Japan Pulp & Paper Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Bleaching Chemicals, Process Chemicals, Functional Chemicals, and Basic Chemicals), By Application (Printing, Packaging & Labelling, and Pulp Mills), and Japan Pulp & Paper Chemicals Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsJapan Pulp & Paper Chemicals Market Insights Forecasts to 2033

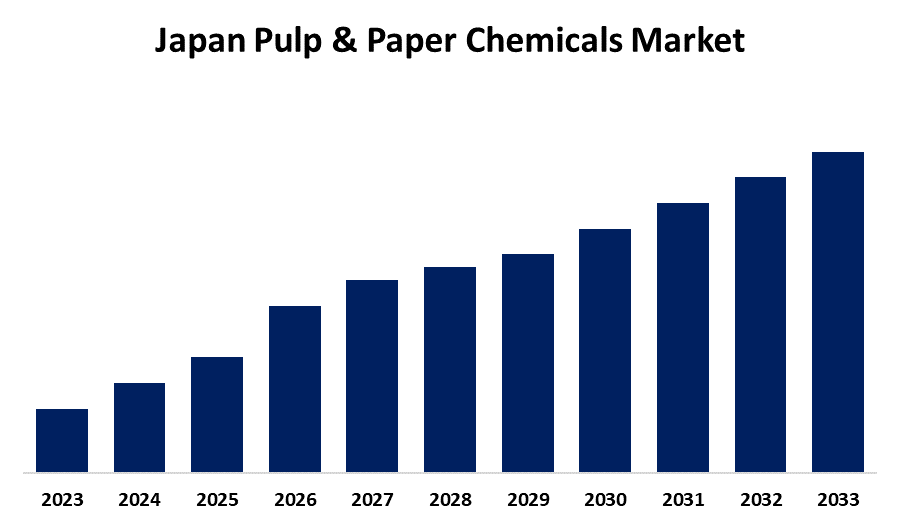

- The Market Size is Growing at a CAGR of 4.18% from 2023 to 2033

- The Japan Pulp & Paper Chemicals Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Japan Pulp & Paper Chemicals Market Size is Expected to hold a significant share by 2033, growing at a CAGR of 4.18% from 2023 to 2033.

Market Overview

The term "paper & pulp chemicals" refers to a class of substances that are either used to make paper or alter its characteristics. These substances have the ability to modify the paper in a variety of ways, such as enhancing its strength and water resistance or altering its color and brightness. The common term for paper pulp is made from chemically separated plant fibers. The main goal of creating chemical paper pulp is to react the chemical solution with the plant fiber at a high temperature, dissolving as much lignin as possible in the cell wall and intercellular layer. Paper pulp is created by dissociating the basic material. In the manufacturing sector, metal enamels and pulp and paper chemicals are utilized in the production of transformers, motors, and generators. Pulp and paper chemicals are needed for the many components used in the electrical sector, such as wire windings, laminated cores, and insulating materials.

Report Coverage

This research report categorizes the market for the Japan pulp & paper chemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan pulp & paper chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan pulp & paper chemicals market.

Japan Pulp & Paper Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.18% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Application |

| Companies covered:: | Nippon Paper Industries Co., Ltd., Oji Holdings Corporation, Hokuetsu Corporation, Daio Paper Corporation, Mitsubishi Paper Mills Limited, Rengo Co., Ltd., Chuetsu Pulp & Paper Co., Ltd., Harima Chemicals Group, Inc., Tokushu Tokai Paper Co., Ltd., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Japan's paper industry is growing rapidly. Out of the world's top three pulp and paper producers, Japan is currently ranked third, after the United States and China, with 30.8 million tons of paper produced. Japan has one of the highest recovered paper use rates worldwide. The pulp and paper sector in Japan set a goal to cut final waste disposal to 130,000 tons by FY2020; the goal was met by cutting the volume to 69,000 tons in FY2020. Furthermore, as a new numerical target for FY2021 and beyond, Japan has established a goal to reduce final waste disposal to 60,000 tons by FY2025. We are still working to reduce waste. In addition, the food and beverage industry's rising concern for food safety has created a need for luxury catering plates and liquid packaging plates.

Restraining Factors

Depletion of natural resources and a shortage of skilled workers are thus barriers to this company's growth. Furthermore, since pulp and paper mills rely so heavily on natural resources, they are currently subject to a great deal of regulation. This limits the growth of the market for specialized chemicals used in the production of pulp and paper.

Market Segmentation

The Japan pulp & paper chemicals market share is classified into product type and application.

- The functional chemicals segment is expected to hold the largest market share through the forecast period.

The Japan pulp & paper chemicals market is segmented by product type into bleaching chemicals, process chemicals, functional chemicals, and basic chemicals. Among these, the functional chemicals segment is expected to hold the largest market share through the forecast period. Coating chemicals, pigments, and dyes are examples of functional chemicals. The biggest consumption of functional chemicals has been caused by the segment's rise, which is being driven by the growing demand for value-added paper.

- The packaging & labeling segment is expected to hold a significant market share through the forecast period.

The Japan pulp & paper chemicals market is segmented by application into printing, packaging & labeling, and pulp mills. Among these, the packaging & labeling segment is expected to hold a significant market share through the forecast period. The packaging and labeling industry's demand for pulp and paper chemicals is being driven by their exceptional print contrast, smooth finishing, lamination, and vacuum metalizing applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan pulp & paper chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

- Hokuetsu Corporation

- Daio Paper Corporation

- Mitsubishi Paper Mills Limited

- Rengo Co., Ltd.

- Chuetsu Pulp & Paper Co., Ltd.

- Harima Chemicals Group, Inc.

- Tokushu Tokai Paper Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Doutor Coffee used Mitsubishi Paper Mills' barrisherpa, which is barricote laminated with plastic film, to package its limited-edition Hatsugama roasted coffees. Coffee items are generally wrapped in vapor-deposited aluminum bags to protect their scent.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Pulp & Paper Chemicals Market based on the below-mentioned segments:

Japan Pulp & Paper Chemicals Market, By Product Type

- Bleaching Chemicals

- Process Chemicals

- Functional Chemicals

- Basic Chemicals

Japan Pulp & Paper Chemicals Market, By Application

- Printing

- Packaging & Labelling

- Pulp Mills

Need help to buy this report?