Japan Wine Market Size, Share, and COVID-19 Impact Analysis, By Color Type (Red Wine, White Wine, Rose Wine, & Others), By Distribution Channel {On Trades (Bars, Restaurants), Off Trades (Groceries, Retail Stores)}, and Japan Wine Market Insights, Industry Trend, Forecasts to 2030.

Industry: Food & BeveragesJapan Wine Market Insights Forecasts to 2030

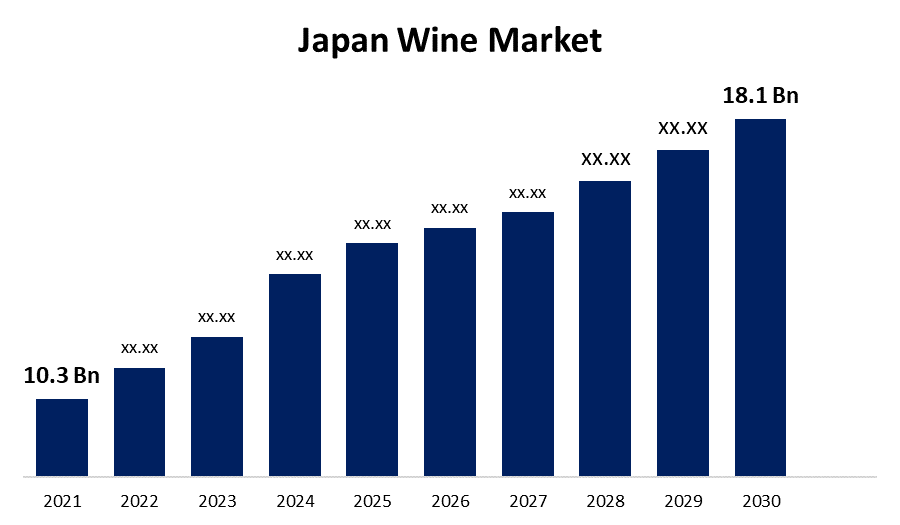

- The Japan Wine Market Size was valued at USD 10.3 billion in 2021.

- The Market is growing at a CAGR of 6.7% from 2022 to 2030

- The Japan Wine Market key players are actively advertising their products to stay in the competition and capture the attention of consumers all over the world.

Get more details on this report -

Market Overview

In terms of the most significant wine markets worldwide, Japan comes in at number 23. Japan is the sixth biggest trade partner for wine with a large number of sommeliers worldwide In Japan, wine drinking makes for 3.8% of all alcoholic beverage consumption. Japan is the sixth biggest trade partner for wine with a large number of sommeliers worldwide. Japan’s wine market is dominated by New World brands. By volume, they hold 39.5% of the market in 2021, with Chile’s prominence being a major factor. But thanks to the EU-Japan economic partnership agreement, which was signed in February 2019, old world nations have begun to reclaim the top rankings. Imported wines dominate the Japanese wine market, with the top three importers including France, Italy, and Australia. Domestic wines, particularly those made in areas like Yamanashi and Hokkaido, are seeing a rise in popularity, though. In the upcoming years, the Japanese wine business offers numerous prospects for expansion and innovation. Understanding the demands and preferences of various customer groups in the market and adapting products and marketing methods accordingly can be beneficial for businesses operating in this sector.

Report Coverage

This research report categorizes the market of Japan wine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan wine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan wine market.

Driving Factors

Several driving factors are contributing to the growth of the Japanese wine market. Some of these factors include, Japan consumers being increasingly interested in wine culture and seeking out new and different types of wines to try. This has led to a growing demand for both domestic and imported wines. Also, Wine is increasingly in demand among consumers who are concerned about their health because it is frequently viewed as a healthier option to other alcoholic beverages. Moreover, Consumers have greater spare money as the Japanese economy continues to recover from the consequences of the 2008 financial crisis, allowing them to spend more on luxury items like fine wines. The Japanese government has been actively promoting the growth of the wine industry through initiatives such as tax incentives for wineries and funding for research and development. Furthermore, with more foreign visitors coming to Japan and looking for native wine experiences, the tourism sector in Japan has been expanding significantly. This has helped to drive demand for both domestic and imported wines. Overall, these driving factors are expected to continue contributing to the growth of the Japan wine market in the coming years, presenting significant opportunities for companies involved in this industry.

