Global Lab Automation Market Size, Share, and COVID-19 Impact Analysis, By Lab Automation Equipment (Automated Workstations, Automated Liquid Handling, Pipetting Systems, and Others), By Application (Drug Discovery, Clinical Diagnostics, Genomics Solutions, and Proteomics Solutions), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Lab Automation Market Insights Forecasts to 2033

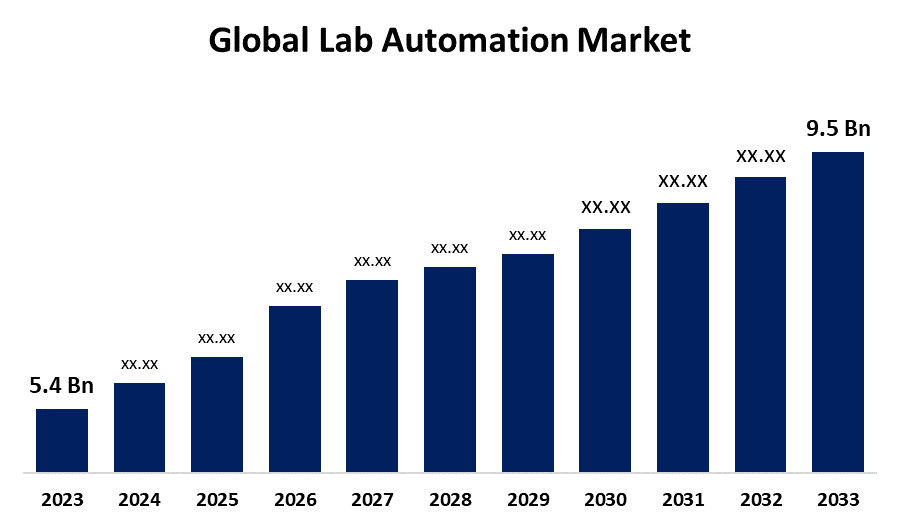

- The Global Lab Automation Market Size was Valued at USD 5.4 Billion in 2023

- The Market Size is Growing at a CAGR of 5.81% from 2023 to 2033

- The Worldwide Lab Automation Size is Expected to Reach USD 9.5 Billion by 2033

- Asia-Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Lab Automation Market Size is Anticipated to Exceed USD 9.5 Billion by 2033, Growing at a CAGR of 5.81% from 2023 to 2033. Lab automation has expanded beyond liquid handling robotics to encompass a wide range of technology that assists lab professionals in carrying out excellent lab practices.

Market Overview:

Lab automation is the integration of automated technologies into research laboratories which allows new and advanced processes. Lab automation is the integration of automated technologies into research laboratories which allows new and advanced processes. Lab automation can decrease manual variability and contamination, resulting in an expansion in the quality of results. This will lead to an increase in the growth of the lab automation market.

The lab automation system can increase the workflow capacity of laboratories and maintain accuracy and reliability for effective treatment processes which will further drive the market growth. For instance, the combined use of a lab information management system (LIMS) is software and hardware designed to manage huge quantities of samples and associated data, resulting in a more simplified and effective workflow. The increased acceptance of technologies such as AI, robotics, and automation will transform the diagnostic lab in the years to come, accelerating the growth of the lab automation market.

Lab automation is widely used in many industries, including drug development, biotechnology, clinical diagnostics, and educational labs which will increase demand for the growth of the lab automation market. In contrast to industrial contexts, firms have made significant investments in automation to optimize outputs and increase profitability.

Opportunity: Healthcare facilities in emerging nations are improvised.

The expanding research and development efforts, such as greater public and private funding, can be ascribed to enhanced healthcare infrastructure in emerging markets. The growing research and development organization have significantly contributed to the expansion of the healthcare sector. This will provide significant opportunities for advanced lab automation technologies.

Report Coverage:

This research report categorizes the market for the global lab automation market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global lab automation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global lab automation market.

Global Lab Automation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 5.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.81% |

| 2033 Value Projection: | USD 9.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 265 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Lab Automation, By Application, By Region |

| Companies covered:: | Danaher, Agilent Technologies, Inc., Eppendorf SE, Hudson Robotics, Aurora Biomed Inc., BMG LABTECH GmbH, Tecan Trading AG, Hamilton Company, F. Hoffmann-La Roche Ltd, QIAGEN, PerkinElmer Inc., Thermo Fisher Scientific, Inc., Siemens Healthcare GmbH, Abbott, and and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors:

The worldwide market is also being driven by an increase in demand for process miniaturization. The growing number of laboratory automation applications is likely to boost the growth of the lab automation market. Lab automation has changed a variety of previously manual laboratory processes. The rising demand for high throughput analysis in labs to process huge quantities of samples is expected to create considerable potential prospects for the growth of the lab automation market.

