Japan Shared Mobility Market Size, Share, and COVID-19 Impact Analysis, By Vehicle (Shared Rides and Shared Vehicles), By Service Model (Bike Sharing, Car Sharing, Ride-Hailing, and Public Transit), and Japan Shared Mobility Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationJapan Shared Mobility Market Insights Forecasts to 2033

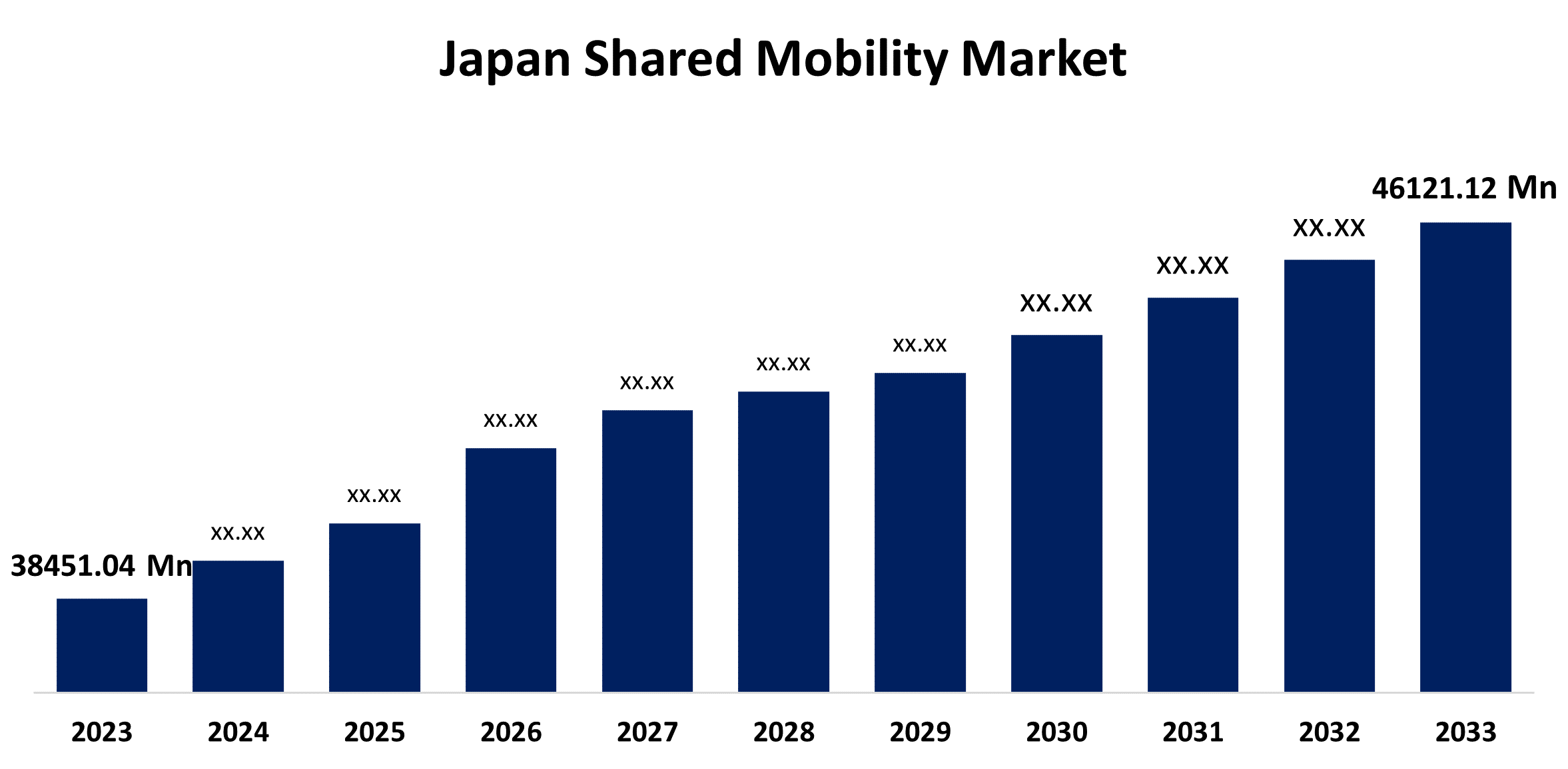

- The Japan Shared Mobility Market Size was valued at USD 38451.04 Million in 2023.