Japan Wine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 10.3 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6.7% |

| 2030 Value Projection: | USD 18.1 Billion |

| Historical Data for: | 2020 to 2022 |

| No. of Pages: | 120 |

| Tables, Charts & Figures: | 93 |

| Segments covered: | Japan Wine Market Segmentation: COVID-19 Impact Analysis, By Color Type, By Distribution Channel, Off Trades, Country Analysis, Growth Factors & Challenges. |

| Companies covered:: | Wakaze, Kirin Holdings, SakeWiz, Tricot, YOI LABO, Suntory Holdings, Oisix, FRARE FOOD FACTORY CO., LTC, Recruit Lifestyle, DyDo Group Holdings, Redish, Enoteca, Pro-Douguya, Fiveneeds, Rice Wine, Japan Foods, Oenon, Liaison Japan, Hotei Wines, Orca International, Monte Bussan, Mottox, Freixenet |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factors

In the Japan wine market, there are also some restraining factors such as the import tariffs on wine in Japan can be high, which can make it difficult for foreign wineries to compete with domestic producers. Moreover, Wine consumption in Japan is rising, but traditional alcoholic beverages like sake and beer, which have a significant cultural impact in Japan, continue to compete with it. Japan's domestic wine market is expanding as a consequence of the country's climate and geography making it difficult to produce high-quality wines on a wide scale. Furthermore, the Japanese economy has faced challenges in recent years, including low growth and deflationary pressures. This could potentially limit consumer spending on luxury goods such as premium wines.

COVID 19 Impacts

The COVID-19 pandemic has had a significant impact on the Japan wine market, both in terms of challenges and opportunities. The pandemic has caused disruptions to Japan supply chains, which has affected the availability of imported wines in Japan. Also, the pandemic has led to a decrease in international tourism, which has affected the demand for wine in areas such as restaurants and hotels. Furthermore, as economic uncertainty persists, some consumers may be shifting towards more affordable wines rather than premium or luxury wines. Although the COVID-19 epidemic has posed certain challenges for the Japanese wine industry, it has also opened up new prospects for innovation and expansion in sectors like online marketing and home production.

Market Segment

In 2021, the red wine segment is leading the market with the largest market share during the forecast period.

Based on color type, the Japan wine market is divided into various segments, such as red wine, white wine, rose wine, & others. Among these, red wine is expected to expand the growth of the market with a market share of almost 50% of the total wine market in Japan.

In 2021, The Hospital segment is influencing the market over the forecast period.

Based on the distribution channel, the Japan wine market is segmented into different segments, such as, on trades (bars, restaurants), off trades (groceries, retail stores). The off-trade market segment (groceries, retail stores) is leading the Japanese wine market due to the lockdown propelling the demand for off-trade sales of wine.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan wine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wakaze

- Kirin Holdings

- SakeWiz

- Tricot

- YOI LABO

- Suntory Holdings

- Oisix

- FRARE FOOD FACTORY CO., LTC

- Recruit Lifestyle

- DyDo Group Holdings

- Redish

- Enoteca

- Pro-Douguya

- Fiveneeds

- Rice Wine

- Japan Foods

- Oenon

- Liaison Japan

- Hotei Wines

- Orca International:

- Monte Bussan

- Mottox

- Freixenet

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, in terms of volume, Mercian Corporation, Suntory Holdings, and E. & J. Gallo Winery dominated the Japanese wine market in 2021, with Mercian, Carlo Rossi, and Frontera being the top three brands.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Japan wine market based on the below-mentioned segments:

Japan Wine Market, By Color Type

- Red Wine

- White Wine

- Rose Wine

- Others

Japan Wine Market, By Distribution Channel

- On Trades (Bars, Restaurants)

- Off Trades (Groceries, Retail Stores)

Need help to buy this report?