Restraining Factors:

The procurement and implementation of automated systems involve significant upfront capital cost, which might be a barrier for smaller laboratories or institutions with limited funds.

Market Segmentation:

The global lab automation market share is classified into lab automation equipment and applications.

- Automated workstations are expected to have the largest share of the market during the forecast period.

Based on the lab automation equipment, the global lab automation market is categorized into automated workstations, automated liquid handling, pipetting systems, and others. Among these, automated workstations are expected to have the largest share of the market during the forecast period. Automated workstations are predicted to account for a large share of lab automation sales, with integrated workflow solutions in especially high demand. As clinical diagnostic investigations get increasingly sophisticated, the demand for innovative imaging, surveillance, and cell detection systems develops, offering an opportunity for important manufacturers to offer new solutions. For instance, XtalPi and ABB Robotics announced a strategic agreement to manufacture a line of automated laboratory workstations in China.

- The clinical diagnostics has the largest share of the market throughout the projected timeframe.

Based on the application, the global lab automation market is categorized into drug discovery, clinical diagnostics, genomics solutions, and proteomics solutions. Among these, clinical diagnostics has the largest share of the market throughout the projected timeframe. The development and acceleration of clinical diagnostics is one area in particular that is contributing to improved patient quality of life and numerous clinical metrics of patient survival. This large proportion can be ascribed to technological improvements, an increase in automated systems offered by market participants, and an increase in the adoption of automated systems due to benefits such as reduced contamination risk and the removal of human error, among others.

Regional Segment Analysis of the Global Lab Automation Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global lab automation market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global lab automation market over the forecast period. The region's rapid growth is attributable to the presence of a well-established healthcare framework, as well as strong demand for automation systems in laboratories due to their speed, uniformity, and precision. Rising demand for integrated laboratory systems, as well as supporting government research policies, are driving the market. Furthermore, rising demand for high-throughput analysis, as well as numerous strategic initiatives launched by regional competitors, are expected to drive market growth. For instance, Automata announced that it is expanding into the United States and shortly build an office in Boston. This expansion coincides with the launch of Automata's completely automated laboratory bench, LINQ. Automata stated that LINQ enables companies in all markets to automate workflows in the same footprint as their present benches.

Asia-Pacific region is expected to fastest CAGR growth during the forecast period. The growing number of small and medium-sized laboratories in the region, as well as increased investments by market leaders in the region to launch novel technologies, are expected to drive regional market growth. Furthermore, favorable government initiatives to encourage lab automation help to drive regional market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global lab automation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- Danaher

- Agilent Technologies, Inc.

- Eppendorf SE

- Hudson Robotics

- Aurora Biomed Inc.

- BMG LABTECH GmbH

- Tecan Trading AG

- Hamilton Company

- F. Hoffmann-La Roche Ltd

- QIAGEN

- PerkinElmer Inc.

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare GmbH

- Abbott

- Others

Key Market Developments:

- In April 2024, Agilent introduced a new lab automation system to improve efficiency. Agilent Technologies Inc. has announced the release of the ADS 2, an advanced dilution system intended to improve laboratory operations and analytical testing productivity.

- In March 2024, Abbott announced the debut of GLP systems Track, a novel automation solution designed to meet the high-volume needs of laboratories. This automated solution was installed in Ahmedabad, Bengaluru, Chennai, and Srinagar.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global lab automation market based on the below-mentioned segments:

Global Lab Automation Market, By Lab Automation Equipment

- Automated Workstations

- Automated Liquid Handling

- Pipetting Systems

- Others

Global Lab Automation Market, By Application

- Drug Discovery

- Clinical Diagnostics

- Genomics Solutions

- Proteomics Solutions

Global Lab Automation Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global lab automation market over the forecast period?The global lab automation market size is expected to grow from USD 5.4 Billion in 2023 to USD 9.5 Billion by 2033, at a CAGR of 5.81 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global lab automation market?North America is projected to hold the largest share of the global lab automation market over the forecast period.

-

3. Who are the top key players in the lab automation market?Danaher, Agilent Technologies Inc, Eppendorf SE, Hudson Robotics, Aurora Biomed Inc, BMG LABTECH GmbH, Tecan Trading AG, Hamilton Company, F. Hoffmann-La Roche Ltd, QIAGEN, PerkinElmer Inc., Thermo Fisher Scientific Inc, Siemens Healthcare GmbH, Abbott, and Others.

Need help to buy this report?