Global Jelly Market Size, Share, and COVID-19 Impact Analysis, By Type (Fruit Jellies and Gelatin Jellies), By Ingredients (Natural Ingredients and Organic Ingredients), By End User (Household Consumers, Food Service Providers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Jelly Market Insights Forecasts to 2033

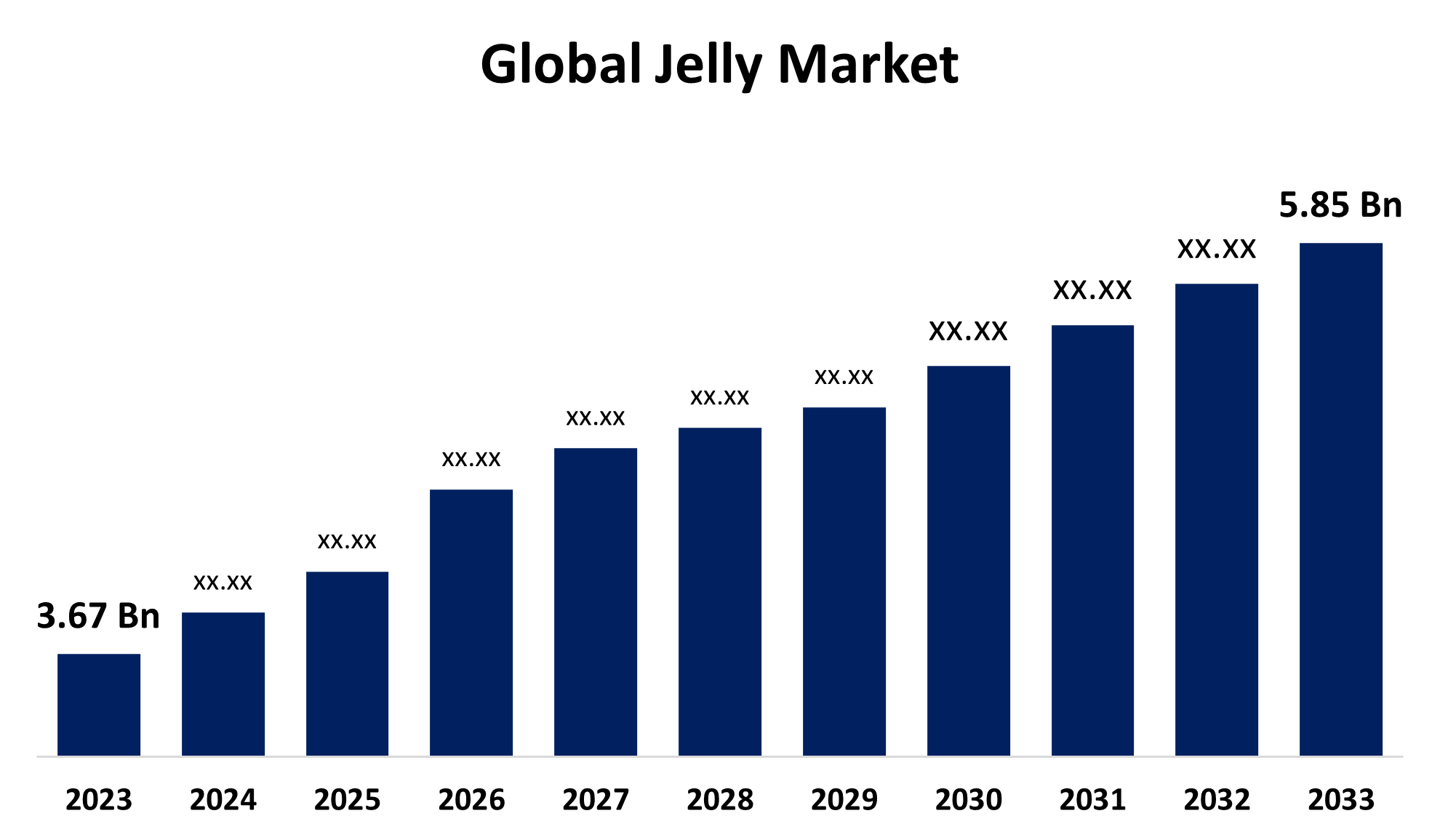

- The Global Jelly Market Size was estimated at USD 3.67 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.77% from 2023 to 2033

