Global Kopi Luwak Coffee Market Size, Share, and COVID-19 Impact Analysis, By Type (Raw Coffee Beans, Cooked Beans), By Distribution Channel (Offline, Online), By End-User (Cafes, Restaurants, Hotels, Individuals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Consumer GoodsGlobal Kopi Luwak Coffee Market Insights Forecasts to 2032

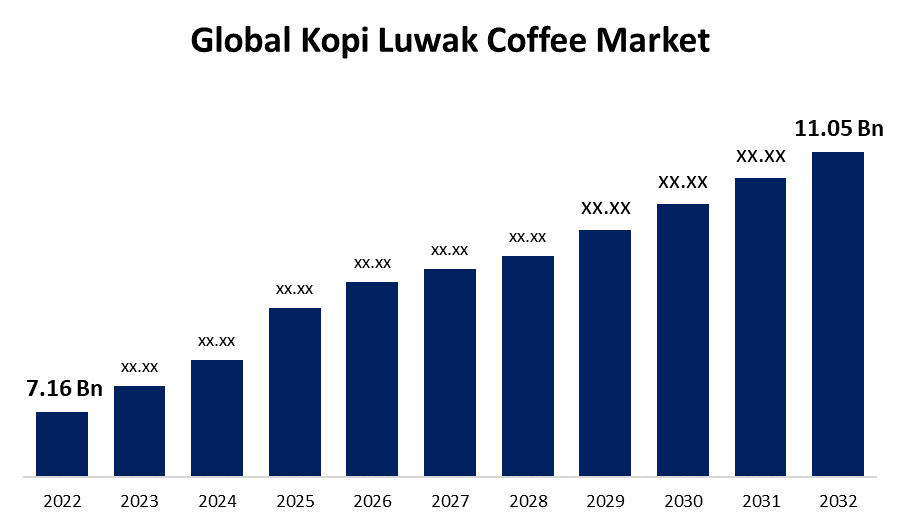

- The Global Kopi Luwak Coffee Market Size was valued at USD 7.16 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.43% from 2022 to 2032

- The Worldwide Kopi Luwak Coffee Market is expected to reach USD 11.05 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Kopi Luwak Coffee Market Size is expected to reach USD 11.05 Billion by 2032, at a CAGR of 4.43% during the forecast period 2022 to 2032.

The coffee known as kopi Luwak is made from the beans found inside the berries that wild civet cats consume and digest. As they digest it, the synthetic properties change, giving kopi luwak a distinct flavour when compared to other coffees. It was discovered for the first time by the Dutch in the eighteenth century. Kopi luwak is also known as civet coffee, and it is one of the most expensive coffees in the world. Moreover, the growing awareness of the medical benefits and the use of wild civet bodily waste for production drives market growth. The high market value of kopi luwak, which is one of the most expensive coffees, contributes to its popularity among those who are willing to pay a premium for unique and luxury products. With rising interest in speciality and artisanal coffee, there is a growing demand for one-of-a-kind coffee experiences. Kopi Luwak fits into this trend, as consumers seek out unique and exceptional coffee varieties in addition to the standard options. Furthermore, changing demographics around the world have had a significant impact on coffee demand. Millennials are currently driving a massive demand for speciality coffees in the market. Millennials make up a sizable portion of the world's coffee drinkers and are gravitating toward speciality coffee as coffee trends shift. Millennials in the United States have the highest demand for speciality and curated beverages, propelling market growth further.

Global Kopi Luwak Coffee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.16 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.43% |

| 2032 Value Projection: | USD 11.05 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Distribution Channel, By End-User and By Region |

| Companies covered:: | Coffee Bean Shop Ltd., Vinacafe, Wild Gayo Luwak, Domba Coffee Factory, Forennte, Tim Hortons, Gloria Jean’s Coffees, Rumacoffee, Bantai Civet Coffee, Kopi Luwak Direct, Kaya Kopi, LLC, Sumatra Kopi Luwak, Luwak Star Gourmet Coffee, Ainmane Coffee, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Kopi Luwak Coffee's numerous health benefits are expected to boost market growth. In addition to its exotic flavour, kopi luwak coffee is known for its anti-bacterial properties, which help to protect teeth and control oral cancer. Because of its low acidic concentration, it is considered ideal for ulcer patients and people suffering from digestive issues. Furthermore, the demand for kopi luwak coffee is primarily driven by Type 2 diabetic patients because it aids in diabetes control, as opposed to regular coffee, which stops the body's insulin resistance. The demand for kopi luwak coffee has spread a promising future for the kopi luwak coffee market due to its exotic taste and health benefits. Moreover, in addition, social media sightseeing websites are thought to be a major factor propelling the kopi luwak coffee market. Coffee's popularity has been influenced by changing socioeconomic conditions around the world. Millennials have recently shown a strong interest in specially prepared coffees. Due to changing coffee patterns, the youth represent a significant portion of the world's coffee consumers and are gravitating toward specially prepared coffee. As a result, the Kopi Luwak Coffee market will experience extraordinary growth during the forecast period.

Restraining Factors

Other speciality and high-quality coffee varieties compete with kopi luwak. With the growing popularity of artisanal and speciality coffees, kopi luwak is finding it difficult to stand out among the many options available to consumers. This limits its availability and affordability to a larger consumer base. The market has been plagued by authenticity issues. Because of the high value of kopi luwak, there have been instances of fraudulent practices in which lower-quality or fake kopi luwak has been sold, causing damage to its reputation and market credibility.

