Japan Smartphone Market Size, Share, and COVID-19 Impact Analysis, By Operating System (Android, iOS, Windows and Others), By Distribution Channel (OEMs Stores, Retailer and E-commerce), and Japan Smartphone Market Insights, Industry Trend, Forecasts to 2032

Industry: Electronics, ICT & MediaJapan Smartphone Market Insights, Industry Trend, Forecasts to 2032

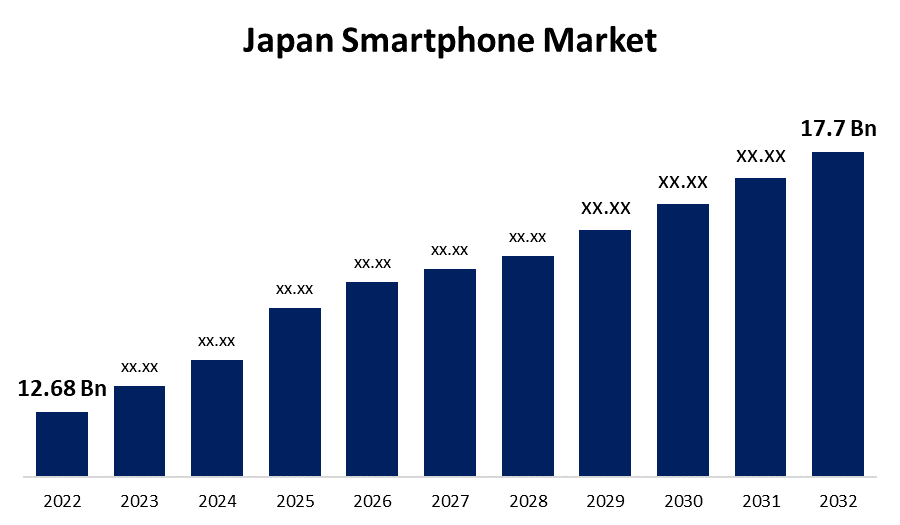

- The Japan Smartphone Market Size was valued at USD 12.68 Billion in 2022.

- The Market is growing at a CAGR of 3.4% from 2022 to 2032

- The Japan Smartphone Market is expected to reach USD 17.7 Billion by 2032

Get more details on this report -

The Japan Smartphone Market Size is expected to grow at a 3.4% CAGR during the forecast period. One of the worlds biggest markets for smartphones is Japan. The nation can also be credited with being a pioneer in the development of mobile phone culture. The first smartphone to be widely used in a nation had e-mail capabilities and was released by NTT Docomo in Japan as early as 1999.

Market Overview

The Japanese smartphone market is one of the largest and most advanced in the world, with a high level of smartphone penetration and a tech-savvy population. The market is dominated by major smartphone manufacturers such as Apple, Samsung, and Sony. According to StatCounter, in March 2023, Apple was the leading smartphone brand in Japan, with a market share of 72.6%, followed by Huawei with 6.46%.

Another unique aspect of the Japanese market is the popularity of mobile payments and other mobile-related services, such as mobile shopping and banking. This has been facilitated by the widespread adoption of contactless payment systems such as NFC, as well as the development of specialized mobile payment services like PayPay and Line Pay.

In addition to these major players, Japanese manufacturers such as Sharp, Fujitsu, and Panasonic also have a presence in the market. These companies offer smartphones with unique features and designs that cater to the needs and preferences of Japanese consumers. The Japanese smartphone market is highly competitive, with various price ranges and models available to consumers. In recent years, there has been a trend towards larger screen sizes and more advanced camera technology. Additionally, 5G network technology has been rapidly expanding in Japan, with major telecom companies such as NTT Docomo and SoftBank rolling out their 5G services.

Report Coverage

This research report categorizes the market for the Japan smartphone market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japanese mobilephone market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japanese smartphone market.

