Japan Processed Meat Market Size, Share, and COVID-19 Impact Analysis, By Processing Type (Frozen, Canned, and Chilled), By Animal Type (Poultry, Beef, Pork, and Others), and Japan Processed Meat Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesJapan Processed Meat Market Insights Forecasts to 2033

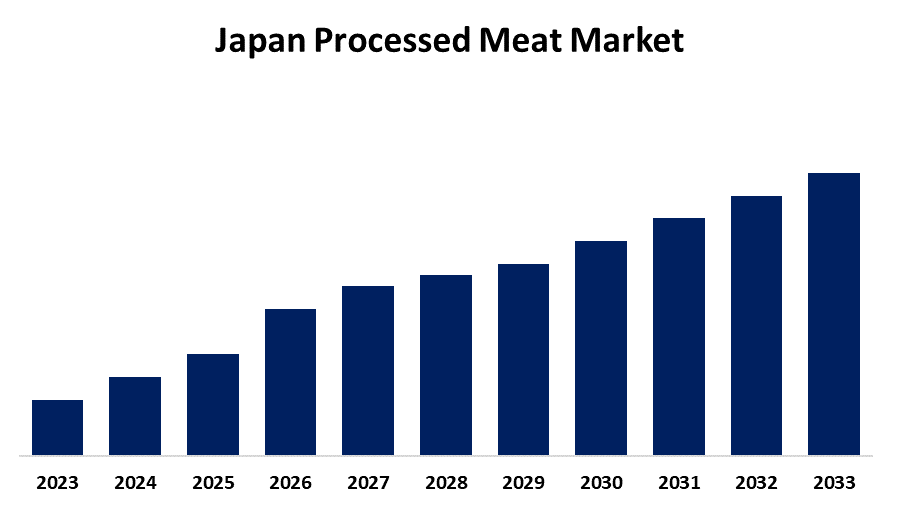

- The Market Size is Growing at a CAGR of 2.04% from 2023 to 2033

- The Japan Processed Meat Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Japan Processed Meat Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 2.04% from 2023 to 2033

Market Overview

Meat that has been enhanced with additional seasonings, flavorings, salts, acidifiers, minerals, and other additions or preservatives is referred to as processed meat. The main purposes of processing meat are to enhance its quality, keep it from deteriorating, and add taste to its natural composition. Red or white meat from birds, pigs, cattle, or marine animals can be used. Meat is treated with certain preservatives to prevent bacteria and other organisms from causing it to deteriorate. These procedures are intended to prolong the meat's shelf life or enhance its flavor. Additionally, the wide selection of cheaper processed meats is one of the main factors propelling this sector in Japan. The expansion of Japan's retail industry and rising consumer spending power in emerging nations like Japan are fueling the market's further expansion.

Report Coverage

This research report categorizes the market for the Japan processed meat market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan processed meat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan processed meat market.

Japan Processed Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.04% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Processing Type, By Animal Type |

| Companies covered:: | Itoham Foods Inc., NH Foods Ltd., Nichirei, Tyson Foods, Inc., Johnsonville, LLC, Prima Meat Packers, Marudai, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Japan's market is expanding due in large part to shifting customer preferences and nutritional habits. Accordingly, the industry is expanding significantly because of the abrupt shift towards higher meat consumption brought on by the expanding impact of Western culture and changing lifestyles. Additionally, Japan's long-standing traditions of eating meat are a major factor driving the country's processed meat sector. A large portion of the Japanese population consumes beef daily, a custom that dates back hundreds of years. A sizable population that still follows these eating patterns, along with a strong cultural attachment to meat, greatly contributes to the expansion of the processed meat sector in Japan. Furthermore, the market is expanding because of the rising demand in Japan for ready-to-eat (RTE) meat items that are convenient and easy to prepare, like sausages, sliced meats, and ready-to-cook meat products. In Japan, where hectic lifestyles fuel the demand for quick and simple meal options, this trend is especially prevalent. As a result, Japan's market for these goods is expanding significantly.

Restraining Factors

The extensive use of artificial preservatives has been shown to have negative impacts on the body. Customers' preference for plant-based meat substitutes will limit market expansion due to these alleged detrimental health impacts.

Market Segmentation

The Japan processed meat market share is classified into processing type and animal type.

- The frozen segment is expected to hold the largest market share through the forecast period.

The Japan processed meat market is segmented by processing type into frozen, canned, and chilled. Among these, the frozen segment is expected to hold the largest market share through the forecast period. A longer shelf life and a lower risk of microbiological contamination are two benefits of frozen meat over fresh meat. Frozen meat is commonly used in meal preparation by many food chains because it is readily available and quick to cook.

- The poultry segment is expected to dominate the Japan processed meat market during the forecast period.

Based on the animal type, the Japan processed meat market is divided into poultry, beef, pork, and others. Among these, the poultry segment is expected to dominate the Japan processed meat market during the forecast period. The high protein content of poultry meat and eggs makes them popular among bodybuilders. The primary factors propelling the industry are poultry's dietary and nutritional qualities as well as its comparatively low and competitive pricing when compared to other meats.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan processed meat market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Itoham Foods Inc.

- NH Foods Ltd.

- Nichirei

- Tyson Foods, Inc.

- Johnsonville, LLC

- Prima Meat Packers

- Marudai

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2021, Rudi's Fine Food Pte. Ltd., a Singaporean meat producer, was acquired by Prima Meat, a prominent meat and ham manufacturer in Japan. Prima Meat will be better able to meet the needs of Japanese meat product enthusiasts in this area by expanding its market share in South Asia as a result of this purchase.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Processed Meat Market based on the below-mentioned segments:

Japan Processed Meat Market, By Processing Type

- Frozen

- Canned

- Chilled

Japan Processed Meat Market, By Animal Type

- Poultry

- Beef

- Pork

- Others

Need help to buy this report?