Japan Refractory Materials Market Size, Share, and COVID-19 Impact Analysis, By Form (Bricks & Shaped and Monolithic & Unshaped), By End-Use Industry (Iron & Steel, Non-Ferrous Metals, Glass, Cement, and Others) and Japan Refractory materials Market Insights, Industry Trend, Forecasts to 2033.

Industry: Advanced MaterialsJapan Refractory Materials Market Insights Forecasts to 2033

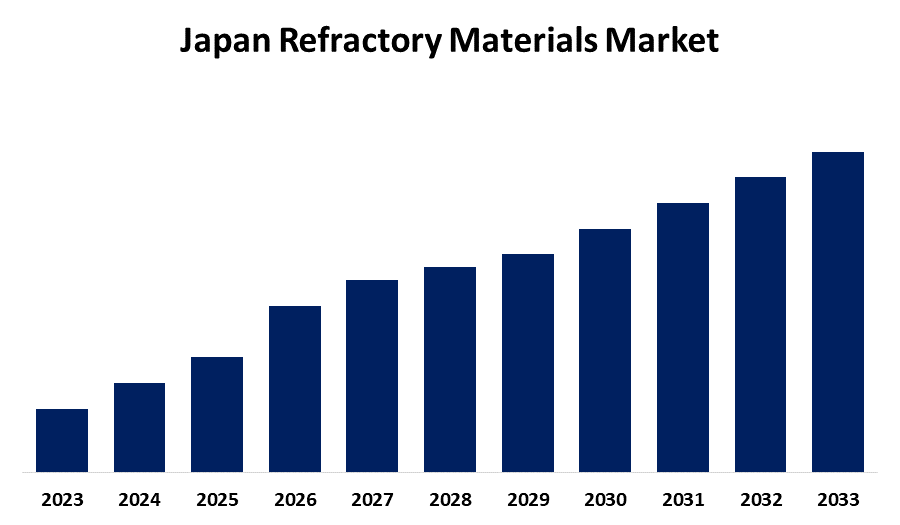

- The Market Size is Growing at a CAGR of 4.12% from 2023 to 2033

- The Japan Refractory Materials Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Japan Refractory Materials Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 4.12% from 2023 to 2033.

Market Overview

A refractory (or refractory material) is a substance that maintains its strength and stiffness at high temperatures and is resistant to breaking down due to heat or chemical attack. These are non-metallic, inorganic materials that can be either porous or non-porous. They can have a wide range of crystallinity, including crystalline, polycrystalline, translucent, and composites. The industrial growth of Japan, especially in sectors like steel, cement, glass, and petrochemicals, is closely tied to the country's long-standing refractory material market. Japan's demand for exceptionally well-refractory materials has grown steadily from the industrial revolution of the Meiji period to the postwar economic boom, solidifying its standing as a world leader in advanced manufacturing. Additionally, a few large domestic and international companies control the majority of the refractory market in Japan. One of the biggest and most well-known refractory producers in Japan, Kurosaki Harima Corporation, controls a substantial portion of the steel, cement, and nonferrous metals sectors.

Report Coverage

This research report categorizes the market for the Japan refractory materials market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan refractory materials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan refractory materials market.

Japan Refractory Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.12% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Form, By End-Use Industry |

| Companies covered:: | Nippon Steel Corporation, Kobe Steel, Ltd., Mitsubishi Materials Corporation, Toyo Refractories Co., Ltd., AGC Ceramics Co., Ltd., Shinagawa Refractories Co., Ltd., Takahashi Refractories Co., Ltd., Krosaki Harima Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan became the tenth largest exporter of refractory bricks worldwide in 2022, with $111 million in exports. Refractory bricks were Japan's 414th most exported product that year. The market for refractory materials in Japan is being driven by the country's growing exports of refractory products to other nations. Additionally, these refractory bricks is utilized for holding high temperatures during various industrial processes. Furthermore, approximately 4,66 thousand industries were involved in the Japanese iron and steel sector in 2023. The market for refractory materials in Japan is driven by the number of steel and iron manufacturing enterprises that are present in the country and require a large quantity of refractory materials to carry out several operations at high temperatures.

Restraining Factors

Humans are at risk from refractory materials including ceramic fibres, silica, and alumina when their concentrations are exceeded.

Market Segmentation

The Japan refractory materials market share is classified into form and end-use industry.

- The bricks & shaped segment is expected to dominate the Japan refractory materials market during the forecast period.

Based on the form, the Japan refractory materials market is divided into bricks & shaped and monolithic & unshaped. Among these, the bricks & shaped segment is expected to dominate the Japan refractory materials market during the forecast period. Insulating furnaces, boilers, and other thermal procedures vessel exterior walls are created by stacking refractory bricks and blocks. Refractory mortar is usually used to bond refractory bricks together.

- The iron & steel segment is expected to hold a significant market share through the forecast period.

The Japan refractory materials market is segmented by end-use industry into iron & steel, non-ferrous metals, glass, cement, and others. Among these, the iron & steel segment is expected to hold a significant market share through the forecast period. In the different stages of the steel production procedure, the refractory lining is changed every 30 minutes to every two days. As a result, the iron and steel industry consume a lot of resources, which propels the segment's expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan refractory materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Steel Corporation

- Kobe Steel, Ltd.

- Mitsubishi Materials Corporation

- Toyo Refractories Co., Ltd.

- AGC Ceramics Co., Ltd.

- Shinagawa Refractories Co., Ltd.

- Takahashi Refractories Co., Ltd.

- Krosaki Harima Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2021, ArcelorMittal Refractories, a division of the ArcelorMittal Group with its headquarters in Kraków, Poland, and Kurosaki Harima Corporation (Japan) have entered into a partnership agreement. The goal of this partnership was to improve ArcelorMittal Refractories' product line and maximize production capabilities.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Refractory Materials market based on the below-mentioned segments:

Japan Refractory Materials Market, By Form

- Bricks & Shaped

- Monolithic & Unshaped

Japan Refractory Materials Market, By End-Use Industry

- Iron & Steel

- Non-Ferrous Metals

- Glass

- Cement

- Others

Need help to buy this report?