- The Worldwide Jelly Market Size is Expected to Reach USD 5.85 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global jelly market size was worth around USD 3.67 billion in 2023 and is predicted to grow to around USD 5.85 billion by 2033 with a compound annual growth rate (CAGR) of 4.77% between 2023 and 2033. The jelly market is being driven by growing demand for convenience foods, health and wellness trends, increasing popularity of snacking, innovation, and flavor variety, and consumer preferences for natural and clean-label products.

Report Coverage

This research report categorizes the jelly market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the jelly market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the jelly market.

Market Overview

The jelly market, which is referred to as the industry, lies in the production, manufacturing, distribution, and sale of different kinds of jellies, usually made from fruit, sugar, and gelatin or pectin. The Jellies are gummy confections such as fruity jellies, gummies, and preserves that have been traditionally well-liked by kids. Consumer demand for convenience foods is a main driver of growth, as jellies and gummies are snacks that can be eaten quickly. Innovation in products and changes in eating habits have contributed to the growth of the global jelly market. The increasing trend toward health and wellness functional foods has, in turn, changed the demand for vegan gels, sugar-free gels, and functional gels based on the jelly market. In addition, the increase in functional foods has led to the production of jellies with health-oriented additions like vitamin-, mineral-, and probiotic-enriched ones. These functional jellies meet the requirements of health-conscious consumers seeking a snack that will work with their wellness objectives. Moreover, there's also a rising trend towards alcohol-infused jellies, especially within the confectionery industry. These new products are picking up pace among adult consumers.

Global Jelly Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.67 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.77% |

| 2033 Value Projection: | USD 5.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Ingredients, By End User, By Region |

| Companies covered:: | American Spoon, Bonne Maman, Braswell’s, Crofters, Dickinson’s, Duerr’s, Hartley’s, Hero Group, Knott’s Berry Farm, Mackays, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

More people having fast-paced lives, the rapid lifestyle succeeded in creating a rising demand for quick and easy-to-consume foods. Jellies, most especially pre-packaged ones, fit this need by acting as a convenient snack or topping for a variety of meals. Manufacturers have been experimenting with new jelly flavors, sometimes drawing inspiration from exotic fruits or savory flavors. Emerging trends include flavors infused with alcohol and vegan-style jellies. Now that consumers are becoming inclined towards artisanal and gourmet foods, small-batch jellies, made with fine quality and natural ingredients, have been growing popular.

Restraining Factors

Although there is a demand for artisanal, sugar-free, and natural jellies, these specialty products are frequently more costly to manufacture. Such higher costs can make the products unaffordable for price-conscious consumers, restricting their popularity in some markets.

Market Segmentation

The jelly market share is classified into type, ingredients, and end user.

- The fruit jellies segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the jelly market is divided into fruit jellies and gelatin jellies. Among these, the fruit jellies segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to fruit jellies frequently produced using natural fruit juices, providing a richer variety of flavors that attract a larger consumer base. Strawberry, grape, and apple are some of the well-liked flavors that are generally universally preferred against gelatin-based jellies. The fruit jelly category is supported by ongoing product development in new flavors and packaging, appealing to a broad base of consumers ranging from traditional to newer experimentations in flavors.

- The natural ingredient accounted for the majority share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the ingredients, the jelly market is divided into natural ingredients and organic ingredients. Among these, the natural ingredient accounted for the majority share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is driven due to natural ingredients usually costing less than the organic varieties, making them easier to mass-produce and price-friendly for consumers. This gives lower costs for manufacturers when it comes to jelly products, especially for the common ones. Natural materials are much more commonly available and therefore easier to source than organic materials, which require specific certification and more rigorous production standards.

