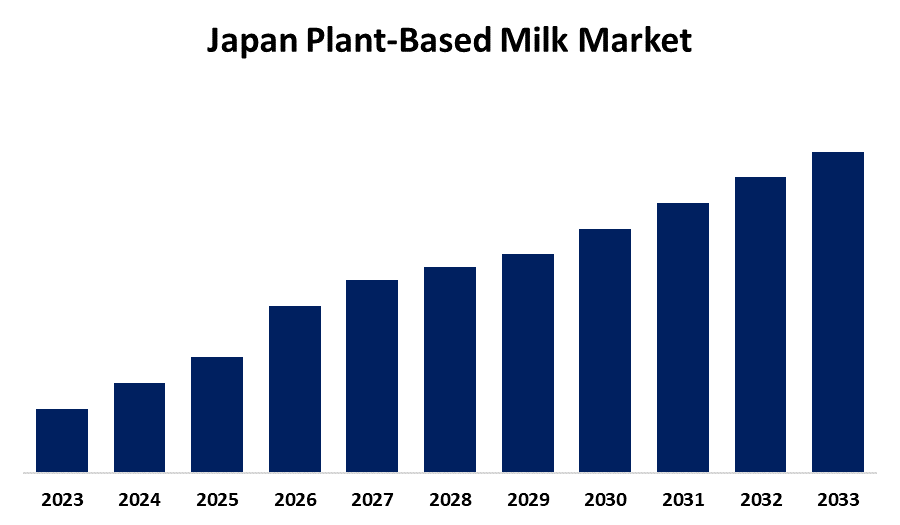

- The Market Size is Growing at a CAGR of 7.8% from 2023 to 2033

- The Japan Plant-Based Milk Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Japan Plant-Based Milk Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 7.8% from 2023 to 2033.

Market Overview

A water-based plant extract is used to flavor and scent plant milk, a non-dairy beverage. Plant milk can have a creamy feeling and is used as a dairy substitute. The Japanese plant-based milk industry has enormous growth potential due to factors like rapid urbanization, lifestyle changes, industrialization, economic development, health and wellness trends, and growing awareness of the health risks associated with long-term animal milk consumption. Additionally, the increasing incidence of lactose intolerance and cow milk allergies, the increased emphasis on health and wellbeing, shifting dietary preferences, and consumers' desire for sustainability are all factors propelling the expansion of the plant-based milk market in Japan. The Japanese market is also being driven by rising government support and investment in plant-based businesses. Furthermore, the prevalence of cow milk allergies and lactose intolerance is high. A lactose intolerance occurs when the body cannot break down lactose, a sugar found in milk. A person with lactose intolerance may have symptoms or none at all. Stomach pain and diarrhea are symptoms of lactose intolerance in symptomatic populations. Seventy to one hundred percent of East Asian adults suffer from lactose intolerance, according to the National Institutes of Health (NIH).

Report Coverage

This research report categorizes the market for the Japan plant-based milk market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan plant-based milk market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan plant-based milk market.

Japan Plant-Based Milk Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.8% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 155 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Flavor |

| Companies covered:: | Kikkoman, Marusan, Alpro (Danone), Otsuka Foods, Sujahta, TopValu, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Japan's intake of plant-based milk has increased at a time when dairy consumption is typically on the decline. According to Japan Dairy Association Research, the percentage of consumers who said they did not drink milk increased from 13.6% in 2019 to 23.3% in 2020. Avoiding the symptoms of lactose intolerance was the primary reason for giving up cow's milk, which was followed by health worries about its high-calorie content. Plant-based milk products are becoming more popular in Japan as a result of customers' increased health consciousness. Additionally, in Japan, about 45% of people self-report having lactose intolerance (LI). In Japan, people are looking for milk substitutes as conditions like lactose intolerance are becoming more common. This rising need for alternative products is a significant reason for the developing market of plant-based milk in Japan. Furthermore, about 2.5 million people, or 2.1% of the Japanese population, identified as vegan. As more people look for dairy substitutes that fit their dietary requirements and lifestyle choices, Japan's demand for plant-based milk products is being driven by the country's expanding vegan population as well as rising health consciousness.

Restraining Factors

One of the main market constraints is the higher prices when compared to traditional dairy milk. The cost of producing and processing materials like almonds, oats, or soybeans for milk substitutes is still higher than that of producing traditional milk, even if consumer interest in plant-based alternatives is growing.

Market Segmentation

The Japan plant-based milk market share is classified into product and flavor.

- The almond milk segment is expected to hold a significant market share through the forecast period.

The Japan plant-based milk market is segmented by product into almond milk, soy milk, coconut milk, oat milk, and rice milk. Among these, the almond milk segment is expected to hold a significant market share through the forecast period. As completely plant-based, almond milk is a good option for people on vegetarian or vegan diets. Since almond milk uses less water and emits fewer greenhouse gases during production than dairy milk, it generally has a lesser environmental impact.

- The non-flavored segment is expected to dominate the Japan plant-based milk market during the forecast period.

Based on the flavor, the Japan plant-based milk market is divided into flavored and non-flavored. Among these, the non-flavored segment is expected to dominate the Japan plant-based milk market during the forecast period. Non-flavored plant-based milks are very adaptable and can be used for many different purposes, such as baking, cooking, and mixing with other ingredients. The market dominance of non-flavored milk is fueled by its versatility, which makes it a staple in many households.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan plant-based milk market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kikkoman

- Marusan

- Alpro (Danone)

- Otsuka Foods

- Sujahta

- TopValu

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Plant-Based Milk Market based on the below-mentioned segments:

Japan Plant-Based Milk Market, By Product

- Almond Milk

- Soy Milk

- Coconut Milk

- Oat Milk

- Rice Milk

- Others

Japan Plant-Based Milk Market, By Flavor

- Flavored

- Non-Flavored

Need help to buy this report?