Japan Space Exploration Market Size, Share, and COVID-19 Impact Analysis, By Space Technology (Rockets, Landers, Robots, Satellites, Orbiters, Others), By Mission Type (Manned Mission and Unmanned Mission), By Exploration Type (Moon Exploration, Transportation, Orbital Infrastructure, Mars Exploration, Others), By End-Use (Government Space Agencies, Commercial, Military, Others), and Japan Space Exploration Market Insights Forecasts to 2032

Industry: Aerospace & DefenseJapan Space Exploration Market Insights Forecasts to 2032

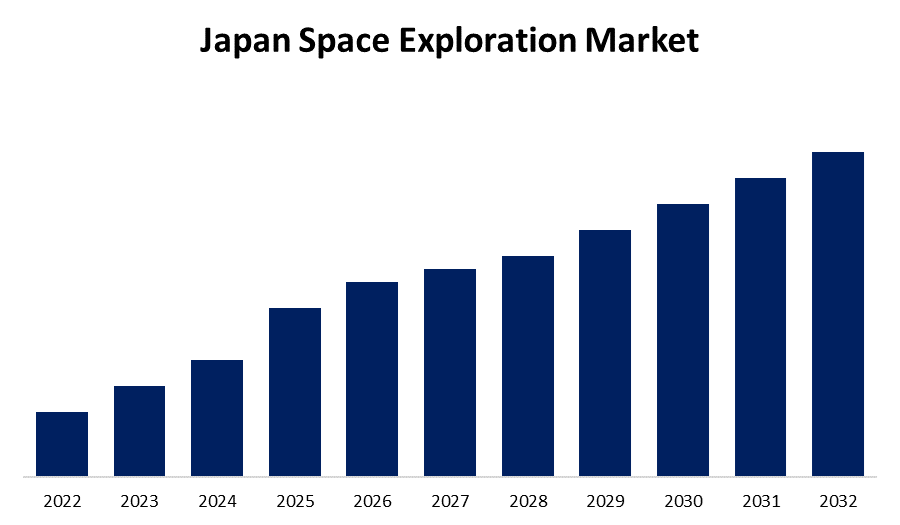

- The Market Size is Growing at a CAGR of 24.78% from 2022 to 2032.

- Japan is Expected To Grow the fastest during the forecast period.

Get more details on this report -

The Japan Space Exploration Market Size is expected to grow at a CAGR of 24.78% during the forecast period 2022 to 2032.

Market Overview

Japan has a rich history of government-sponsored 'old space' exploration and ranks as one of the leading space-faring nations, alongside the United States, Russia, Europe, and China. It was the fourth nation to journey into space after the Soviet Union, the United States, and France, and the first Asian country to launch a satellite into orbit in the year 1970. It remains the third country that has launched spacecraft to the two celestial bodies Mars and the Moon, behind the United States and the Soviet Union. Japan has carried out numerous missions in Earth Observation, Space Science, and Exploration utilizing its own rocket family, and it is a key contributor to the International Space Station's operations. For example, it is the only country to have returned an object from an extraterrestrial body other than the lunar surface, when Hayabusa descended in the Australian outback in 2010 with a sample obtained from the outermost layer of a deep-space asteroid.

The Japan Aerospace Exploration Agency (JAXA) is the primary government agency responsible for Japan's space exploration and development. Within the context of government acquisition, Japan's space agency, JAXA, has adopted NASA's lead by transitioning from government-owned and controlled facilities to outsourcing corporations to collaborate on particular missions. JAXA is in charge of satellite research, innovation in technology, and launching into the earth's orbit as well as numerous more technologically advanced missions such as planetary study as well as potential manned exploration of the Earth's moon. For instance, JAXA will supply the radar equipment on the satellite for the EarthCARE mission with ESA in 2023. EarthCARE, the sixth satellite in ESA's Earth Explorer Programme, is a scheduled joint European/Japanese (ESA / JAXA / NICT) mission. The mission's primary purpose is to observe and characterize atmospheric conditions and aerosols, as well as to measure reflected solar radiation and infrared wavelengths emitted by the Earth's surface and stratosphere. EarthCARE's launch is expected for early 2024 as of October 2022.