- The household segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the end user, the jelly market is divided into household consumers and food service providers. Among these, the household segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to household usage of jellies being ubiquitous, applied in a plethora of ways, sprinkled onto bread, on top of sweets, or for homemade delicacies such as cake and pastries. Easy accessibility and high utilization make the consumption of jellies convenient in many home settings. Jellies are ubiquitously distributed through supermarkets and electronic media platforms and are easy for household customers to access. Single-serving-sized packs are offered by the package producer, thereby simplifying direct end consumption.

Regional Segment Analysis of the Jelly Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

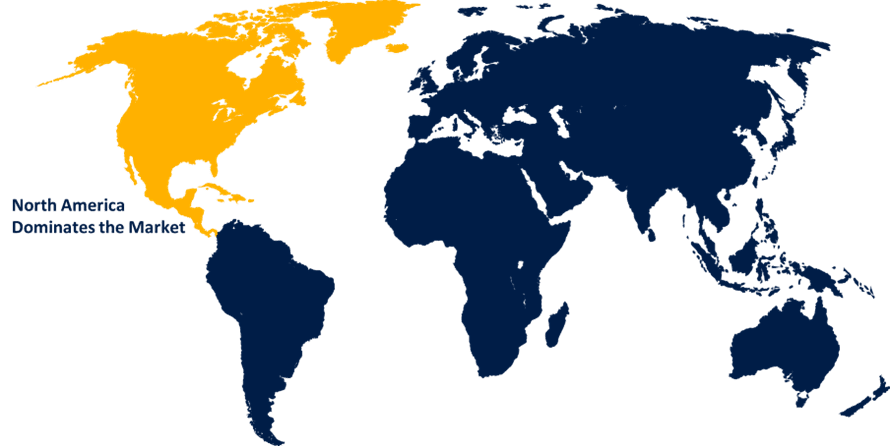

North America is anticipated to hold the largest share of the jelly market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the jelly market over the predicted timeframe. Jelly, especially those of fruit-based varieties and spreads, has been the mainstay of North American households for ages. It is most often used for breakfasts, snacks, and desserts. It just instills a very consistent and continuous demand with which the tradition has been established over the years. A new trend that boosts sales of jellies in North America is the increasing demand for natural and healthy food options. Consumers are increasingly becoming conscious of their health and therefore prefer jellies with organic ingredients, less sugar, or even no added preservatives for clean-label natural products.

Asia Pacific is expected to grow at a rapid CAGR in the jelly market during the forecast period. APAC consumers are increasingly health-oriented, driving the demand for natural, organic, and low-sugar jellies. Consumers seek healthier alternatives to snacks, and manufacturers of jelly are filling the gap with sugar-free and fruit-based products. Functional foods, like vitamins, probiotics, or other healthy ingredients, infused into jellies, are also trending in the region. This innovation draws health-oriented consumers seeking additional value.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the jelly market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Spoon

- Bonne Maman

- Braswell's

- Crofters

- Dickinson's

- Duerr's

- Hartley's

- Hero Group

- Knott's Berry Farm

- Mackays

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Alpenliebe Juzt Jelly, the much-loved brand of Perfetti Van Melle, launched India's first-ever heart-shaped, two-layer jelly, designed to provide a new sensory experience at a reasonable price. This new jelly has two different layers, a soft-foamy layer and a jelly layer, which results in a soft & chewy feeling, resulting in a great combination that gives an enhanced consumption experience.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the jelly market based on the below-mentioned segments:

Global Jelly Market, By Type

- Fruit Jellies

- Gelatin Jellies

Global Jelly Market, By Ingredients

- Natural Ingredients

- Organic Ingredients

Global Jelly Market, By End User

- Household Consumers

- Food Service Providers

Global Jelly Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the jelly market over the forecast period?The global jelly market is projected to expand at a CAGR of 4.77% during the forecast period.

-

What is the market size of the jelly market?The global jelly market size is expected to grow from USD 3.67 billion in 2023 to USD 5.85 billion by 2033, at a CAGR of 4.77% during the forecast period 2023-2033.

-

Which region holds the largest share of the jelly market?North America is anticipated to hold the largest share of the jelly market over the predicted timeframe.

Need help to buy this report?