Market Segmentation

By Type Insights

The cooked beans segment dominates the market with the largest revenue share over the projection period.

On the basis of type, the global kopi luwak coffee market is segmented into raw coffee beans, and cooked beans. Among these, the cooked beans segment is dominating the market with the largest revenue share over the projection period. Brew coffee is another term for cooked coffee beans. Cooked coffee is greatly influenced by light, heat, moisture, and oxygen, resulting in a loss of flavour and aroma. Favourable preferences and demand for fresh coffee are increasing. The increase in coffee output to meet rising consumer demand around the world is also fueling market expansion.

By Distribution Channel Insights

The online segment is expected to hold the highest share of the global kopi luwak coffee market during the anticipation period.

Based on the distribution channel, the global kopi luwak coffee market is classified into offline, and online. Among these, the online segment is expected to hold the highest share of the kopi luwak coffee market during the anticipation period. Online deals are rising with the online market. Buyers across the world are chasing after convenient and upgraded client care, prompting the growth of online business. As the quantity of online consumers is increasing, coffee makers are cooperating with other online business sites and focusing on their web presence to acquire more of the kopi luwak market.

By End-User Insights

The cafes segment accounted for the largest revenue share through the forecast period.

On the basis of end users, the global kopi luwak coffee market is segmented into cafes, restaurants, hotels, and individuals. Among these, the cafe segment dominates the market with the largest revenue share through the forecast period. Ordering large quantities of coffee from roasters without knowing how much demand there will be may result in a coffee shop brewing coffee with older beans. Nowadays coffee consumers are more curious about the provenance of their coffee than ever before. As a result, in cafes, customers may receive stale or undesirable flavours in their cups.

Regional Insights

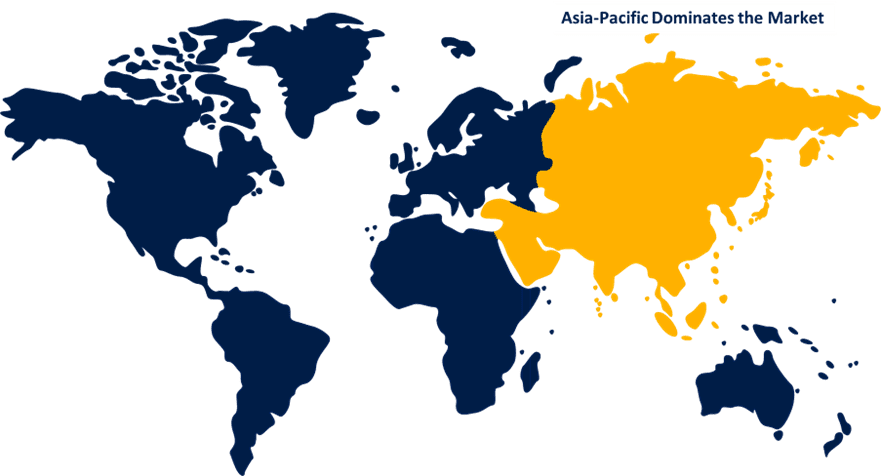

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with the largest market share over the forecast period. The geographic location of the region, specifically the region, provides an ideal habitat for civet cats, allowing for the natural production of kopi luwak. While kopi luwak production remains niche and small-scale in the global coffee market, the region has been a primary producer and exporter of this speciality coffee, contributing significantly to market share. Indonesia, which ranks fourth after Brazil, Vietnam, and Colombia, is the market's pioneer due to the existence of Asian palm civet cats on the islands of Java and Sumatra. Indonesian farmers, in collaboration with relevant associations and services, want to expand their coffee estates while restoring old estates, thereby increasing kopi luwak efficiency. Similarly, India, a regional coffee giant, has recently begun producing wild kopi luwak coffee without harming or caging the civet cats. Because civet cats can select the fruity coffee cherry, kopi luwak is produced naturally and of higher quality.

North America is expected to grow the fastest during the forecast period. The region is home to a large number of luxury goods buyers who are willing to pay premium prices for luxury items. Furthermore, there are significant areas of strength for extravagance products in North America, which provides enormous growth opportunities for the kopi luwak coffee market.

List of Key Market Players

- Coffee Bean Shop Ltd.

- Vinacafe

- Wild Gayo Luwak

- Domba Coffee Factory

- Forennte

- Tim Hortons

- Gloria Jean’s Coffees

- Rumacoffee

- Bantai Civet Coffee

- Kopi Luwak Direct

- Kaya Kopi, LLC

- Sumatra Kopi Luwak

- Luwak Star Gourmet Coffee

- Ainmane Coffee

Key Market Developments

- In March 2023, Snoop Dogg, a rapper and entrepreneur from the United States, launched the INDOxyz premium coffee brand. The product is unique in that it is sourced from the Gayo region of Sumatra and other areas in Indonesia that produce the best Arabica and kopi luwak coffee.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global kopi luwak coffee market based on the below-mentioned segments:

Kopi Luwak Coffee Market, Type Analysis

- Raw Coffee Beans

- Cooked Beans

Kopi Luwak Coffee Market, Distribution Channel Analysis

- Offline

- Online

Kopi Luwak Coffee Market, End-User Analysis

- Cafes

- Restaurants

- Hotels

- Individuals

Kopi Luwak Coffee Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?