Japan Sugar Market Size, Share, and COVID-19 Impact Analysis, By Source (Cane Sugar, Beet Sugar), By Form (Granulated, Powdered, Syrup), By Use (Food & Beverage, Pharmaceuticals), By Distribution Channel (Online, Offline), and Japan Sugar Market Insights, Industry Trend, Forecasts to 2032

Industry: Food & BeveragesJapan Sugar Market Insights Forecasts to 2032

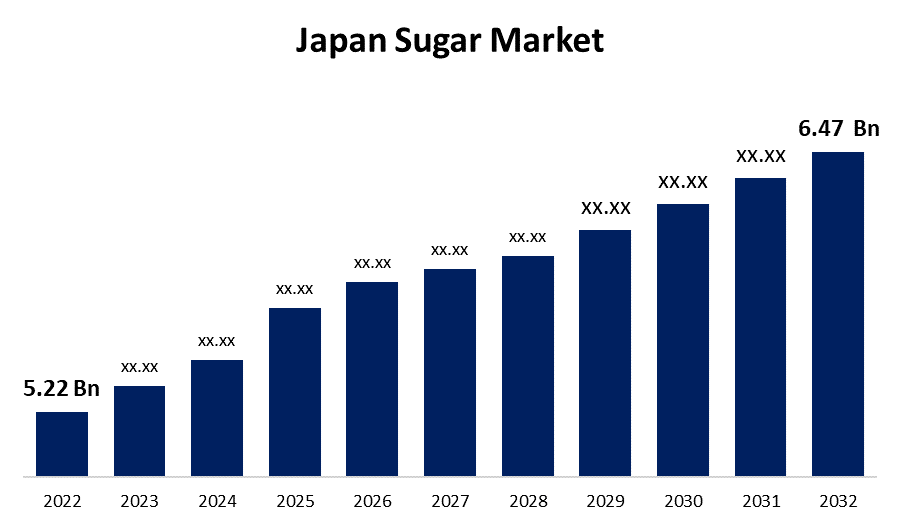

- The Japan Sugar Market Size was valued at USD 5.22 Billion in 2022.

- The Market Size is Growing at a CAGR of 2.1% from 2022 to 2032

- The Japan Sugar Market Size is expected to reach USD 6.47 Billion by 2032

Get more details on this report -

The Japan Sugar Market size was valued at USD 5.22 Billion in 2022. The Japan Sugar Market is expected to reach USD 6.47 Billion by 2032, at a CAGR of 2.1% during the forecast period 2022 to 2032. The Japan sugar market is vital to meeting the country's sweetener needs and supporting the country's food and beverage industries. The market strives to strike a balance between maintaining domestic production capacity and meeting consumer demand through a combination of domestic production and imports.

Market Overview

The Japan sugar market is an important part of the country's agricultural and food industries. Sugar is a popular commodity in Japan, where it is used not only as a sweetener but also as an ingredient in a variety of food and beverage products. Sugar production, importation, distribution, and consumption within the country are all part of the market. Japan is one of the world's largest sugar consumers, with a strong demand for both refined sugar and sugar-containing products. The market is characterized by a mix of domestic and imported goods. Due to limited domestic production capacity, the country has historically relied on imports to meet its sugar needs. To protect domestic sugar producers, the Japan sugar market is governed by strict regulations and import quotas imposed by the government. The market is primarily supplied by imports from Australia, Thailand, and Brazil. Tariffs and quotas apply to these imports in order to balance domestic production with imports. Sugar consumption in Japan is influenced by a variety of factors such as population size, changing dietary preferences, and economic conditions. Because of the rising health consciousness among consumers, the market has shifted towards alternative sweeteners and healthier sugar substitutes in recent years.

Report Coverage

This research report categorizes the market for the Japan sugar market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sugar market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sugar market.

