Japan Vending Machine Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Food Products Vending Machines, Beverage Products Vending Machines, Tobacco Vending Machines, Others), By Application (Corporate Offices, Shopping malls and Retail Stores, Educational Institutions, Hotels & Restaurants, Others), and Japan Vending Machine Market Insights Forecasts 2023 – 2033

Industry: Consumer GoodsJapan Vending Machine Market Size Insights Forecasts to 2033

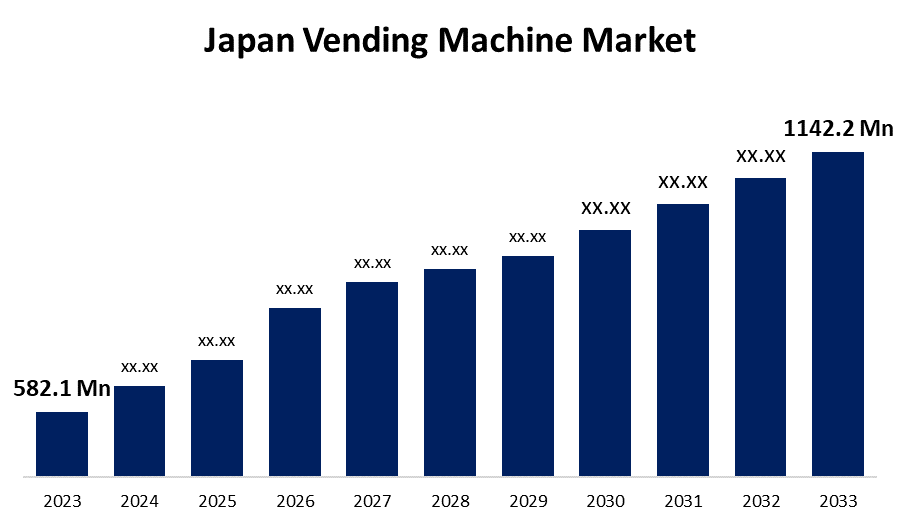

- The Japan Vending Machine Market Size was valued at USD 582.1 Million in 2023.

- The Market Size is Growing at a CAGR of 6.97% from 2023 to 2033.

- The Japan Vending Machine Market Size is Expected to Reach USD 1142.2 Million by 2033.

Get more details on this report -

The Japan Vending Machine Market Size is Expected to Reach USD 1142.2 Million by 2033, at a CAGR of 6.97% during the forecast period 2023 to 2033.

Market Overview

Vending machines are portable automatic machines that dispense a variety of products when money is inserted. Such machines are common in places such as offices, public spaces, and many other places in Japan have adopted vending machines due to their ease of use. A vending machine is a machine that dispenses items such as packaged food, beverages, and tobacco products in exchange for coins or tokens inserted. Dispensing is a fully automated process that reduces the need for human labor and saves humans valuable time. These machines are commonly seen in fast-paced cities due to the fast-paced nature of life. Vending machine technology continues to provide the most recent advancements, such as ID card identification and face recognition systems, to see consumer purchasing history, bringing in a period of technologically advanced vending machines. Furthermore, the use of vending machines helps businesses strengthen their pricing power while boosting their operating margins. Customers keep going to benefit from the businesses' proper product mix. This is frequently expected to assist businesses in increasing their sales per transaction, hence driving demand for vending machines.

Report Coverage

This research report categorizes the market for Japan vending machine market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan vending machine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan vending machine market.

Japan Vending Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 582.1 Million |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 6.97% |