- The Market Size is Growing at a CAGR of 1.84% from 2023 to 2033

- The Japan Shared Mobility Market Size is Expected to Reach USD 46121.12 Million by 2033

Get more details on this report -

The Japan Shared Mobility Market is Anticipated to Reach USD 46121.12 Million by 2033, growing at a CAGR of 1.84% from 2023 to 2033.

Market Overview

Vehicles that are made available in public areas and are managed by a mobility provider are typically used for shared mobility. Software or apps are used by the majority of shared mobility companies to deliver their services. During the registration process, users are required to furnish their details and typically submit to verification using their ID card and, in the case of e-moped and vehicle-sharing companies, their driver's license. After the account is activated, users can use the app to reserve or hire the car of their choice. Rates by the minute, hour, or day are available to users. Certain companies, like Miles, charge a fee per kilometer for their automobiles. The payment method is stored in the app and is made straight through it. Here, common choices include credit cards, PayPal or other payment methods, or an internal corporate mobility budget.

Report Coverage

This research report categorizes the market for the Japan shared mobility market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan shared mobility market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan shared mobility market.

Japan Shared Mobility Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 38451.04 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.84% |

| 2033 Value Projection: | USD 46121.12 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle, By Service Model |

| Companies covered:: | Times Mobility Co., Ltd., Mitsui Fudosan Realty Co., Ltd., Orix Auto Corporation, Toyota Motor Corporation, Nissan Rental Solution Co., Ltd., Earthcar Co., Ltd., Meitetsu Kyosho Co., Ltd, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The population and workforce decline in Japan is contributing to a decline in the sales and ownership of new cars, and other global and national developments are affecting mobility in Japan as well. Manufacturers of original equipment for cars are transitioning to electric vehicles, and fuel cell vehicles are being used by public transportation due to the growing urgency of addressing climate change. With the advent of driverless cars, micromobility in urban areas, and innovative ground transportation options, numerous businesses are venturing into the mobility as a service market. Japan's population and transportation patterns are changing dramatically. It is necessary to take into account new collaboration models, atypical entrants, and technical advancements when making the shift from the long-established vehicle ownership paradigm to a shared mobility system. On April 1, 2024, the Japanese government repealed most of the restrictions placed on ride-sharing services, permitting taxi firms to offer these services in locations and at periods when cabs are scarce.

Restraining Factors

A rise in the cost is causing a decline in the number of passengers. Pressure is coming from investors as well to lessen the significant losses.

Market Segmentation

The Japan shared mobility market share is classified into vehicle and service model.

- The shared vehicles segment is expected to hold the largest market share through the forecast period.

The Japan shared mobility market is segmented by vehicle into shared rides and shared vehicles. Among these, the shared vehicles segment is expected to hold the largest market share through the forecast period. Traditional mobility services are included with shared vehicles. This is widespread and typically requires infrastructure or hubs. Additionally, these are included in governmental establishments. Due to its ability to carry a larger number of passengers on each journey, this service is more efficient and will eventually lessen its negative environmental effects.

- The ride-hailing segment is expected to dominate the Japan shared mobility market during the forecast period.

Based on the service model, the Japan shared mobility market is divided into bike sharing, car sharing, ride-hailing, and public transit. Among these, the ride-hailing segment is expected to dominate the Japan shared mobility market during the forecast period. In the Shared Mobility sector, ride-hailing has become the most popular service type, transforming urban transportation by offering easy, immediate transportation via applications for smartphones.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan shared mobility market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Times Mobility Co., Ltd.

- Mitsui Fudosan Realty Co., Ltd.

- Orix Auto Corporation

- Toyota Motor Corporation

- Nissan Rental Solution Co., Ltd.

- Earthcar Co., Ltd.

- Meitetsu Kyosho Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Nissan Motor Co., Ltd. revealed its plan for Japan's commercialization of its in-house, autonomous-drive*1 mobility solutions.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Shared Mobility Market based on the below-mentioned segments:

Japan Shared Mobility Market, By Vehicle

- Shared Rides

- Shared Vehicles

Japan Shared Mobility Market, By Service Model

- Bike Sharing

- Car Sharing

- Ride-Hailing

- Public Transit

Need help to buy this report?