Global Laboratory Proficiency Testing Market Size, Share, and COVID-19 Impact Analysis, By Industry (Clinical Diagnostics, Microbiology, and Pharmaceuticals), By Technology (Cell Culture, PCR, and Immunoassays), By End-User (Hospitals, CROs, and Diagnostic Laboratories), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Laboratory Proficiency Testing Market Insights Forecasts to 2033

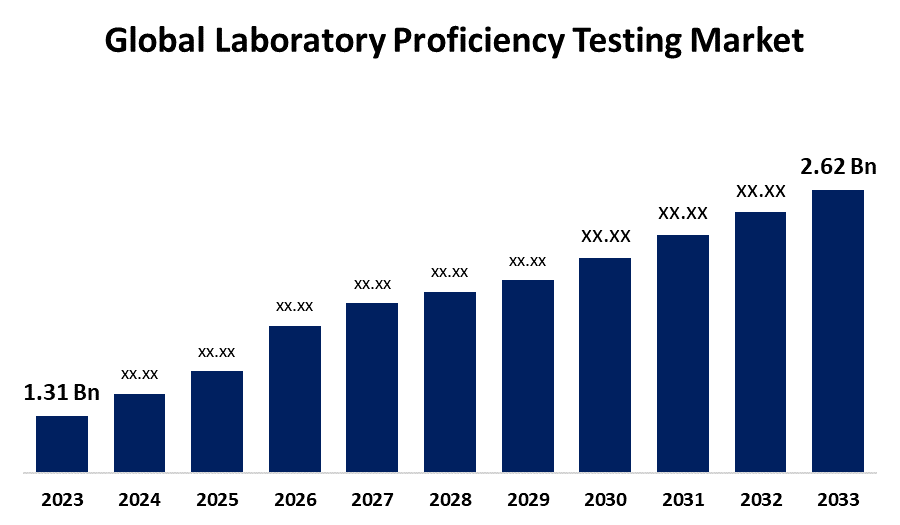

- The Global Laboratory Proficiency Testing Market Size was Valued at USD 1.31 Billion in 2023

- The Market Size is Growing at a CAGR of 7.18% from 2023 to 2033

- The Worldwide Laboratory Proficiency Testing Market Size is Expected to Reach USD 2.62 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Laboratory Proficiency Testing Market Size is Anticipated to Exceed USD 2.62 Billion by 2033, Growing at a CAGR of 7.18% from 2023 to 2033.

Market Overview

Laboratory proficiency testing is a procedure for external quality and accuracy assessment that verifies correct lab testing results by examining unknown specimens obtained from other sources. Testing for lab proficiency is more than just an internal quality control procedure. It offers a crucial comparison and impartial evaluation of the skills of lab personnel in specimen handling, equipment operation, results reporting, and equipment functionality. Testing for laboratory proficiency includes sampling, data transformation, interpretation, and quantitative, qualitative, sequential, simultaneous, one-time, and continuous testing. The examination is typically carried out to assure accreditation and these laboratories' optimal functioning. For a thorough comparative analysis, the outcomes from various laboratories are compared to one another. Consequently, the testing solutions find wide-ranging applications in a variety of industries, such as pharmaceutical, food and beverage, medical, and cosmetics. Notable growth in pharmaceutical companies around the world is one of the major factors contributing to a positive outlook for the market. Laboratory proficiency testing is broadly used in the manufacturing of generic and biosimilar drugs and to remove chemical residual solvents in prescription opioids. Moreover, the rising cases of chemical contamination in food products are providing a thrust for market expansion. Various food safety and regulatory authorities are executing stringent policies for maintaining the quality standards of ready-to-eat (RTE) and packaged food products. The tests are directed using polymerase chain reaction, immunoassay, chromatography, and spectrometry techniques for pathogen, endotoxin, pyrogen, and other microbial testing. The growth of the market is propelled by factors like the increasing number of accredited laboratories and regulatory mandates for proficiency testing.

Report Coverage

This research report categorizes the market for the global laboratory proficiency testing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global laboratory proficiency testing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global laboratory proficiency testing market.

Global Laboratory Proficiency Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.31 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.18% |

| 2033 Value Projection: | USD 2.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Industry, By Technology, By End-User, By Region |

| Companies covered:: | Boiron, Heel, Nelsons, SBL Homeopathy, Reckweg, Ainsworths, WHP (Washington Homeopathic Products), Schwabe Group, Dolisos, Weleda, Hahnemann Laboratories, Inc., Helios Homeopathy, Pekana, Hyland’s Homeopathic, and and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The rising acquisition of proficiency testing services by laboratories is a key factor driving the growth of the laboratory proficiency market. Proficiency testing authorizes laboratories to evaluate and monitor the quality and accuracy of their testing processes. To increase the uptake of proficiency testing services, more accredited laboratories are opening up, and obtaining ISO certifications is necessary. The rising reliance of healthcare providers on accurate test results provided by labs and the increasing focus on giving quality patient care are some of the major factors driving the acquisition of laboratory proficiency testing services. Additionally, market players are aiming for inorganic schemes like agreements, partnerships, and collaborations to increase their market share. These are the major factors driving the growth of the laboratory proficiency market.

Restraining Factors

The high expenses related to implementing and participating in proficiency testing programs hinder the growth of the market. Recognized laboratories are required to undertake PT across the various tests and analytes regularly that require very high costs. Furthermore, the need for complete sample preparation requires laboratory analysts to employ polished testing techniques and advanced technologies. Advanced technologies, including liquid chromatography, high-performance liquid chromatography, and spectrometry, are precise, sensitive, and efficient. Although these technologies come with disadvantages, such as prolonged sample preparation times and calibration challenges, they contribute to the considerable investments required for proficiency testing. These factors restrain the growth of the laboratory proficiency testing market.