In addition to JAXA, another governmental agency in Japan involved in space research and development is Japan Space Systems (JSS). JSS, which is administered by the Japanese Ministry of Economy, Trade, and Industry (METI), has a greater industrial and commercial priority than JAXA. The primary objective of JSS is to foster technological progress, particularly the assessment of COTS (commercially available off-the-shelf) components, robotics, material sciences, and optical Earth-observing technologies. JSS has completed four missions as of today, including EXPRESS, SERVIS 1, USER, and SERVIS 2.

The Japanese space industry has received assistance from Japan's leading large-scale manufacturing and electronics corporations. Several companies, including Mitsubishi Heavy Industries, IHI Aerospace Co., Ltd., Mitsubishi Electric, and NEC Space Technologies, Ltd., are the primary suppliers of launchers and spacecraft for exploration. Japan's space exploration program was created for peaceful purposes, distinct from the development of military technology. As a result, the program's goals are typically commercial or scientific research.

Report Coverage

This research report categorizes the market for Japan Space Exploration Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Space Exploration Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Space Exploration Market.

Japan Space Exploration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 24.78% |

| Historical Data for: | 2020 to 2022 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Space Technology, By Mission Type, By Exploration Type, By End-Use, |

| Companies covered:: | Japan Aerospace Exploration Agency (JAXA), IHI AEROSPACE CO LTD., Axelspace Corporation, SKY Perfect JSAT Group, Interstellar Technologies, Inc., Ispace, Infostellar, Inc., Mitsubishi Electric Corporation, National Space Development Agency of Japan, Mitsui & Co., Ltd, NEC Corporation, Mitsubishi Heavy Industries, Ltd., National Aerospace Laboratory of Japan, NEC Space Technologies, and Japan Space Systems (J-space systems) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's space exploration industry is driven by key factors such as private sector investment in the aerospace industry, increasing the nation's safety through the use of space, and advancing and developing science, technology, and industrial foundations, which are expected to drive demand for Japan's space exploration market. Furthermore, one of Japan's advantages in creating innovations in space technology is the significant government funding for the commercial and industrial sectors. Furthermore, Japanese industries and higher education institutions have been key contributors to micro-, nano-, and even pico-satellite technology, allowing countries that are still waiting to enter the aerospace industry economic means of reaching space.

The Japanese government is now launching a number of programs to boost the local commercial aerospace and exploration market. Furthermore, in order for the marketplace to achieve long-term growth, a change from the government to the commercial sector is required, which is expected to drive the Japanese space exploration market. This trend is being driven in large part by the allocation of government funds for large projects, as well as the numerous developing opportunities for businesses to benefit from space. Furthermore, the government is proactively attempting to foster development in space technologies by sponsoring research and development efforts, and it has launched an incentive program to stimulate innovative concepts for space-related commercial companies. As a result of the foregoing results, the Japanese space exploration market is predicted to expand at an exponential rate over the forecast period.

Market Segment

- In 2022, the satellite segment is witnessing a higher growth rate over the forecast period.

Based on space technology, the Japan Space Exploration Market is segmented into rockets, landers, robots, satellites, orbiters, and others. Among these, the satellite segment is witnessing a higher growth rate over the forecast period. This expansion can be attributed to an increase in demand for low-Earth geosynchronous-based services, satellite Earth observation imagery, and a rise in the number of space exploration missions. The demand for high-resolution Earth imaging has grown across verticals for a variety of applications, including agricultural field monitoring, detecting climatic changes, meteorology, and disaster mitigation. Satellites are also employed for communication in defense. Japan has launched satellites to monitor the military forces of other countries, particularly North Korea, China, and Russia.

- In 2022, the unmanned mission segment is witnessing significant CAGR growth over the forecast period.

