Japan Third-Party Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service (DTM, ITM, and VAL), By Transport (Railways, Roadways, Airways, and Waterways) and Japan Third-Party Logistics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationJapan Third-Party Logistics Market Insights Forecasts to 2033

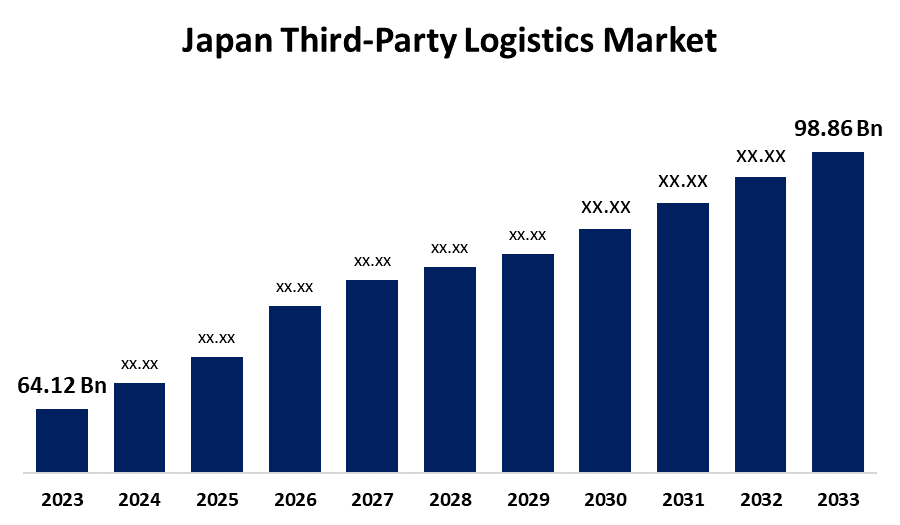

- The Japan Third-Party Logistics Market Size was valued at USD 64.12 Billion in 2023

- The Market is Growing at a CAGR of 4.42% from 2023 to 2033

- The Japan Third-Party Logistics Market Size is Expected to Reach USD 98.86 Billion by 2033

Get more details on this report -

The Japan Third-Party Logistics Market is Anticipated to Reach USD 98.86 Billion by 2033, growing at a CAGR of 4.42% from 2023 to 2033.

Market Overview

Third-party logistics is a company or service that helps manufacturers, particularly e-commerce merchants, contract out duties linked to distribution and logistics. A third-party logistics company offers specialized services like inventory management, shipment from one location to another, cross-docking, and product packaging. Japan's strategic location at the center of the Asia Pacific region, along with its easy access to cheap labor and manufacturing bases in Southeast Asia and Western consumers, have made it a worldwide superpower in the supply chain. As the fourth largest e-commerce industry in the world, Japan's business-to-consumer (B2C) e-commerce sector was valued at JPY 22.7 trillion in 2022, representing a 9.9% annual growth. To reduce expenses and boost operational efficiency, businesses all across Japan are utilizing 3PL services more and more, which is supporting the growth of the third-party logistics (3PL) market in Japan.

Report Coverage

This research report categorizes the market for the Japan third-party logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan third-party logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan third-party logistics market.

Japan Third-Party Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 64.12 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.42% |

| 2033 Value Projection: | USD 98.86 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By Transport and COVID-19 Impact Analysis |

| Companies covered:: | Nippon Express, Yamato Holdings, Kintetsu World Express, Sagawa Express, Hitachi Transport System, Nichirei Logistics, Sankyu, Kokusai Express, Fukuyama and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for third-party logistics in Japan is expanding quickly for a number of reasons, including new trends. The tendency of companies to focus more on their core skills in an attempt to gain a competitive edge is one of the main causes. Businesses are handling their operations through third-party logistics companies, freeing them up to concentrate on their core competencies. Furthermore, as online merchants increasingly rely on logistics outsourcing to better manage warehousing, order fulfillment, and delivery, the developing e-commerce sector in Japan is a major factor in the growth of the third-party logistics business. Additionally, in Japan, there are over 97 million active eCommerce users and clients. This amounts to a remarkable 76.4% of the nation's overall population. The rate at which the market is expanding is even more remarkable. The Japanese eCommerce market is expanding at a rate of 4% annually, according to data from 2020. The market for third-party logistics in Japan has grown dramatically as a result of the e-commerce industry's rapid expansion. Furthermore, Japan's automobile export and manufacturing industry contributes 2.9% of the nation's GDP and 13.9% of its manufacturing GDP. The rise of the Japanese car manufacturing industry is opening doors for 3PL businesses and boosting the country's third-party logistics (3PL) market.

Restraining Factors

The third-party logistics sector in Japan has several obstacles, such as strict regulations that increase compliance costs and growing labor and salary prices that raise operating costs. The high cost of real estate, especially in urban areas, and the scarcity of available warehouse space provide further challenges to the business. Significant economic constraints accompany the need to integrate cutting-edge technology, such as automation and IoT, to meet the rising demands for efficiency and transparency.

Market Segmentation

The Japan third-party logistics market share is classified into service and transport.

- The DTM segment is expected to dominate the Japan third-party logistics market during the forecast period.

Based on the service, the Japan third-party logistics market is divided into DTM, ITM, and VAL. Among these, the DTM segment is expected to dominate the Japan third-party logistics market during the forecast period. DTM services are carried out in tandem with freight brokers, who handle the origin and destination of shipments. The DTM segment is growing as a result of increased carrier rates, an increase in cross-docking solutions, a rise in fuel surcharge, and an increase in trade movement between the unloading dock and the warehouse.

- The roadways segment is expected to hold a significant market share through the forecast period.

The Japan third-party logistics market is segmented by transport into railways, roadways, airways, and waterways. Among these, the roadways segment is expected to hold a significant market share through the forecast period. Growing public-private partnerships and a greater focus on the logistical infrastructure are driving the segment's expansion. Additionally, the market is anticipated to grow faster due to recent improvements in automobile technology and supportive government road rules.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan third-party logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Express

- Yamato Holdings

- Kintetsu World Express

- Sagawa Express

- Hitachi Transport System

- Nichirei Logistics

- Sankyu

- Kokusai Express

- Fukuyama

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Geekplus Co., Ltd. (Geekplus), which has dominated the Japanese market for automated guided vehicles (AGV) for four years running, has chosen the Boomi AtomSphereTM Platform to automate its next-generation smart logistics platform, according to a statement released by BoomiTM, the leader in intelligent connectivity and automation.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Third-Party Logistics Market based on the below-mentioned segments:

Japan Third-Party Logistics Market, By Service

- DTM

- ITM

- VAL

Japan Third-Party Logistics Market, By Transport

- Railways

- Roadways

- Airways

- Waterways

Need help to buy this report?