Japan Titanium Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Grade (Rutile and Anatase), By Application (Paints and Coatings, Plastics, Paper & Pulp, and Cosmetics), and Japan Titanium Dioxide Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsJapan Titanium Dioxide Market Insights Forecasts to 2033

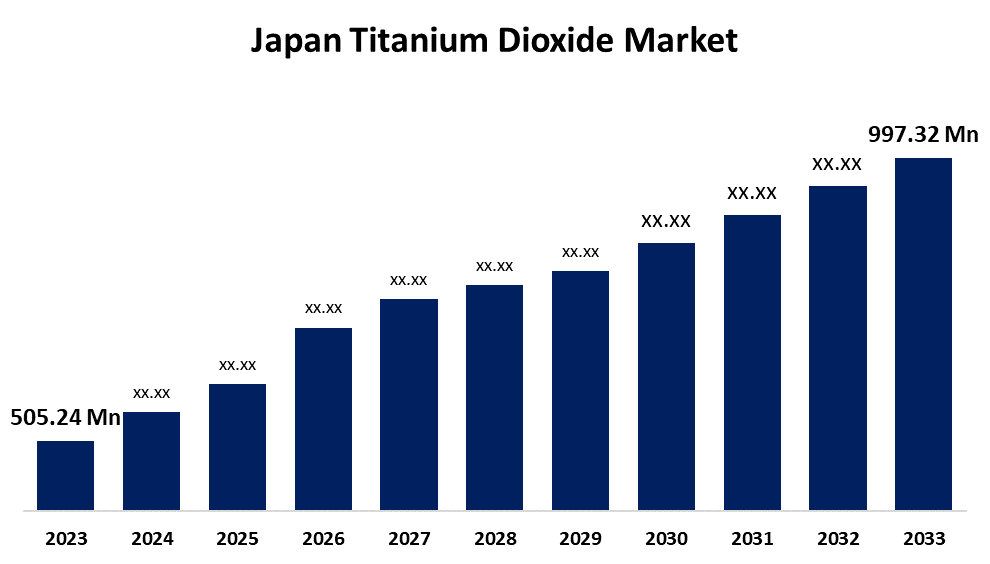

- The Japan Titanium Dioxide Market Size was valued at USD 505.24 Million in 2023

- The Market Size is Growing at a CAGR of 7.04% from 2023 to 2033

- The Japan Titanium Dioxide Market Size is Expected to Reach USD 997.32 Million by 2033

Get more details on this report -

The Japan Titanium Dioxide Market Size is Anticipated to Reach USD 997.32 Million by 2033, Growing at a CAGR of 7.04% from 2023 to 2033.

Market Overview

The oxide of titanium that occurs naturally is called titanium dioxide, or TiO2. It is frequently used as a white pigment in numerous uses due to its exceptional density and brightness. In order to add whiteness, brightness, and UV protection, titanium dioxide is frequently employed in paints, coatings, plastics, paper, and cosmetics. Additionally, in some products, it is employed as a food additive and as a photocatalyst in environmental applications. The versatility and broad variety of uses of titanium dioxide make it indispensable in numerous sectors and everyday products. Furthermore, a wide range of applications from different industries continue to impact the Japanese market. Titanium dioxide's opacifying and UV-protective qualities make it a common pigment in paints, varnishes, and polymers. As a whitening agent, it also finds use in skin care products and cosmetics. Personal protective equipment (PPE), lightweight cars, and the growing need for textiles are some of the reasons driving the Japanese industry.

Report Coverage

This research report categorizes the market for the Japan titanium dioxide market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan titanium dioxide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan titanium dioxide market.

Driving Factors

Rising worldwide use in sectors including plastics, cosmetics, and automobiles, as well as Japan's reputation for superior production and cutting-edge manufacturing processes, are driving Japan's titanium dioxide export boom. Japan shipped 2,052 cargoes of titanium dioxide (TTM) between March 2023 and February 2024. With 484 Japanese exporters selling to 476 buyers, these exports represented a 2% increase over the previous 12 months. The market for titanium dioxide in Japan is being further driven by the increase in titanium dioxide exports from Japan. Additionally, The market is expected to rise as a result of Japan's expanding construction industry, which increases demand for paints and coatings because of their superior opacity and durability. Additionally, the market for this specialized chemical in automotive coatings has grown as a result of the increase in automobile manufacturing and exports in Japan. This is owing to the chemical's durability against ultraviolet light (UV) and its capacity to enhance color retention, both of which contribute to the market's expansion. Additionally, the growing use of products as whitening agents in paper, plastics, and cosmetics is driving market expansion as manufacturers seek to acquire high-quality pigments to meet consumer needs.

Restraining Factors

Concerns over the energy usage, waste generation, and emissions of titanium dioxide production processes have led to heightened regulatory scrutiny and a demand for stricter environmental regulations.

Market Segmentation

The Japan titanium dioxide market share is classified into grade and application.

- The rutile segment is expected to hold the largest market share through the forecast period.

The Japan titanium dioxide market is segmented by grade into rutile and anatase. Among these, the rutile segment is expected to hold the largest market share through the forecast period. The main reasons for rutile's dominance are its superior qualities, which include a higher refractive index, increased stability, and more potent UV absorption.

- The paints and coatings segment is expected to dominate the Japan titanium dioxide market during the forecast period.

Based on the application, the Japan titanium dioxide market is divided into paints and coatings, plastics, paper & pulp, and cosmetics. Among these, the paints and coatings segment is expected to dominate the Japan titanium dioxide market during the forecast period. Titanium dioxide's remarkable qualities, which include a high refractive index, strong UV light absorption, and dazzling whiteness, are the main cause of its domination and make it a necessary pigment in paint and coating formulations. Excellent opacity, brightness, and durability are provided, improving the coatings' protective and aesthetic properties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan titanium dioxide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kuraray Co., Ltd.

- Showa Denko K.K.

- Nippon Light Metal Company, Ltd.

- Sumitomo Chemical Co., Ltd.

- Daikin Industries, Ltd

- Celanese Corporation

- Tosoh Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, the world's leading manufacturer of niobium, Brazil's CBMM, along with Japan's Toshiba Corporation and Sojitz Corporation, have finished developing a next-generation lithium-ion battery that uses niobium titanium oxide (NTO) as the anode.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Titanium Dioxide Market based on the below-mentioned segments:

Japan Titanium Dioxide Market, By Grade

- Rutile

- Anatase

Japan Titanium Dioxide Market, By Application

- Paints and Coatings

- Plastics

- Paper & Pulp

- Cosmetics

Need help to buy this report?