Japan Shredded Waste Market Size, Share, and COVID-19 Impact Analysis, By Waste Type (Municipal Waste, Industrial Waste, and Hazardous Waste), By End-User (Landfills, Cement Plants, Incineration Plants, and Materials Recovery/Recycling Facilities), and Japan Shredded Waste Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsJapan Shredded Waste Market Insights Forecasts to 2033

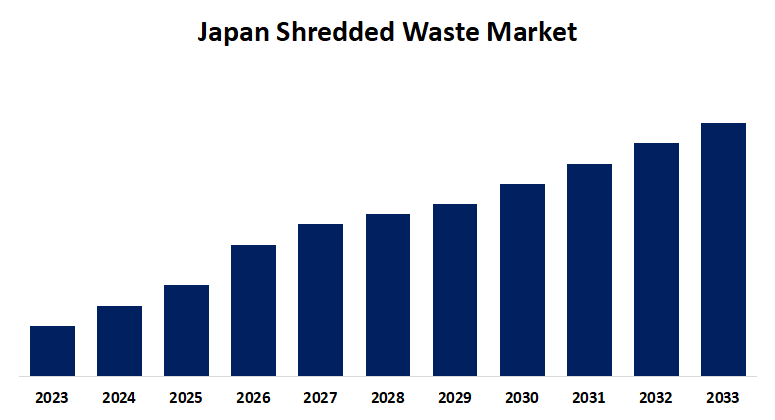

- The Market Size is Growing at a CAGR of 3.21% from 2023 to 2033

- The Japan Shredded Waste Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Japan Shredded Waste Market Size is Expected to Hold a Significant Share by 2033, growing at a CAGR of 3.21% from 2023 to 2033.

Market Overview

Shredders contribute to lowering waste volume by reducing waste material size, which makes garbage easier to handle, transport, and store. This is crucial for waste streams that might take up a lot of room in their natural form, like plastic, cardboard, wood, and metal. As of 2019, Japan is among the top nations in the world for PET bottle management, with a 93% collection rate and an 85.8% recycling rate. Regarding the channels of collection, 46% rely on local authorities and groups, and 54% rely on commercial establishments, such as PET bottle-specific garbage cans positioned next to vending machines and other collection boxes. This well-established infrastructure and high efficiency in PET bottle management indicate a robust foundation for expanding into the shredded waste industry, leveraging Japan's advanced waste handling practices to further enhance recycling and waste reduction efforts.

Report Coverage

This research report categorizes the market for the Japan shredded waste market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan shredded waste market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan shredded waste market.

Japan Shredded Waste Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.21% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Waste Type, By End-User |

| Companies covered:: | IKC Co., Ltd., KUBOTA Environmental Engineering Co., Ltd., RYOHSHIN Co., Ltd., Harden Machinery Ltd., HOXAN CORPORATION, Eco-Tech Recycling Co. Ltd, Recycle One, Inc, JFE Engineering Corporation, Takuma Co., Ltd, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan produced about 40 million metric tons of trash in the fiscal year 2022. Household garbage accounted for the majority of created waste, amounting to nearly 28.4 million metric tons, while waste attributable to businesses made up a smaller portion. This significant volume of waste, particularly from households, underscores the potential for growth in the shredded waste industry in Japan. The majority of waste produced, or over 30 million metric tons, was residential waste. Shredded home waste can help reduce the amount of waste that ends up in landfills, which is a major source of waste filling.

Restraining Factors

Industrial shredders can be prohibitively expensive for small and medium-sized businesses (SMEs) to utilize due to the substantial upfront expenses associated with machine utilization in the shredded waste market. Furthermore, some regions' insufficient infrastructure for waste treatment and ignorance prevents industrial growth.

Market Segmentation

The Japan shredded waste market share is classified into waste type and end-user.

- The industrial waste segment is expected to hold the largest market share through the forecast period.

The Japan shredded waste market is segmented by waste type into municipal waste, industrial waste, and hazardous waste. Among these, the industrial waste segment is expected to hold the largest market share through the forecast period. The increasing quantity of garbage produced by the sector is responsible for the segment's growth. By 2020, Japan's total industrial waste generation was estimated to be about 380 million tons annually. About 75 million trash items, or 20% of the total garbage, originate from the building industry.

- The incineration plants segment is expected to hold a significant market share through the forecast period.

The Japan shredded waste market is segmented by end-users into landfills, cement plants, incineration plants, and materials recovery/recycling facilities. Among these, the incineration plants segment is expected to hold a significant market share through the forecast period. Japan had over 1.16 thousand trash incinerator plants in the fiscal year 2022. The majority of waste that is collected in Japan is either treated at facilities for recycling or incineration. Shredders are used to process waste before it is disposed of for burning. It increases the waste's calorific value, combustion stability, and incineration impact.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within Japan shredded waste market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IKC Co., Ltd.

- KUBOTA Environmental Engineering Co., Ltd.

- RYOHSHIN Co., Ltd.

- Harden Machinery Ltd.

- HOXAN CORPORATION

- Eco-Tech Recycling Co. Ltd

- Recycle One, Inc

- JFE Engineering Corporation

- Takuma Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, the Alliance to End Plastic Waste (Alliance) declared that it would support local entrepreneurs Kaman Inc. and RECOTECH Inc. in growing their businesses by offering seed money and technical know-how. Moreover, Kaman and RECOTECH are being partnered with Mitsui Chemicals and Mitsubishi Chemical Corporation, the founding members of the Alliance, to expedite their respective development.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Shredded Waste Market based on the below-mentioned segments:

Japan Shredded Waste Market, By Waste Type

- Municipal Waste

- Industrial Waste

- Hazardous Waste

Japan Shredded Waste Market, By End-user

- Landfills

- Cement Plants

- Incineration Plants

- Materials Recovery/Recycling Facilities

Need help to buy this report?