Japan Point-of-Sale Terminal Market Size, Share, and COVID-19 Impact Analysis, By Product (Fixed, Mobile), by Component (Hardware, Software), By Deployment (Cloud, On-premises), and Japan Point-of-Sale Terminal Market Insights Forecasts 2022 - 2032

Industry: Semiconductors & ElectronicsJapan Point-of-Sale Terminal Market Insights Forecasts to 2032

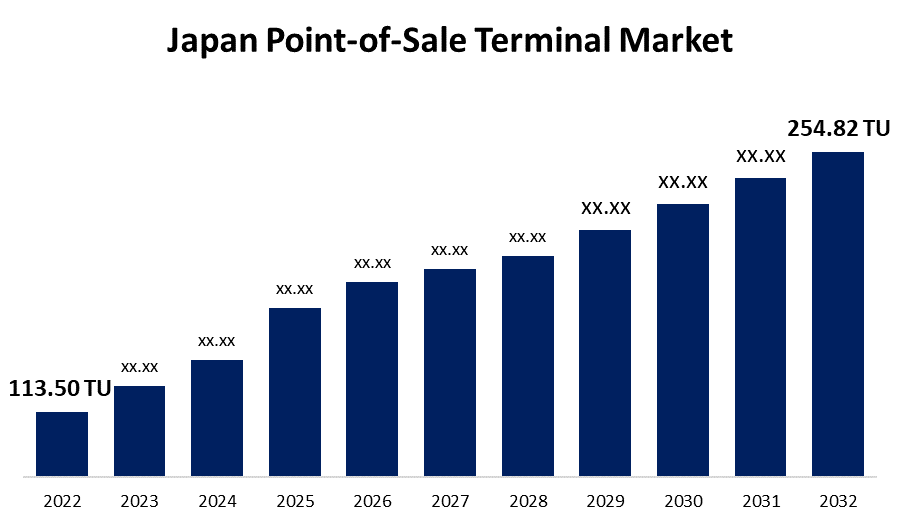

- The Japan Point-of-Sale Terminal Market Size was valued at 113.50 Thousand Units in 2022.

- The Market Size is Growing at a CAGR of 8.42% from 2022 to 2032.

- The Japan Point-of-Sale Terminal Market Size is Expected to Reach 254.82 Thousand Units by 2032.

Get more details on this report -

The Japan Point-of-Sale Terminal Market Size is Expected to Reach 254.82 Thousand Units by 2032, at a CAGR of 8.42% during the forecast period 2022 to 2032.

Market Overview

A point of sale (POS) terminal is a digital electronic device that integrates software and hardware to allow retail outlets to accept card payments without using their cash registers to read cards directly. POS terminals are electronic devices that are used to process card payments, manage inventory, print bills, and implement loyalty programs in a variety of end-use verticals such as restaurants, hospitality, healthcare, retail, warehouse/distribution, and entertainment. The cost of implementing POS terminals varies depending on the size of the organization and the terms offered by the suppliers. Small retailers or merchants may not have to pay rent to operate the POS devices, and customers are not charged an additional fee for using the service POS terminal. In other words, the point of sale is a broader concept that includes displays and devices that allow customers to conduct online transactions using computers, barcode scanners, and cash registers. Users can use the product to record and track customer orders, and credit and debit cards, and connect to other systems. Continuous technological advancements have resulted in advancements in these systems, which include mobile POS with bar code scanners and cloud-based POS, which increase business efficiency by providing high Returns on Investments (ROI).

Report Coverage

This research report categorizes the market for the Japan Point-of-Sale Terminal market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Point-of-Sale Terminal market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan Point-of-Sale Terminal market.