Market Segmentation

The global laboratory proficiency testing market share is classified into industry, technology, and end-user.

- The clinical diagnostics segment is anticipated to hold the largest share of the global laboratory proficiency testing market during the forecast period.

On the basis of the industry, the global laboratory proficiency testing market is divided into clinical diagnostics, microbiology, and pharmaceuticals. Among these, the clinical diagnostics segment is anticipated to hold the largest share of the global laboratory proficiency testing market during the forecast period. This can be attributed to advancements in clinical diagnostic techniques, an increasing demand for early and accurate disease detection, and growing government initiatives aimed at improving the quality and accessibility of clinical diagnostic tests. Furthermore, increasing funding from both public and private areas, such as research investment and approval, aimed to develop inventive laboratory testing procedures.

- Thecell culture segment is anticipated to hold the highest share of the global laboratory proficiency testing market during the forecast period.

On the basis of the technology, the global laboratory proficiency testing market is divided into cell culture, PCR, and immunoassays. Among these, the cell culture segment is anticipated to hold the highest share of the global laboratory proficiency testing market during the forecast period. Rising awareness regarding the benefits of cell cultures in the production and testing of microbiology samples, biopharmaceuticals, and clinical diagnostic samples is supporting the expansion of this market. Furthermore, with the rising acquisition of cell-culture-based products, like monoclonal antibodies, there is an increasing demand for cell culture tests to optimize the production of microbial strain culture.

- The hospitals segment is anticipated to hold the largest share of the global laboratory proficiency testing market during the forecast period.

On the basis of end-user, the global laboratory proficiency testing market is divided into hospitals, CROs, and diagnostic laboratories. Among these, the hospitals segment is anticipated to hold the largest share of the global laboratory proficiency testing market during the forecast period. The growing number of tests provided by hospitals is further predicted to propel the demand for PT. The Health Secretary initiated a computerized proficiency test conducted by SPIC for these personnel in government hospitals. These initiatives aim to assess the ability and effectiveness of outsourced staff in data entry tasks, maintaining high standards of laboratory PT in the healthcare system.

Regional Segment Analysis of the Global Laboratory Proficiency Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global laboratory proficiency testing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global laboratory proficiency testing market over the predicted timeframe. This can be attributed to the developed healthcare system and high PT acquisition rate. The traditional regulatory framework also organizes quality management in this region, which impacts market growth positively. The broad availability of PT programs in this region is another reason for the high market future of laboratory testing in North America. In addition, severe environmental and water safety norms are also fueling the demand for laboratory tests and, hence, laboratory proficiency testing. These factors are driving the expansion of the laboratory proficiency testing market over the predicted timeframe in this region.

Asia-Pacific is anticipated to grow at the fastest rate in the global laboratory proficiency testing market over the predicted timeframe. Asia Pacific is expected to grow at the fastest rate due to rising healthcare awareness and an increasing number of laboratories going for international authorization in the region. Furthermore, Asia Pacific is becoming a home for international pharmaceutical and biopharmaceutical companies because of the low expenses of labor and the overall production of high-quality products. Therefore, the continuous laboratory testing of raw materials, finished products, & microbial cultures for production and authorization from the FDA becomes remarkable. These factors are driving the growth of the laboratory proficiency testing market over the predicted timeframe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global laboratory proficiency testing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bio-Rad Laboratories, Inc.

- QACS - The Challenge Test Laboratory

- Weqas

- NSI Lab Solutions

- INSTAND

- LGC Limited

- Randox Laboratories Ltd.

- Merck KGaA

- BIPEA

- Absolute Standards, Inc.

- American Proficiency Institute

- Fapas

- AOAC International

- Water Corporation

- Others

Key Target Audienc

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, BIPEAAunveiled PTS 110A, a novel Proficiency Testing Scheme that allows testing laboratories to evaluate their analytical potential by analyzing a rice sample. This initiative can empower laboratories to examine and improve their performance in rice sample analysis, propelling excellence in the field.

- In July 2023, LGC Limited (US) adopted Kavo International (US) to nourish its portfolio of quality measurement tools.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global laboratory proficiency testing market based on the below-mentioned segments:

Global Laboratory Proficiency Testing Market, By Industry

- Clinical Diagnostics

- Microbiology

- Pharmaceuticals

Global Laboratory Proficiency Testing Market, By Technology

- Cell Culture

- PCR

- Immunoassays

Global Laboratory Proficiency Testing Market, By End-User

- Hospitals

- CROs

- Diagnostic Laboratories

Global Laboratory Proficiency Testing Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Who are the key players in the global laboratory proficiency testing market?The key players in the global laboratory proficiency testing market are Bio-Rad Laboratories, Inc., QACS - The Challenge Test Laboratory, Weqas, NSI Lab Solutions, INSTAND, LGC Limited, Randox Laboratories Ltd., Merck KGaA, BIPEA, Absolute Standards, Inc., American Proficiency Institute, Fapas, AOAC International, Water Corporation, and Others.

-

2. Which region grow at the fastest rate in the global laboratory proficiency testing market?Asia-Pacific is anticipated to grow at the fastest rate in the global laboratory proficiency testing market over the predicted timeframe.

-

3. Which industry segment accounted for the largest share in the global laboratory proficiency testing market?The clinical diagnostics segment is anticipated to hold the largest share of the global laboratory proficiency testing market during the forecast period.

Need help to buy this report?