Japan Smartphone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.68 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.4% |

| 2032 Value Projection: | USD 17.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Operating System, By Distribution Channel, COVID-19 Impact Analysis |

| Companies covered:: | Apple, Samsung, Sony Group Corporation, Fujitsu, Kyocera, Xiaomi, Huawei, Sharp, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan is known for its advanced technology and innovation, and this has translated into the smartphone market. The country has a highly developed telecommunications infrastructure, with fast and reliable internet connectivity, which has allowed for the rapid adoption of smartphones. Japanese consumers are also known for their interest in cutting-edge technology, which has fueled demand for new and innovative smartphone features, such as high-quality cameras, AI-powered assistants, and 5G connectivity.

Japan is a highly cash-based society, but there has been a shift towards mobile payments and other mobile-related services in recent years. This has been facilitated by the widespread adoption of contactless payment systems such as NFC, as well as the development of specialized mobile payment services like PayPay and Line Pay. The popularity of mobile payments has also created opportunities for smartphone manufacturers to integrate payment technology directly into their devices, such as the mobile wallet feature on the latest iPhones.

Japanese consumers are known for their love of gaming and entertainment, and this has translated into the smartphone market. The popularity of mobile gaming and streaming services has driven demand for smartphones with large screens, powerful processors, and long battery life. Smartphone manufacturers have responded to this trend by developing devices with specialized gaming features, such as high-refresh-rate screens and dedicated gaming modes.

Restraining Factors

While the Japanese smartphone market is large and established, it is also highly saturated. There are numerous domestic and foreign players competing for market share, and consumers are increasingly demanding and discerning in their smartphone purchases. This has made it difficult for new entrants to gain a foothold in the market, and has created intense competition among existing players.

The Japanese smartphone market is dominated by domestic players such as Sony, Sharp, and Panasonic. While this has created a strong and competitive market, it has also made it difficult for foreign players to gain traction. Foreign companies such as Apple and Samsung have established a presence in the market, but they face strong competition from established domestic players with strong brand recognition.

Market Segment

The Japan Smartphone Market share is segmented into operating system and distribution channel.

- The android segment is expected to hold the largest share of the Japan smartphone market during the forecast period.

Based on the operating system, the Japan smartphone market is segmented into android, iOS, windows, and others. Among these, the android segment is expected to hold the largest share of Japan mobile phone market during the forecast period. The growth can be attributed due to the popularity of domestic manufacturers such as Sony, Sharp, and Fujitsu, which have traditionally used the android platform for their devices. These companies have built up strong brand recognition and a loyal customer base in Japan, which has helped to drive demand for Android devices in the market. The open-source nature of the Android platform has also allowed for greater customization and localization for the Japanese market, with apps and services tailored to local needs and preferences.

- The E-commerce segment is expected to grow at the highest CAGR during the forecast period.

Based on the distribution channel, the Japan smartphone market is classified into OEMs stores, retailer and E-commerce. Among these, the E-commerce segment is expected to grow at the highest CAGR during the forecast period. The growth can be attributed due the ability to offer a wider range of products, competitive pricing, and convenient delivery options than physical retailers. E-commerce platforms are a growing segment of the Japanese smartphone market, accounting for around 25% of all smartphone sales. While e-commerce platforms may not offer the same level of personalized service and support as OEMs stores and retailers, they do offer competitive pricing and convenient delivery options that appeal to many Japanese consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan smartphone market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apple

- Samsung

- Sony Group Corporation

- Fujitsu

- Kyocera

- Xiaomi

- Huawei

- Sharp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On February 2023, in order to appeal to first-time smartphone users, Sharp has released the Basio Active smartphone in Japan.

- On August 2022, The Nothing Phone (1), the first smartphone manufactured by Carl Pei, a former co-founder of OnePlus, was officially unveiled in Japan. In the Japanese market, there are three variations of the Nothing Phone (1): 8GB + 128GB, 8GB + 256GB, and 12GB + 256GB.

Market Segment

This study forecasts revenue at, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Japan Smartphone Market based on the below-mentioned segments:

Japan Smartphone Market, By Operating System

- Android

- iOS

- Windows

- Others

Japan Smartphone Market, By Distribution Channel

- OEMs Stores

- Retailer

- E-commerce

Need help to buy this report?