Japan Sugar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 5.22 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 2.1% |

| 2032 Value Projection: | USD 6.47 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Source, By Form, By Use, By Distribution Channel |

| Companies covered:: | Nissin Sugar Co., Ltd., Wilmar International Ltd, Mitsui DM Sugar Co., Ltd., Nippon Beet Sugar Manufacturing Co., Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan has a diverse population with a wide range of dietary preferences. The population size and composition have a direct impact on the overall demand for sugar and sugar-containing products. The sugar market adjusts to meet changing consumption patterns as the population grows or demographic shifts occur. The sugar market in Japan has a direct connection to the food and beverage industries. Sugar demand is driven by the production of a variety of food products such as confectionery, bakery items, beverages, and processed foods. Growth and innovation in the food and beverage industry have a significant impact on sugar demand. Sugar production, refining, and processing technological advancements have the potential to impact the market. Sugar production innovations that improve efficiency, quality, and sustainability can have an impact on the market's competitiveness and supply dynamics.

Restraining Factors

Japan has a limited amount of land suitable for sugarcane cultivation, limiting the country's ability to meet its sugar demand solely through domestic production. Because the market is so reliant on imports, it is vulnerable to fluctuations in global sugar prices and supply disruptions. Price volatility and trade barriers, such as tariffs and quotas imposed by various countries, affect the global sugar market. Changes in international trade policies and market conditions can have an impact on the availability and cost of imported sugar in Japan, thereby influencing market dynamics.

Market Segmentation

The Japan Sugar Market share is classified into source, form, and use.

- The cane sugar segment is expected to hold the largest share of the Japan sugar market during the forecast period.

The Japan sugar market is segmented by source into cane sugar and beet sugar. Among these, the cane sugar segment is expected to hold the largest share of the Japan sugar market during the forecast period. The growth can be attributed due to factors such as availability, cost, and the country's historical reliance on cane sugar imports to meet sugar demand. Cane sugar has been the market's dominant segment because it is more widely produced worldwide and has a longer history of importation into Japan.

- The granulated segment is expected to hold the largest share of the Japan sugar market during the forecast period.

Based on the form, the Japan sugar market is divided into granulated, powdered, and syrup. Among these, the granulated segment is expected to hold the largest share of the Japan sugar market during the forecast period. Granulated sugar is the most widely used and versatile type of sugar, and it is widely used in both domestic and industrial applications. It is used as a primary sweetener in a variety of food and beverage products, such as baked goods, desserts, beverages, and processed foods. Granulated sugar demand is being driven by its widespread use in everyday cooking and consumption habits in Japan.

- The food & beverage segment is expected to hold the largest share of the Japan sugar market during the forecast period.

The Japan sugar market is divided by use into food & beverage and pharmaceuticals. Among these, the food & beverage segment is expected to hold the largest share of the Japan sugar market during the forecast period. Sugar demand in the food industry, which includes confectionery, baked goods, beverages, and processed foods, is significantly higher than in the pharmaceutical sector. Sugar's widespread use as a sweetener and ingredient in a variety of food products contributes to its market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan sugar market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nissin Sugar Co., Ltd.

- Wilmar International Ltd

- Mitsui DM Sugar Co., Ltd.

- Nippon Beet Sugar Manufacturing Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development:

- In October 2022, Nissin Sugar Co., Ltd. and ITOCHU Corporation signed a fundamental agreement to purchase Itochu Sugar Co., Ltd. Nissin Sugar and ITOCHU will swap shares, with Nissin Sugar serving as the exchange's wholly-owned parent company and ITOCHU Sugar serving as the exchange's wholly-owned subsidiary.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Japan Sugar Market based on the below-mentioned segments:

Japan Sugar Market, By Source

- Cane Sugar

- Beet Sugar

Japan Sugar Market, By Form

- Granulated

- Powdered

- Syrup

Japan Sugar Market, By Use

- Food & Beverage

- Pharmaceuticals

Japan Sugar Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?