On the basis of mission type, the Japan Space Exploration Market is segmented into manned missions and unmanned missions. Among these, the unmanned mission segment is witnessing significant CAGR growth over the forecasted period. Unmanned missions are regularly contemplated for the exploration of Earth's moon and Mars missions. Furthermore, unmanned spacecraft missions are less expensive and risky than manned missions. Furthermore, the launch of new satellites into orbit will increase demand for unmanned spacecraft during the forecast period.

- In 2022, the moon exploration segment is expected to hold the largest share of Japan's space exploration market during the forecast period.

Based on the exploration type, the Japan Space Exploration Market is classified into moon exploration, transportation, orbital infrastructure, mars exploration, and others. Among these, the moon exploration segment is expected to hold the largest share of Japan's space exploration market during the forecast period. The expanding number of Japanese space exploration initiatives and operations has considerably strengthened the moon exploration mission. For example, Japan intends to launch the Smart Lander for Investigating Moon (SLIM) in FY2022, and this mission will be critical in determining astronaut landing sites on the Moon's South Pole. In conjunction with the Indian Space Research Organization (ISRO), JAXA is also doing research into the Lunar Polar Exploration Mission Launch (LUPEX). The anticipated launch date for LUPEX is FY2023.

- The commercial segment is expected to hold the largest share of Japan space exploration market over the forecast period.

Based on the end-use, the Japan Space Exploration Market is segmented into government space agencies, commercial, military, and others. Due to rising investment from the private sector, the commercial segment is expected to hold the largest share of the Japan space exploration market over the forecast period. For example, in April 2022, IHI AEROSPACE Co., Ltd (hereafter 'IA') received an order to launch the Institute for Q-Shu Pioneers of Space, Inc.'s tiny SAR satellites. IA and iQPS inked a deal for the launch of QPS-SAR-3 and QPS-SAR-4 satellites.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Space Exploration Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Japan Aerospace Exploration Agency (JAXA)

- IHI AEROSPACE CO LTD.

- Axelspace Corporation

- SKY Perfect JSAT Group

- Interstellar Technologies, Inc.

- Ispace

- Infostellar, Inc.

- Mitsubishi Electric Corporation

- National Space Development Agency of Japan

- Mitsui & Co., Ltd

- NEC Corporation

- Mitsubishi Heavy Industries, Ltd.

- National Aerospace Laboratory of Japan

- NEC Space Technologies

- Japan Space Systems (J-space systems)

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On April 2023, Space Compass Corporation announced the formation of a capital and commercial alliance arrangement with Axelspace Corporation, as well as the signing of a basic agreement to use our optical data relay service. Imaging frequency and resolution are likely to grow dramatically with the deployment of higher-performance missions in the future, necessitating the usage of high-speed and instantaneous data relay over optical communication networks.

- On February 2023, Axelspace and New Space Intelligence have formed a strategic alliance to increase the use of satellite imagery. Both companies will collaborate through this partnership to boost the spread of satellite data consumption. They will work together to develop innovative applications employing satellite imagery and to expand services to international markets.

- In November 2022, ispace, Inc., a worldwide lunar exploration firm headquartered in Japan with regional offices in the United States and Europe, stated that the Japanese government has granted it permission to conduct business on the moon as part of its first lunar mission. ispace presented a business activity plan for Mission 1 (M1) to Japan's Cabinet Office under the Space Activities Act and the Promotion of Business Activities for the Exploration and Development of Space Resources in order to secure a license to perform its first mission.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Space Exploration Market based on the below-mentioned segments:

Japan Space Exploration Market, By Space Technology

- Rockets

- Landers

- Robots

- Satellites

- Orbiters

- Others

Japan Space Exploration Market, By Mission Type

- Manned Mission

- Unmanned Mission

Japan Space Exploration Market, By Exploration Type

- Moon Exploration

- Transportation

- Orbital Infrastructure

- Mars Exploration

- Others

Japan Space Exploration Market, By End-Use

- Government Space Agencies

- Commercial

- Military

- Others

Need help to buy this report?