| 2033 Value Projection: | USD 1142.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | Fuji Electric Co. Ltd., Smartvend (Canonigo Enterprise LLC), TPK Vending Corporation Co., Ltd., Hunan Xingyuan Technology Co., Ltd., OMRON SOFTWARE Co., Ltd., Otsuka Wellness Vending Co., Ltd., TPK Vending Corporation Co., Ltd., 365 Retail Markets, Kubota Corporation, JAC corporation, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The unparalleled convenience and accessibility that these machines provide is one of the primary drivers behind the Japan vending machine market's robust growth. Vending machines have become a vital component of Japanese life, and their prevalence is astounding. Vending machines operate around the clock, giving customers access to a wide range of products at all hours of the day and night, these factors boost the market growth. Vending machines are well-known for their efficiency and speed. The entire transaction, from product selection to delivery, takes only a few seconds. Vending machines do not require any human interaction to complete a purchase. This level of automation improves privacy and reduces potential language or communication barriers, making them appropriate for both locals and tourists. Japan's vending machines are well-known for delivering fresh and high-quality goods. This is especially important in beverage vending machines, where the taste and temperature of the drinks are consistent. Product safety is highly valued in Japan, and vending machines are no exception. Japanese vending machines are well-known for their openness in displaying product information, such as nutritional information, expiry dates, and pricing factors that propel the market growth. These are the vending machine market drivers in Japan.

Restraining Factors

Market saturation and intense competition are two of the most significant challenges confronting Japan's vending machine market. Locating prime vending machine locations has become increasingly difficult. Machines are already crowded in high-traffic areas, leaving little room for expansion. Vending machines are also susceptible to vandalism, theft, and unauthorized access. Security challenges must be addressed by operators by investing in robust security systems, surveillance, and remote monitoring.

Market Segment

- In 2023, the food products vending machines segment accounted for a significant revenue share over the forecast period.

Based on product type, the Japan vending machine market is segmented into food products vending machines, beverage products vending machines, tobacco vending machines, and others. Among these, the food products vending machines segment has a significant revenue share over the forecast period. Food vending machines provide consumers with unparalleled accessibility and ease of use. These machines are strategically placed in high-traffic areas like train stations, shopping malls, office buildings, and even street corners. This simplicity allows people to grab a quick meal or snack on the go, catering to Japan's fast-paced urban lifestyle. The variety of options provided by food vending machines is one of the primary reasons for their success. From hot and cold beverages to ready-to-eat meals, we have it all. Food vending machines provide cost-effective meal options for many consumers. Purchasing a meal from a vending machine is frequently less expensive than dining out.

- The shopping malls and retail stores segment is witnessing the largest CAGR growth over the forecast period.

Based on application, the Japan vending machine market is segmented into corporate offices, shopping malls and retail stores, educational institutions, hotels & restaurants, and others. Among these, the shopping malls and retail stores segment is witnessing the largest CAGR growth over the forecast period. Vending machines dispense items such as beverages, hot and cold snacks, and health and beauty products, and are commonly found in shopping malls and retail stores. The strategic placement of vending machines in shopping malls and retail stores is one of the key factors driving their success. Furthermore, these businesses place vending machines in high-traffic areas, entrances, and near key anchor stores. Vending machines provide a variety of revenue streams for shopping malls and retail stores. These machines generate additional revenue in addition to the sales generated by traditional retail operations. Retailers can form alliances with vending machine providers or operate their machines, ensuring a share of the vending machine market's profits.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan vending machine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fuji Electric Co. Ltd.

- Smartvend (Canonigo Enterprise LLC)

- TPK Vending Corporation Co., Ltd.

- Hunan Xingyuan Technology Co., Ltd.

- OMRON SOFTWARE Co., Ltd.

- Otsuka Wellness Vending Co., Ltd.

- TPK Vending Corporation Co., Ltd.

- 365 Retail Markets

- Kubota Corporation

- JAC corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In June 2022, Kirin Holdings announced the release of a new vending machine, the "Kirin Hot Meal Vending Machine," which offers a variety of hot meals such as ramen, udon, and curry.

In May 2022, Lawson took a new approach with their new vending machine, which was installed in a Tokyo convenience store. This machine provides a variety of fruits and vegetables, including apples, bananas, and tomatoes.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Japan Vending Machine Market based on the below-mentioned segments:

Japan Vending Machine Market, By Product Type

- Food Products Vending Machines

- Beverage Products Vending Machines

- Tobacco Vending Machines

- Others

Japan Vending Machine Market, By Application

- Corporate Offices

- Shopping malls and Retail Stores

- Educational Institutions

- Hotels & Restaurants

- Others

Need help to buy this report?