Japan Point-of-Sale Terminal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | 113.50 Thousand Units |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.42% |

| 2032 Value Projection: | 254.82 Thousand Units |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Component and By Deployment |

| Companies covered:: | NEC Corporation, NCR Corporation, Pax Japan, Sharp Electronics, Uniwell Corporation, Fujitsu Japan Limited, Casio Computer Co. Ltd., Samsung Electronics Co. Ltd., Ingenico Japan Co. Ltd., Vesca Co., Ltd., Micros POS Systems (Oracle), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing adoption of cashless payment methods, the need for better inventory management, and the rise of omnichannel retailing are all driving factors in the Point-of-Sale (POS) Terminal market. Demand for mobile POS systems, the growth of e-commerce, and the need for faster and more efficient checkout processes are all driving factors. Furthermore, the incorporation of cutting-edge technologies such as Artificial Intelligence (AI), Near Field Communication (NFC), and Radio Frequency Identification (RFID) is propelling the POS Terminal market forward. Finally, the growing emphasis on data security and compliance with Payment Card Industry (PCI) standards is driving POS system adoption.

Restraining Factors

The high cost of installation and maintenance, particularly for small and medium-sized businesses, is a constraint in the Point-of-Sale (POS) Terminal market. Other constraints include the requirement for continuous software and hardware updates, which can be costly and time-consuming. Concerns about security, such as the risk of cyber-attacks and data breaches, are also a significant challenge.

Market Segment

- In 2022, the fixed segment accounted for the largest revenue share over the forecast period.

Based on the product, the Japan point-of-sale terminal market is segmented into fixed, mobile. Among these, the fixed segment has the largest revenue share over the forecast period. Due to its widespread use in a variety of industries such as retail, hospitality, and healthcare. Fixed POS systems are more robust and feature-rich than mobile or tablet-based systems, making them ideal for larger, more complex businesses. Furthermore, fixed POS systems are more dependable and provide faster processing times than mobile systems. The rise of cloud-based POS solutions has boosted demand for fixed POS systems, which can be easily integrated with cloud-based platforms for enhanced functionality and ease of use.

- In 2022, the hardware segment will be the fastest-growing segment in the forecast period.

Based on the component, the Japan point-of-sale terminal market is segmented into hardware and software. Among these, the hardware segment is the fastest-growing segment in the forecast period. Since its essential role in processing transactions and managing inventory. A POS system's hardware components, such as cash registers, card readers, and barcode scanners, are required for the smooth operation of retail businesses. The hardware segment also includes the necessary components of mobile and fixed POS systems, such as tablets, computers, and printers. With the growing acceptance of digital payments and the emergence of new technologies such as AI and IoT, the demand for advanced hardware components in POS systems is expected to rise further in the coming years.

- In 2022, the cloud segment accounted for a significant revenue share over the forecast period.

Based on the deployment, the Japan point-of-sale terminal market is segmented into cloud, and on-premises. Among these, the cloud segment has a significant revenue share over the forecast period. This expansion can be attributed to the increasing use of SaaS technology and software integration. Customers pay a minimum monthly fee on a subscription basis in the SaaS model, rather than paying upfront for all software, hardware, and support services. This assists restaurants and other end-users in lowering their initial costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan point-of-sale Terminal market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NEC Corporation

- NCR Corporation

- Pax Japan

- Sharp Electronics

- Uniwell Corporation

- Fujitsu Japan Limited

- Casio Computer Co. Ltd.

- Samsung Electronics Co. Ltd.

- Ingenico Japan Co. Ltd.

- Vesca Co., Ltd.

- Micros POS Systems (Oracle)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2022, Samsung Electronics announced a strategic alliance with Mastercard to develop payment cards with built-in fingerprint sensors. Both companies hoped to achieve a more secure and faster payment experience while reducing physical contact with the payment terminal through this collaboration. This system also removed the requirement for users to enter PINs when making payments with their credit cards.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Point-of-Sale Terminal Market based on the below-mentioned segments:

Japan Point-of-Sale Terminal Market, By Product

- Fixed

- Mobile

Japan Point-of-Sale Terminal Market, By Component

- Hardware

- Software

Japan Point-of-Sale Terminal Market, By Deployment

- Cloud

- On-premises

Need help to buy this report?